China’s Aviation Industry: a GlobalPartnership Strategy

丁朱寅 陈 诚 / DING Zhuyin CHEN Cheng(. 中国商用飞机有限责任公司,上海 006; . 上海飞机设计研究院,上海 00)(. Commercial Aircraft Corporation of China Ltd., Shanghai 006, China; . Shanghai Aircraft Design and Research Institute, Shanghai 00, China)

[Abstract] This article discusses one of the main strategies which China has implemented to develop its competency in the aviation field. It is strategic for China to boost its aviation industry via international cooperation and several models of involvement into the global aviation value chain with leading aviation industries. As it is depicted as a strategy here, it is not necessary to say that a formal strong national strategy in encouraging exists. Actually, it is clearly a way China’s aero-industry takes to develop its competency and business at the context it encounters. From an observer’s perspective, it is indeed a critical strategy. This article describes this strategy via the context, policies, program cases, as well as the evolution of the cooperation models in order to synthesize the strategy.

[Keywords] aviation; international cooperation; strategy

1 Introduction

China, as the world’s largest developing country and one of the BRICS, has been playing a notable role in today’s aerospace and aviation world. China’s dynamic and booming economy has witnessed that it becomes the second largest air transport market after the United States. This continued rapid growth in leading the world fleets could be expected for the next 20 years. The world major aviation OEMs (Original Equipment Manufacturers) have vastly recognized the significant business value and have launched cooperative projects with China. While China’s aviation companies have long served as minor suppliers for the Boeing and Airbus aircrafts. recently its indigenous civil aircraft programs have attracted the participation of worldwide supply chain, which lead to a wave of joint-venture creation between Western enterprises and its China partners. In addition, China’s conglomerate AVIC (Aviation Industry Corporation of China) has walked abroad with several overseas acquisitions in Europe and the US. It is obvious that an increasing participation of China’s aviation sector in the world stage has been manifested and a trend of integration into the international value chain is under progressing.

Aviation sector has been playing a strategic role in all nations since the day of its birth. How to develop it for the emerging economies? China’s aviation sector has given the answer. That is with a combination of both domestic innovation and an open, global way[1].

The scope of this article will be within the civil side since the cooperation stories mainly happen in the civil projects.

2 Market and Industry Overview

2.1 China’s Aviation Market

China is already the world’s second-largest air transportation market after the United States. This market is expected to continue growing rapidly over the next two decades. China’s overall economy is forecasted to be the fastest growing in the world over the next 20 years, with an estimated GDP growth averaging at 4.86 percent per year. The continuing booming of its economy will be a key driver of the growth of air travel in China. Its Revenue Passenger Kilometers (RPK) will be expected to grow at nearly 6% per annum through next 20 years[2].

Commercial Aircraft Corporation of China (COMAC) estimates that China will need about three times the size of its fleet by 2035. This requires China to take delivery of 6,865 new aircrafts-constituting 17% of the total global deliveries-valued at over $929.9 billion. Single-aisle aircraft serving the domestic market will account for 65 percent of the new deliveries[2].

It is clear that China is already a key market for aerospace and over the medium term China will become the most important aviation market outside of North America with the potential to offer substantial future business opportunities.

2.2 China’s Aviation Sector

China’s aviation sector is dominated by state-owned enterprises. Most of them belong to the conglomerate the AVIC, while the rest is well known as COMAC. AVIC was created in 1993 from portions of the former Ministry of Aerospace Industry. In 1999, AVIC was split into two corporations, AVIC I and AVIC II, but, in 2008, they were recombined and COMAC was spun off as an independent corporation.

AVIC has over 200 subsidiaries and was ranked 426th in the Fortune Global 500 list in 2009, with sales revenue of $21.738 billion and profits of $568 million. It was the 11th largest in the field of aerospace and defense, placed ahead of Bombardier. Its products range from defense, transport aircraft, aero-engine, helicopter, avionics and system, to general aviation and flight test. AVIC is a major developer and supplier to China’s ARJ21 regional jet program and will also play a key role in the C919 trunk liner program developed by COMAC. It also has significant sub-contract manufacturing business with major aerospace OEMs.

COMAC, launched by the State Council of China in 2008 as an OEM/prime manufacturer, is responsible for the development, final assembly, marketing and service of the C919 trunk liner program enter service before 2020 and the ARJ21 regional jet has also been taken over from former AVIC I.

The establishment of COMAC is a significant measure taken by China’s top decision-makers. The Trunk Liner Program is one of China’s “Special Programs” determined by The Outline of National Long-and-Medium-Term Scientific and Technological Development (2006-2020). It has been treated as a major strategic measure of enhancing China’s capacity for innovation and improving the national core competitiveness.

3 Strategies and Embodies

3.1 Policies

In history, the former Ministry of Aviation framed a “Three-Step Take-off” plan which, generally hoped through international cooperation at different levels, would allow China to acquire the necessary skills to self-design and manufacture a large commercial aircraft (LCA). However, each of the three steps was unsuccessful at that time including the MD82, MD90 assembly cooperation with US as the first step.

The Five-Year Plan (2006-2010) set the objectives relevant to aerospace with the aim of optimizing and upgrading the China’s industry. Another important policy of promoting the aircraft sector is China’s “Outline of the National Medium and Long Term Science and Technology Development Program (2006-2020),” a 15-year plan that delineates the industries in which China will focus its efforts on science and technology; LCA is noted as an area for development. In developing aero-industrial capacity, China is looking to develop interactive partnerships to improve its technological base, management expertise and customer service capability. It is willing to work with international partners with these capabilities looking to enter or expand in the market.

In 2007, China published the “Catalogue of Encouraged Hi-tech Products for Foreign Investment”, which encouraged foreign direct investment (FDI) in several areas of aircraft manufacturing, including investments in LCA and general aviation aircraft, and engines and parts for both. China’s “Catalogue of Encouraged Foreign Investment Industries” lists several areas of aircraft manufacturing as encouraged industries.

3.2 Production of Foreign Design and FDI

China’s huge fast growing market has drawn large aircraft OEMs’ pushing access. In this context, one of the business model is based on exchanging market for technology transfer, that is attracting foreign partners as well as FDI in the aircraft and parts manufacturing industry sector. The aim is to gain expertise in aircraft design, manufacturing and program management through joint ventures.

The first joint venture was between Shanghai Aviation Industrial (Group) Co., Ltd (SAIC), now merged into COMAC and McDonnell Douglas in 1985 to produce a limited number of the MD-80 series of aircraft in Shanghai for China’s domestic market. In 1992, a second joint venture followed, aiming at producing the MD-90 aircraft. While the MD-80 program was successful, the MD 90 program was abandoned due to Boeing’s acquisition of McDonnell Douglas and consequently domestic Airlines’ refusal in purchasing MD series. Before the MD program, SAIC had the experience of designing and manufacturing a 180 seats trunk liner named Y-10, which did not commercially enter into service.

17.Frozen to death on the last evening of the old year . . . No one had the slightest suspicion of what beautiful things she had seen; no one even dreamed of the splendor in which, with her grandmother she had entered on the joys of a new year: This is Andersen s version of a happy ending. The little girl is with God and her grandmother, never to suffer more in her worldly existence. Even being rescued from her plight44 and escaping death would not be as wonderful to him as the ending he chose.

Another case which is widely-known is with Airbus of the A320 final assembly line in Tianjin. The production site is a joint venture between Airbus and a Chinese consortium of Tianjin Free Trade Zone and AVIC (Airbus 51%, the Chinese partners 49%). In 2009, the first A320 built in China completed its maiden flight and now more Tianjin assembled A320 are in service. Unlike the MD program, this site is Airbus managed and mainly local blue workers are recruited. Besides, in 2006, a joint venture between Airbus and AVIC was set up, where 5% portion of the airframe design and development for the A350 XWB were carried out.

As for regional jets, AVIC II signed an agreement with Embraer in 2002 to build a production facility in Harbin. The joint venture is responsible for the final assembly of the ERJ 135/140/145 families. But only limited ERJ-145 aircrafts have been delivered and the site almost stops production. Recently it turns to assembly of business jets.

3.3 The Role as Sub-contractors

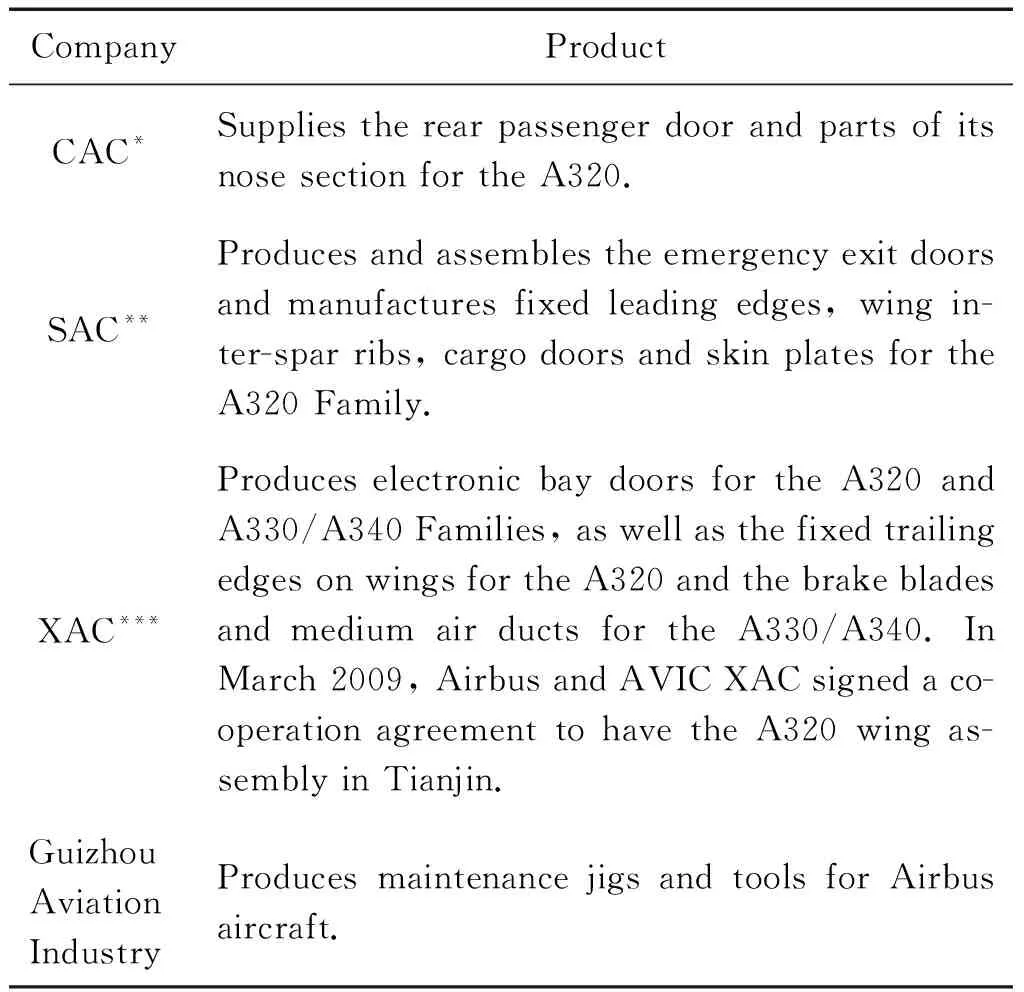

Another cooperation model is producing parts for leading OEMs. It could be directly or indirectly contracting (sub contracting).The production of parts for OEMs could gain the strict aero-product quality methods. This form of cooperation vastly exists in China’s aero-manufacturers. For instance, the main AVIC companies involve in Airbus supplier chain (Table 1). It is said over half of the Airbus fleet in service world-wide has parts produced by Chinese companies[3].

Table 1 AVIC Suppliers for Airbus[3]

*Chengdu Airplane Company

**Shenyang Airplane Company

***Xi’an Airplane Company

China also plays a partnership role in the manufacture of Boeing’s commercial airplane models—the 737, 747, 767, and 777. For the new 787 Dreamliner, Chinese suppliers build the rudder, wing-to-body fairing panels, leading edge panels for the vertical fin, and other composite parts. Boeing and its suppliers have active supplier contracts with China’s aviation industry valued at well over $2.5B US.

One trend needs to be mentioned is that via this cooperation, China is now increasing the integration into the “Upper Layer” of the value chain. As indicated in Table 1, AVIC XAC and Airbus signed a cooperation agreement to manufacture the A320 wings. Besides, a more significant case is the MoU (Memorandum of Understanding) for a long term strategic cooperation between AVIC and Bombardier. The MoU recognizes AVIC as a major international Tier 1 structural supplier for C-Series (100~149 seats). Under the proposed agreement, AVIC SAC became Bombardier’s biggest partner on the C-Series program.

3.4 Global Supply Chain in Indigenous Programs

As mentioned with the introduction of China’s aviation sector, another state-owned company COMAC was established and it undertook the development of the regional jet program ARJ21 and the trunk liner C919 program. In these programs, COMAC plays just exactly the same OEM role as Airbus and Boeing, with AVIC providing structure parts. International supply chain with leading Tier 1 and Tier 2 system companies mainly from US and Europe has been formed.

In the ARJ21 program, OEM has sourced major systems to Western suppliers (risk sharing). Partners include GE for propulsion, Rockwell Collin for avionics, Liebherr Aerospace for the landing gear, Honeywell for the primary flight control and so on. Most of the equipment on the ARJ21 comes from foreign companies (mostly US companies) are off-the-shelf products[4].

It is quite clear that this strategy is aiming for boosting the domestic system supplier capabilities, which is a big step forward beyond the ARJ21.

3.5 Overseas Acquisition

In recent years, it could be seen that China’s aviation sector has begun to “go abroad” to acquire foreign firms. After the 2008 crisis, some Western manufacturers could face financial shortages, and the state-owned AVIC has the financial resource to invest in them by acquisition or taking stakes. The acquired assets may assist the development of China’s aviation manufacturing capabilities.

4 Analysis

4.1 Synthesis

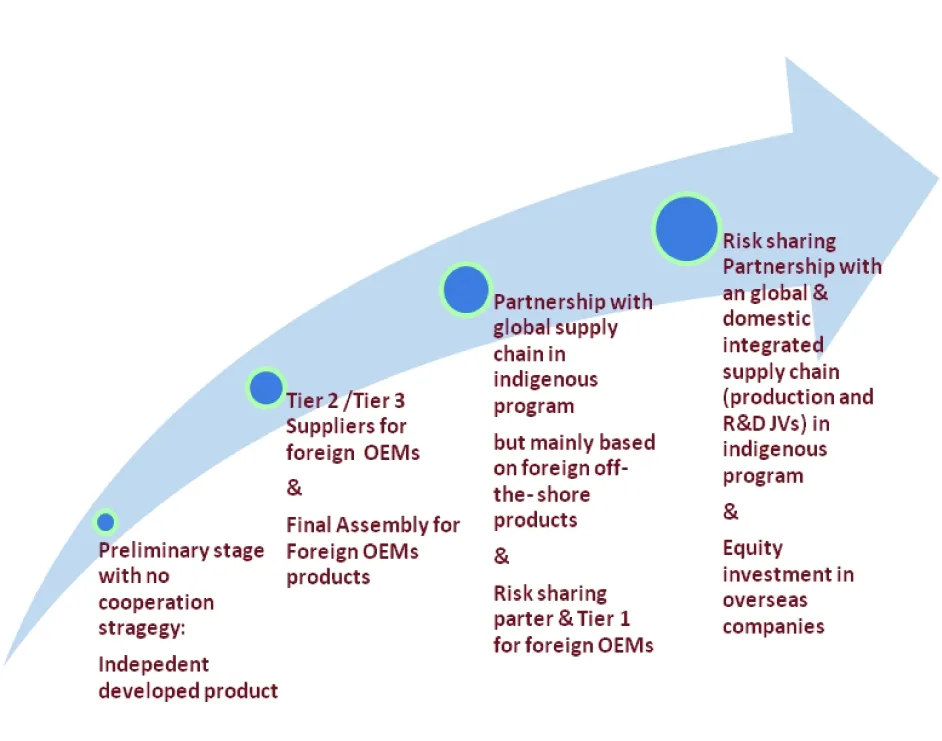

Among the models and methods above mentioned, the models of international cooperation generally have been evolved through the following stages (Figure 1). So far, and generally speaking, the portfolio works well, and it has been advancing China’s aviation sector moving towards the upper layers of the global value chain.

The industry context for the successful implementation of these strategies comes from two aspects and their combined effect:

1)Promising Market: China will likely be the largest single market for aircraft sales over the next 20 years. And Western aircraft manufacturers appear to work with the Chinese industry to gain further access.

2)Externalization Trend: China is the ideal low cost pole for Western manufacturing’s outsourcing or setting up overseas JVs.

China’s aviation sector has captured this opportunity, and puts in practice a portfolio of partnership strategies. To simplify, there are two arms of China’s integration into the global value chain: (Figure 2)

Figure 1 Evolvement of China’s Aviation International Cooperation

4.2 Comments on Different Models

Being structure parts suppliers even though just Tier3 or Tier 2 and carrying out big parts and final assembly for leading OEMs indeed fosters its capabilities in advanced processing and production methodologies, in both technical and management aspects. The corner stone program for this dimension of structure manufacturing is indeed the MD series, rather than today’s A320 assembly line which the aid to Chinese aero-capability is very limited. From the start of MD program, China’s aviation industry had enhanced the competency, gained confidence and orders from the international OEM or Tier 1, and even further to be a risk-sharing partner in today’s Bombardier’s C-series. On the other hand, the indigenous programs also benefit from it, being able to have a mature domestic supply chain for structures. One limitation is that airframe structure is now under transformation from traditional aluminum to composite, which might result in a lagging-behind.

In the model of ARJ21 program, although the approach of a global system souring does not directly raise the capabilities of the Chinese systems suppliers, it does enable China to produce an aircraft as a platform, and increases the chances for international sales and certification through the use of Western systems on the aircraft. A drawback of this approach for China is that it more or less contradicts China’s stated goal of indigenous innovation stipulated in the Five-Year Plan. However, it will allow expertise to be developed domestically in integration, manufacturing processes and managing an international supply chain, which are the two critical areas for China to master if it wants to become a globally-competitive industry.

The C919 program adopts a more aggressive supply chain approach regarding the participation of domestic suppliers. Unlike the ARJ21 model, the created JVs between West and China become the main partners for China’s own OEM COMAC and the most valuable work packages such as avionics, flight controls, electrical are undertaken. There are two “Leaps” in this strategy:one is that it is the first but vast creation of domestic system supplier for commercial airplane, and the other is that the cooperation in these JVs reaches beyond manufacturing to R&D activities. The main effect of this model is that the vast adoption of new players in the supply chain for a commercial program could probably compromise and increase the risk regarding technical and supply chain reliability. For the domestic partners inside JVs, how much they could learn from their West partners are questionable, regarding IP(Intellectual Property) transfer or military spin-off concern.

The untraditional way is to do equity investment. Through this approach, Chinese enterprise has access to the foreign firm’s R&D, manufacturing and business process capabilities. However, some states or the current parent company are cautious to approval this kind of deals with a Chinese buyer. Even a successful acquisition may face technology export restrictions and merging difficulties.

5 Conclusions

This article presents and analyzes the international cooperation strategy. China’s aviation industry has been implemented to stimulate its development. The models of this strategy could be various, and a portfolio of different models is adopted by the sector. Though setbacks in international cooperation were encountered, the current strategy works well. The indigenous programs are currently under development and making progress. Considering that aerospace programs are highly complicated in both technology and commercial dimensions, the eventual effect of this strategy still need time to observe.

——徐小林