Seven New Trends in China’s Economy

by+China+Pictorial

The 2016 sessions of the National Peoples Congress (NPC) and the Chinese Peoples Political Consultative Conference(CPPCC), or the two sessions, were held from March 3 to March 16. During the annual sessions of the two organizations that make national-level political decisions, thousands of officials and business leaders held discussions on various issues, including the economic reforms and this years targets. It is an important platform to provide suggestions regarding issues concerning the Chinese people, and an opportunity for the world to better understand the eastern country.

This year, some worried about a Chinese hard landing, the term“new economy” proposed in the government work report aroused spirited debate, and this years GDP target was approved. This year marks the beginning of the 13th Five-Year Plan (FYP) on national economy and social development. A draft outline was presented during the sessions for review. At the end of the two sessions, the 13th FYP was approved by Chinese lawmakers, charting Chinas future economic path. Listed below are seven future trends for Chinas economy.

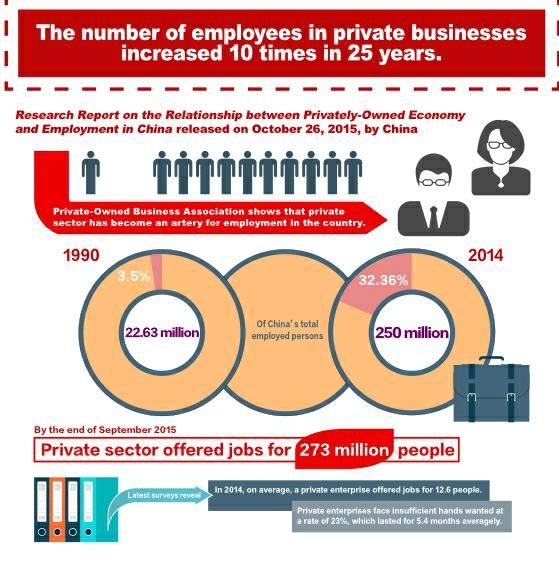

Promoting the Private Sector

On March 4, 2016, President Xi Jinping attended the group discussion of CPPCC members from the China Democratic National Construction Association (CDNCA) and the Federation of Industry and Commerce (FIC), and gave a keynote speech on the development of the private sector in the country.

It is significant that President Xi chose to brainstorm state affairs with CPPCC members from 34 circles, most from the private sector.

President Xi reiterated the “two unswerving paths” that the Communist Party of China (CPC) has adhered to since the convention of its 16th National Congress in 2002: Unswervingly consolidate and develop the public-owned economy, and unswervingly encourage, support, and guide the non-public sector.

Taking a realistic position on the private sector, President Xi described it with “three no-changes”: no change in its position and function in Chinas social and economic development, no change in policies and guidelines to encourage, support, and navigate its development, and no change in commitment to creating a favorable environment and offering better chances for development.

Issues related to private businesses that President Xi addressed included strategies for segments ranging from SME financing, market access and establishment of public service system to integration of equity markets and private capital. He called for simplifying the process of administrative examination and approval, and enterprise-related charging.

President Xi clearly spelled out the position and function of the private sector in the larger scheme of Chinas economic development and what the country expects of it. In 2016, private enterprises will enjoy many genuine policy bonuses from the government as it relaxes control over market access, encourages innovative transformation, reduces taxes and lowers fees. These policies will serve as both relief and stimulants for all involved in the private sector.

Chinas basic economic system, with public ownership at the center while allowing diverse forms of ownership to develop side by side, is a fundamental policy established by the CPC. Over the last 30 years since its launch of the economic reform and openingup policies, China has experienced dramatic progress with a privately-owned economy that started from scratch and grew from small to large, from weak to strong. The private sector has contributed significantly to the rapidly developing Chinese economy.

Statistics show that today in China, private sector organizations account for 90 percent of the countrys main market players. To date, private enterprises have contributed over 60 percent of Chinas GDP, over 80 percent of its employment, over 65 percent of its investment in fixed assets, and 67 percent of its direct investment overseas.

China Remains a Magnet for Foreign Investment

On March 5, the 12th NPC convened its fourth annual session at the Great Hall of the People in Beijing. Premier Li Keqiang delivered a report on government work in which he said, “Chinas investment environment will become even more fair, transparent, and predictable, and China will be able to maintain its strong appeal and serve as a favorite destination for foreign investment.”

Chinas GDP in 2015 represented an increase of 6.9 percent over the previous year – a growth rate faster than that of most other major economies. Still, some foreign media acted concerned about Chinas economy and reported about foreign enterprises withdrawing money from China.

Premier Li rebutted these rumors by declaring that “In 2015, China utilized US$126.3 billion of overseas investment, an increase of 5.6 percent.” Statistics from Chinas Ministry of Commerce show that during Chinas 12th FYP period, foreign investment in China witnessed an increase of 30 percent compared to its 11th FYP period. With accelerated adjustment of Chinas industrial structure, its true that some foreign-funded companies engaged in low-end industries are leaving China. Conversely, foreign investment in service, high-end manufacturing and high-tech industries are seeing a heavy increase. The Ministry of Commerce figures show that in 2015, the service industry actually used $69.58 billion foreign investment, representing a year-on-year growth of 18.8 percent and accounting for 61 percent of total foreign investment, while hi-tech manufacturing industry actually used $8.54 billion, 11.7 percent higher than the previous year. Meanwhile, besides direct foreign investment, China also uses mergers and acquisitions as a way to attract investment from abroad. In 2015, China actually used $16.82 billion in foreign investment through mergers and acquisitions, 181 percent higher than last year.

Chinas economy is transforming and upgrading, and its foreign capital management policy is being reformed, which will not hinder the growth of foreign investment but rather shift focus in some aspects. Going forward, Chinas rapid growth of domestic consumption, promotion of urbanization, speedy development of tertiary industry and new-energy demand for sustainable development will provide more opportunities for foreign enterprises.

Chinas economy is transforming and upgrading, and its foreign capital management policy is being reformed, which will not hinder the growth of foreign investment but means some shifts in its focus. Going forward, Chinas rapid growth of domestic consumption, promotion of urbanization, speedy development of tertiary industry and new-energy demand for sustainable development will provide more chances for foreign enterprises.

Healthy Development of Capital Market Based on Law

2016 marks the first year of Chinas 13th FYP period. In terms of the long-term goal for the capital market during the period as well as ongoing financial and capital market reforms in China, support and guarantee of laws and regulations is necessary. Laws and regulations must be employed to ensure that reforms are carried out in accordance with market discipline, and that administrative and human interventions are gradually reduced.

During this years two sessions, Premier Li Keqiang delivered the government work report in which he said, “We will move forward with reform of stock and bond markets and strengthen rule of law in their development, promote the sound development of the multi-level capital market, and ensure that the proportion of direct financing is increased.” On “deepening reform of the financial sector,” Li pointed out that in 2016, “managing the market in accordance with law” and “safeguarding financial security” will be Chinas two major working tasks. This is not only a lesson drawn from abnormal fluctuation in the countrys stock market in 2015, but also a reflection of the urgent need to guarantee Chinas economic development.

At present, revision of Securities Law of the Peoples Republic of China and formulation of other related laws and regulations are ongoing. A basic feature of the capital market, Chinas registrationbased stock listing reforms have won wide acclaim. During this years two sessions, NPC deputies and CPPCC members reached the consensus that to better carry out reform, related institutional designs need to be further improved and optimized.

Progress in the Belt and Road Initiative

“Progress was made in the Silk Road Economic Belt and 21st Century Maritime Silk Road Initiative (the Belt and Road Initiative), and the pace of our industrial-capacity cooperation with other countries was stepped up,” said Premier Li when delivering the report on government work at the Fourth Session of the 12th NPC. “We will push ahead with the Belt and Road Initiative. With a commitment to achieving common development and shared growth through joint consultation, we will ensure that the Belt and Road Initiative creates bonds of peace, friendship, and common prosperity,” declared Li.

At a press conference held on March 8, Foreign Minister Wang Yi reported on the progress of the Belt and Road Initiative. Since its launch, over 70 countries and international organizations have expressed a willingness to cooperate, while more than 30 countries have signed cooperation agreements.

The Belt and Road Initiative is a strategy that will impact China and the world for the next 30 years. From the beginning, the initiative has attracted great attention and progressed at an astonishingly fast pace. In the autumn of 2013, President Xi Jinping proposed the initiative, and in 2015, it already began to bear fruit and came alive with programs and projects.

Before Premier Li delivered the report, President Xi attended a March 4 panel discussion of CPPCC members from China Democratic National Construction Association and the Association of Industry and Commerce, where he mentioned the Belt and Road Initiative and encouraged both State-owned and private companies to seize the opportunity to promote their development against the backdrop of “new normal.”

Financial Reform: One Change Will Make All Changes

On the morning of March 12, on the sidelines of the fourth session of the 12th NPC, a press conference on financial reform and development was held. At the event, Chinas central bank governor Zhou Xiaochuan and his colleagues fielded questions on various topics including internet finance, monetary policy, internationalization of the RMB and interest-rate policy. Zhou pointed out that Chinas reform and opening-up will continue to promote growth, and, as the countrys urbanization process continues, its expected growth rate will be realized. Thus, China could realize its growth target by adopting prudent monetary policy in tune with the growing role of domestic demand and innovation. “Theres no need for extra policies,” Zhou said. Zhou also revealed that reform of Chinas financial regulation system was under discussion and that participants were listening to input from all sides. He said that there wasnt a global consensus on a system of financial oversight.

Reform of Chinas financial sector has long been a popular topic. Compared with the goal of “moving ahead with financial reform to better serve the real economy,” which was mentioned in the 2015 government work report, this year, emphasis is placed on other areas. In a sentence, it would be: “We will move faster with reform to improve the modern financial regulatory system and ensure that the financial sector serves the real economy more efficiently and that regulation covers all financial risks,” as outlined in the 2016 government work report. To deepen reform of the financial sector, this years government work report has set goals in many areas, including a regulation system, marketization of exchange and interest rates, institutional reform, multi-level capital market, internet finance, inclusive finance, green finance, and crackdown on illegal finance.

Many experts believe that when characteristics of Chinas financial market are taken into consideration, the priority for Chinas financial development in 2016 should be to integrate the function of various financial supervision administrations and establish a cutting-edge oversight system in tune with the countrys situation and development trends.

Science and Technology Innovation: The Primary Driving Force for Development

On March 10, Minister of Science and Technology Wan Gang answered questions from domestic and foreign reporters on the development of scientific and technological innovation.

Wan Gang, also Vice Chairman of the CPPCC, pointed out that since the implementation of the 12th FYP, Chinas capacity for scientific and technological innovation has greatly increased. This includes a series of successful basic research projects and industri- al upgrade through scientific and technological innovation, which resulted in the formation of new productivity and new growth drivers, improving livelihoods with strategic high-technology. Enlightened regional innovation helps create an atmosphere for innovation and entrepreneurship and, comprehensively promotes reform of systems serving science and technology. However, many shortcomings are yet to be eliminated, such as sluggish transformation of key industry and lack of implementation for some innovative policies.

Innovation has become one of Chinas pillars of governance. The term "innovation" frequently appeared in this years government work report, which stated that by 2020, China will strive to achieve major breakthroughs in both basic and applied research, and promote research in strategic and frontier areas. Chinas investment in research is expected to reach 2.5 percent of GDP, and contributions of scientific and technological advances towards economic growth could reach 60 percent.

At the moment, Chinas economy is facing great downward pressure. Providing a new model for industrial development and cultivating new economic growth point are not only related to construction of a well-off society, but have consequences for trends in the world economy. Today, with scientific and technological innovation and the “Made in China 2025” initiative as a new starting point, China will gradually become an innovative and talent-rich country.

SOE Reform Enters a New Phase

2015 marked the first year of a new round of State-owned enterprise (SOE) reform in China. A series of blueprints and plans including the Guiding Opinions of the Central Committee of the CPC and the State Council on Deepening the Reform of SOEs were formulated, laying a solid foundation for the nations SOE reform.

The year also witnessed the beginning of a new round of SOE reform. In June 2015, China CNR Corporation Limited and CSR Corporation Limited merged into CRRC Corporation Limited(CRRC), heralding a new round of merging and reform of SOEs. That year, the State-owned Assets Supervision and Administration Commission (SASAC) of the State Council reorganized 12 enterprises under its jurisdiction, cutting the number of SOEs under its direct administration from 112 to 106.

SOE reform entered a new phase in 2016. On March 7, 2016, at a panel discussion of NPC deputies from Heilongjiang Province, President Xi Jinping pointed out that in order to deepen reform, SOEs must take the “tailwind”, tap their inherent potential and enhance their strength through market competition. In the government work report, Premier Li Keqiang proposed a boost to development through reform and mapped out specific requirements for the reform of SOEs.

During this years NPC and CPPCC annual sessions, NPC deputies and CPPCC members voiced their support for the SOE re- form plan mentioned in the government work report, on the ground that deepening reform is a vital part of supply-side reform and will play an important role in relieving industrial overcapacity.