New Connection

By Li Xiaoyang

On June 17, the long-awaited ShanghaiLondon Stock Connect scheme was launched as part of Chinas latest efforts to open up its capital markets, allowing foreign enterprises to list their shares on the Chinese mainland for the fi rst time and enabling Chinese investors to raise new funds through the London Stock Exchange (LSE).

Proposed during Chinese President Xi Jinpings visit to the UK in October 2015, the idea materialized after four years of preparations and was inaugurated during the 10th China-UK Economic and Financial Dialogue in London.

After the global index compiler Morgan Stanley Capital International decided to increase the weighting of Chinas A shares in its benchmark indexes in February and FTSE Russell, another major index provider, announced the inclusion of the A shares in its indexes from June 24, the new scheme has made global investors increasingly upbeat about the outlook of Chinas A-share market.

The launch of the scheme marks a crucial step in the opening up of Chinas capital markets and China-UK cooperation in the fi nancial sector, the China Securities Regulatory Commission (CSRC) said.

New blessings

In recent years, China has made advances in opening up its capital markets, launching the Shanghai-Hong Kong Stock Connect scheme in 2014 and the Shenzhen-Hong Kong Stock Connect scheme in 2016. As a follow-up, the Shanghai-London connect is expected to bring more opportunities to Chinese and overseas investors.

The three programs have different business modes. The Shanghai-Hong Kong and Shenzhen-Hong Kong connects enable investors on both sides to directly trade stocks in the market on the other side. However, in the Shanghai-London connect, the depositary receipts converted from the stocks in the opposite market are listed and traded in the local market, the Shanghai Stock Exchange (SSE) said on its website.

The eastbound business of the scheme allows London-listed companies to issue Chinese depositary receipts (CDRs) backed by existing shares on the SSE. Meanwhile, in its westbound business, Shanghai-listed companies are able to issue global depositary receipts (GDRs) on the London bourse.

The initial quota for the former was 250 billion yuan ($36.1 billion) and that of the latter 300 billion yuan ($43.4 billion), a joint statement issued by the CSRC and the Financial Conduct Authority, the British fi nancial regulator, said.

Notably, it has set thresholds for participants. According to an earlier document released by the SSE, overseas firms issuing depositary receipts in China should meet a minimum market value of 20 billion yuan ($2.9 billion), while individuals applying to participate in CDR trading should have no less than 3 million yuan ($430,000) on average in their daily account.

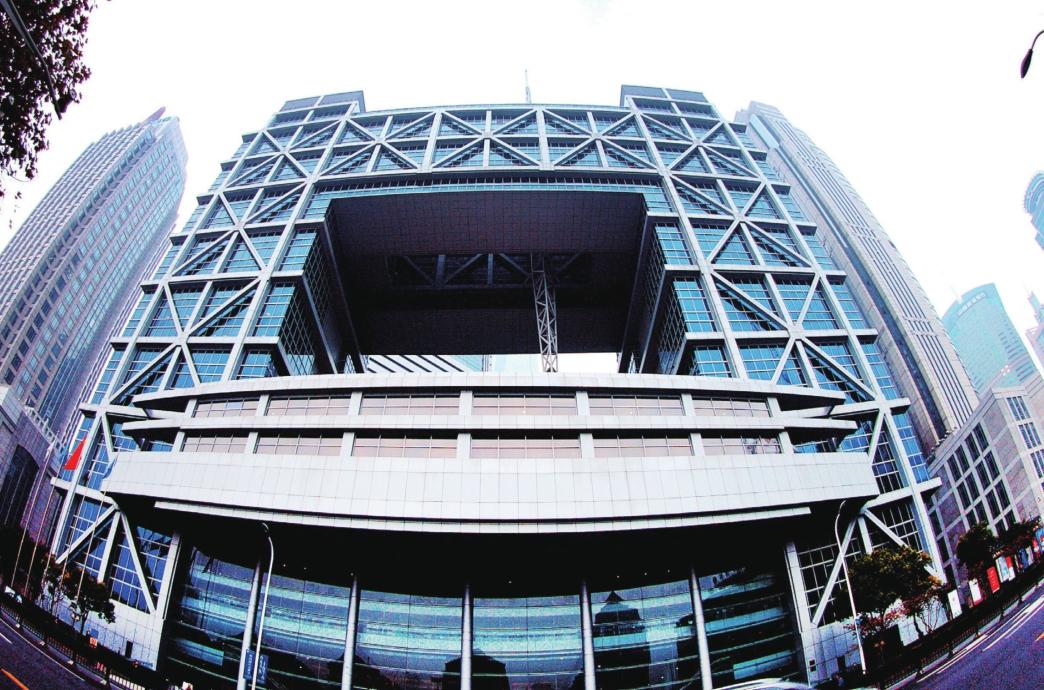

The successful listing of Huatai Securities GDRs on the LSE will allow Chinese institutions to better integrate into the international capital markets and improve cooperation between Shanghai and London, an SSE statement said.

More to come

“The groundbreaking scheme will deepen global connectivity as the UK looks outward to new opportunities in Asia,”British Chancellor of the Exchequer Philip Hammond said at the launch of the Shanghai-London connect.

According to the British Embassy in China, more than 260 of the 1,500 Shanghai-listed companies will be potentially eligible to be listed on the LSE via the program.

UK investors are seeking to tap into Chinas expanding market, as the country is expected to see more than $17 trillion in assets under management by the end of 2030, it said.

Dong Dengxin, Director of the Finance and Securities Institute at Wuhan University of Science and Technology, said there is a lot of room for growth in China-UK fi nancial cooperation and interconnectivity. Through borrowing strength from London as an international financial center, the development of Chinas stock market and the internationalization of the renminbi will be accelerated.

As Shanghai accesses the sophisticated regulation mechanisms, operation modes and investment concepts of Londons market, the uncertainties facing the UK caused by Brexit may also be eased through the cooperation, Ruan said.

More connectivity between Chinese mainland and overseas stock exchanges is on the way. As Yang Delong, chief economist of First Seafront Fund Management, predicted, the new scheme is expected to be a model for similar programs between Chinese mainland bourses and those in Tokyo, New York and Moscow.

Right before the launch of the Shanghai-London connect, Yi Huiman, CSRC Chairman, told the Lujiazui Forum, an annual gathering of fi nancial regulators and experts in Shanghai on June 13, that China will continue to further the two-way opening up of its capital markets and boost overseas investment. The new scheme will be followed by more opening-up measures.

According to Fu Lichun, Research Director at Changchun-based Northeast Securities in northeast Chinas Jilin Province, China has moved fast to reform its domestic capital markets by following international standards. “More mature capital markets are necessary for the countrys high-quality economic development,” he said.