Knowledge Composition and Its Influence on New Product Development Performance in the Big Data Environment

Chuanrong Wu , Veronika Lee and Mark E.McMurtrey

Abstract: Product innovation is regarded as a primary means for enterprises to maintain their competitive advantage.Knowledge transfer is a major way that enterprises access knowledge from the external environment for new product innovation.Knowledge transfer may face the risk of infringement of the intellectual property rights of other enterprises and the termination of licensing agreements by the knowledge source.Enterprises must develop independent innovation knowledge at the same time they profit from knowledge transfers.Therefore, new product development by an enterprise usually consists of three types of new knowledge: big data knowledge transferred from big data knowledge providers, private knowledge transferred from other enterprises, and new knowledge developed independently by an enterprise in the big data environment.To find what the influences of different types of knowledge are on new product development (NPD) performance, a model is presented that maximizes the expected NPD performance.The results show that the greater the weight of independent innovation knowledge, the greater the performance of NPD.Enterprises tend to transfer knowledge from the external environment when the research and development (R&D) investment is much higher, and enterprises will speed up independent innovation when independent innovation knowledge is expected to bring a larger market share.The model can help enterprises to determine knowledge composition, the scale of R&D investment and predict the performance of NPD.

Keywords: Big data, knowledge transfer, independent innovation, new product development, R&D investment.

1 Introduction

Product innovation has been recognized as a primary means of organization renewal [Dougherty (1992)] and as an ‘engine of renewal’ Bowen et al.[Bowen, Clark and Holloway (1994)].As Schumpeter [Schumpeter (1942)] describes, much of the microeconomic dynamics within markets is generated by temporary competitive advantages created by the introduction of new products or the adoption of new production processes.Enterprises need to continuously renew their products to survive and prosper in dynamic environments.Innovation derived only from the enterprises’ internal technical breakthroughs is difficult to sustain in changing times [Li and Chen (2017); Hu (2018)].Knowledge transfer is one major way that enterprises get knowledge from the external environment for new product innovation.The process of enterprises absorbing, applying and innovating knowledge through various channels is called knowledge transfer [Szulanski (2000)].

Fast changes in customer preference, information technologies, and competition strategies in the big data environment bring new challenges for product innovation.Users experience from big data is becoming increasingly important with the advent of the big data era.The big data era is the user experience driven or consumer driven era [Li and Chen (2017)].Big data knowledge has become one important type of knowledge that enterprises need for new product innovation [Manyika, Chui, Brown et al.(2011); McGuire, Manyika and Chui (2012)].Only by absorbing more external knowledge and integrating it with internal knowledge can enterprises give users a better experience.Enterprises usually transfer big data knowledge from big data knowledge providers by “service outsourcing” [Houacine, Bouzefrane and Adjaz (2016); Liu, Peng and Wang (2018)].

Private knowledge is another important type of knowledge that enterprises need for new product innovation [Wu, Chen and Li (2016); Wu (2017)].Patent information gleaned from big data for new product innovation has a risk of infringement of the intellectual property rights of other enterprises [Wu, Zhu, Wu et al.(2014)].The purchase of patents and components are the primary ways that enterprises transfer private knowledge to promote new product innovation [Parra (2014); Levitt (1996)].This type of knowledge transfer may face the risk of the termination of licensing agreements by the knowledge source [Ding (2008); Ashish (2011)].From the perspective of imitative innovation, enterprise transfer knowledge serves mainly to achieve imitative innovation.Imitative innovation is not to completely copy but to develop new products on the basis of the predecessors’ technology combined with an enterprise’s own actual situation and needs [Posen, Lee and Yi (2013)].For example, Tencent’s first product, OICQ, was an imitation of the United States launched ICQ.However, Tencent’s product was not just a copy it got rid of the stale features and brought forth fresh innovation, forming its own characteristics [Hu (2018)].Enterprises must develop independent innovation knowledge while utilizing knowledge transfer.Therefore, new product innovation from an enterprise usually consists of three types of new knowledge: big data knowledge transferred from big data knowledge providers, private knowledge transferred from other enterprises, and new knowledge developed independently by the enterprise.

Many scholars have researched the significance of product innovation to business survival [Dougherty (1992); Bowen, Clark and Holloway (1994); Knudsen and Mette Præst (2010); Leonard-Barton (2010); Carlile (2002); Cooper and Kleinschmidt (2010); Davila (2016)].Scholars also have researched the problems of knowledge transfer in the big data environment [McGuire, Manyika and Chui (2012); Houacine, Bouzefrane and Adjaz (2016); Sukumar and Ferrell (2013); Suchanek and Weikum (2013); Horst and Duboff (2015); Jun, Park and Jang (2015); Manyika, Chui, Brown et al.(2011); Koman and Kundrikova (2016); Wu, Zapevalova, Chen et al.(2018)].However, few researchers have considered the influence of independent innovation knowledge on NPD performance in the big data environment.This paper categorizes the knowledge composition of new product innovation in the big data environment.A model of new product innovation is established by maximizing the present value of the total expected profit of the new product.The model can help enterprises to determine the weight of different types of knowledge and the scale of R&D investment when developing new products.After introducing knowledge composition and the necessity of independent innovation in the big data environment in Section 1, an optimization of knowledge update of new product is presented in Section 2.Parameters setting, simulation experiments and experimental results are described in Section 3.Conclusions are drawn in Section 4.

2 Optimization model of new product knowledge update

2.1 Model hypotheses

Viis an enterprise in an innovation network G =(V , E ,BD)that will update a new product, producing just the one product.The total market volume of the new product is Q, the price of the product is p , and the marginal cost in the starting period is MC.The knowledge absorption capacity is α(0< α< 1).The market share of Viin the starting period is φ.The market share of Viincreases at a rate ofin the first L1periods and decreases at a rate of θ(0< θ< 1) in the other periods.The discount rate is r, the life cycle of the product is N ,and N is renumbered after each knowledge transfer.For the details on assumptions, see Wu et al.[Wu, Zapevalova, Chen et al.(2018)].In addition, six new hypotheses are proposed.

Hypothesis 1.Viis an enterprise inneeds to transfer one type of private knowledge from other enterprises, andiV also needs to transfer one type of big data knowledge from the big data knowledge providers.The third type of knowledge is independent R&D knowledge.The three types of knowledge will be used for new product innovation simultaneously at time period T (0 < T < N).

Hypothesis 2.ω1, ω2and ω3are the weights of private knowledge, big data knowledge and the independent R&D knowledge

Hypothesis 3.The update rate of private knowledge from another enterprise is β1, the update rate of big data knowledge is β2, and the update rate of independent R&D knowledge is β3.The update rate of total new knowledge at time period n= 0 is β (0< β< 1).

Hypothesis 4.The fixed transfer cost of private knowledge transferred is k1, the fixed transfer cost of big data knowledge is k2, and the fixed R&D investment of independent R&D knowledge in the starting period is kR.All the fixed costs are constants.

Hypothesis 5.ρ (0< θ1< ρ< 1) is the total growth rate of market share of Viin the first L2periods immediately after Viupdates its new product knowledge at time period T .ρ1is the growth rate of the market share of Viin the first L2periods immediately after Vionly transfers the private knowledge at time periodT .ρ2is the growth rate of the market share of Viin the first L2periods immediately after Vionly transfers the big data knowledge at time period T .ρ3is the growth rate of the market share of Viin the first L2periods immediately after Vionly updates its new product by using independent R&D knowledge in the starting period.(0< θ1<ρ1, ρ2,ρ3< 1).

Hypothesis 6.ζ(T)is the DEP of Vibefore new product innovation, ξ(T)is the DEP of Vireceived after new product innovation at time point T , and K (T)is the knowledge renewal cost.The total DEP of Viis denoted as Ψ(T)and Ψ(T)=ζ (T)+ξ (T)-K (T).

2.2 DEP before new product innovation

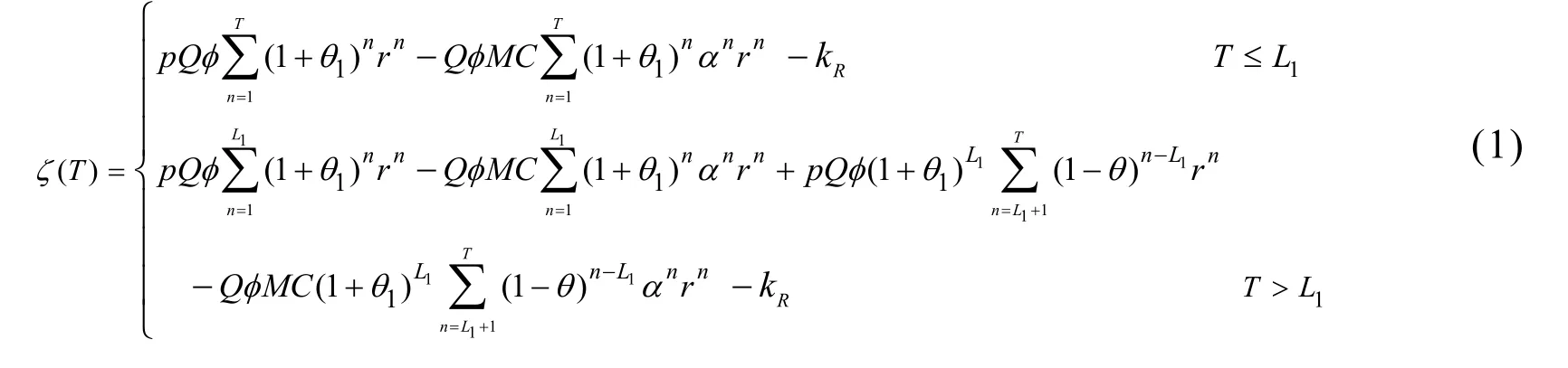

Because there is no new knowledge at this stage,iV produces product using prior knowledge.The DEP before an update in new product knowledge is shown in Eq.(1).

2.3 Knowledge renewal cost

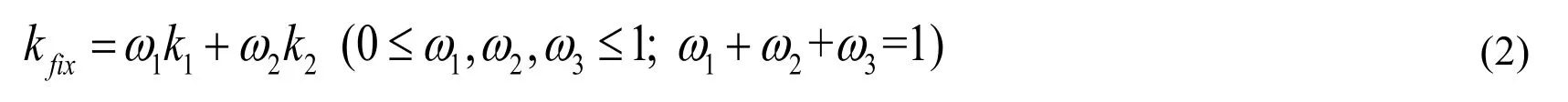

The knowledge renewal cost K is formed by the fixed costfixk and the variable cost kvar.The fixed transfer cost kfixcan be calculated by the weight and the fixed transfer cost of each type of knowledge.From hypotheses 2 and 4, the fixed cost of new product can be calculated by Eq.(2).

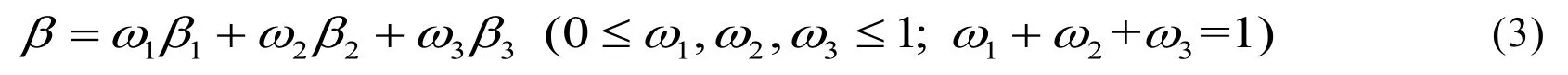

The variable cost kvaris related to the knowledge-level gap between Viand the updated rate of external new knowledge.From the modeling method, the weights of private knowledge and big data knowledge are calculated by the profit contribution rate of each type of knowledge.Thus, ω1,ω2,ω3can also be seen as the weight of the update rate of each type of knowledge.The update rate of all external new knowledge β can be obtained by Eq.(3).

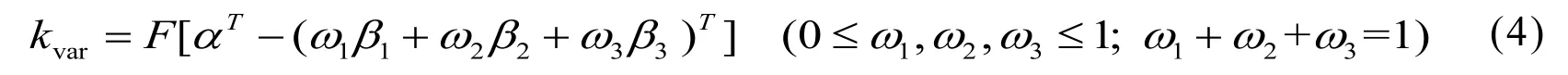

From hypotheses 2, 3 and 4, the variable cost can be computed by Eq.(4), where F is the coefficient of variable cost and a constant.

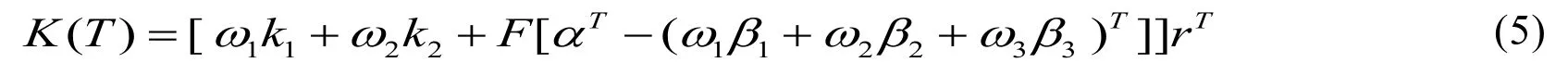

After discounting the transfer costs to the starting point, the total transfer cost of various types of knowledge can be expressed as Eq.(5).

2.4 DEP after new product innovation

Suppose that ω1, ω2,ω3are also the weights of the growth rates of the market shares of each type of knowledge.The total growth rate of market share ρ can be calculated by Eq.(6).

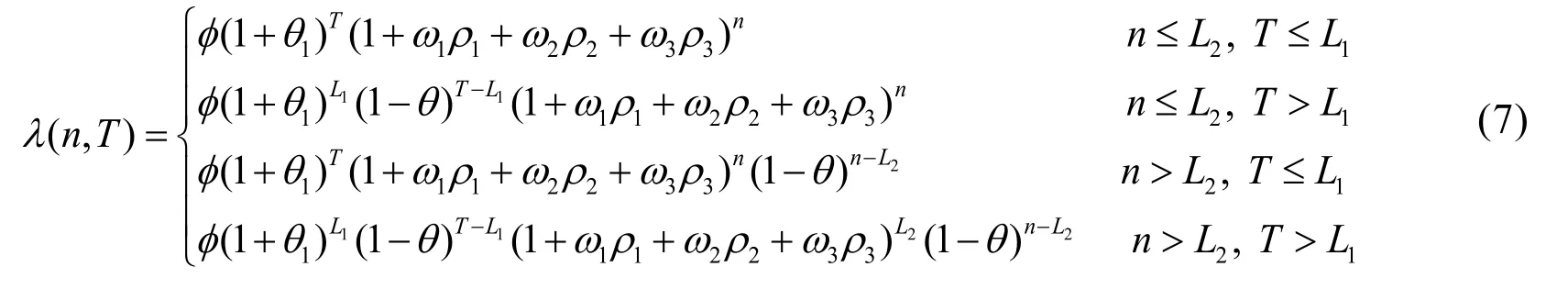

If Vitransfers new knowledge at time period T , when T ≤ L1, the market share of Viin time period T is φ (1+θ1)T.When T >L1, the market share of Viis φ (1 +θ1)L1(1 -θ)T-L1.After the period of time T , new knowledge began to work on the market share of Vi.From previous hypotheses and hypothesis 5, the market share of Viwill increase at a rate of ρ in the L2periods immediately after time period T , and it will then decay at a rate of θ .Hence, the market share of Viin periodncan be denoted as Eq.(7).

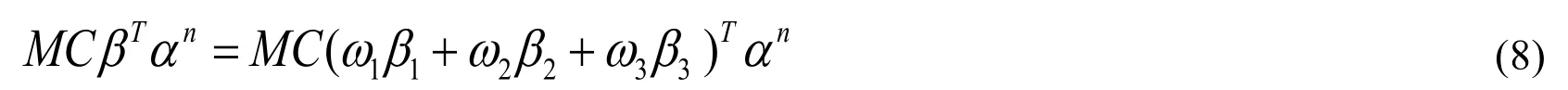

From hypothesis 3, the update rate of all external new knowledge at time period n=0 is β .Considering the time cumulative effect, the external new knowledge at time period T has been updated by βT, which can make the marginal cost of Viat time period T reduce to MCβT.The knowledge absorption capacity of Viis α .Then, the marginal cost of Viat time period T will become MCβTαn.By replacing βTwith Eq.(3), the marginal cost at time period T of Vican be calculated by Eq.(8).

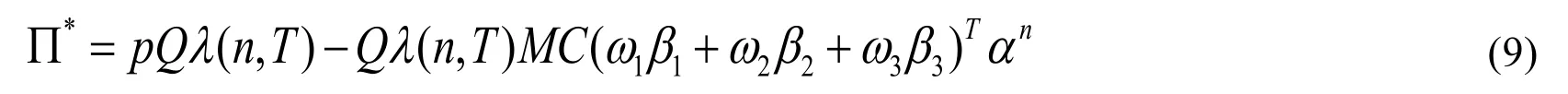

The total production cost in time period n after knowledge transfer isBy subtracting the total production cost from the sales revenue pQλ (n,T), the profit at time period n after knowledge transfer can be obtained by Eq.(9).

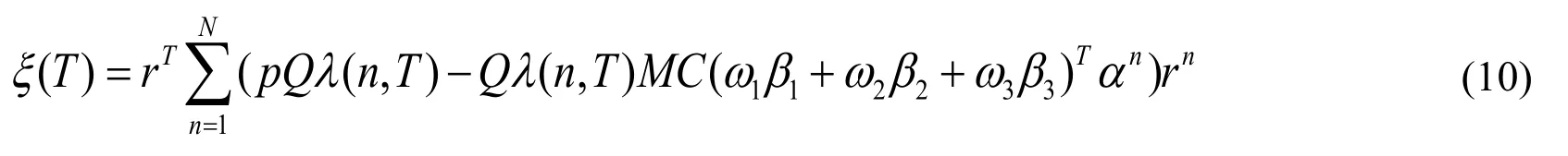

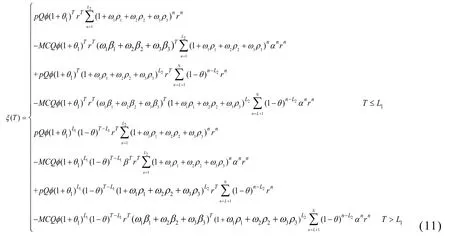

Through discounting the profits in periodto the starting point by multiplying Eq.(9) with rTrnand summing up all the discounted profits in the life cycle N , the DEP after knowledge transfer is as shown in Eq.(10).

By using Eqs.(7) and (10), the expected profits after knowledge transfer can be expressed as Eq.(11).

2.5 Total DEP of new product

From the modeling idea and methods, the time optimization problem of multiple simultaneous knowledge transfer of various types of knowledge must find the maximum of the total DEP Ψ(T)offor the given parameters.Therefore, the optimization model of multiple simultaneous knowledge transfer can be expressed as Eq.(12).

3 Simulation experiments

3.1 Model solution

It can be seen from Eq.(12) that Ψ(T) is a piecewise continuous differential function of T.Therefore, Ψ(T) can reach its maximum in a closed interval 0≤T≤N, and the maximum profits in the life cycle of the product can be found.Then, the optimal time of multiple knowledge transfers can be obtained.

MATLAB 7.0 has been used to compile a program that considers the power of the numerical calculation and simulation functions.Some simulation experiments of actual situations can be conducted by adjusting the model’s parameters.

3.2 Simulation experiments

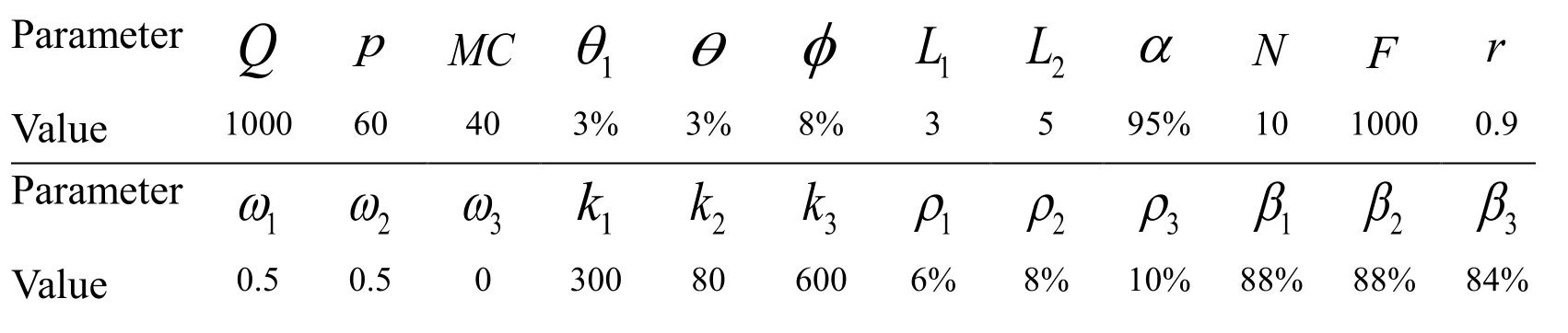

(1) Parameter setting and simulation with

To compare knowledge transfer models in a big data environment, the same parameters are set at the same values.The R&D investment is usually higher than the fixed cost of private knowledge transfer, and independent innovation knowledge usually brings higher market share and a higher knowledge update rate.Therefore, the parameters are set as follows.The total product sales Q=1000; the price per unit product p=60; the marginal cost in the starting period MC=40; the growth rates of total market volume in the first L1periods θ1=3%; the natural attenuation rate of market volume in the other periods θ =3%; the market share of Viin the starting period φ =8%; the period of total market volume increased before knowledge update of the new product L1= 3; the period of total market volume increased after knowledge update of the new product L2= 5; the knowledge absorption capacity α =95%; the life cycle of the product N =10; the variable cost coefficient F =1000; the discount rate is 10%, then r =1/(1 +10%) ≈0.9; the fixed transfer cost of the private knowledge k1=300; the fixed transfer cost of the big data knowledge k2=80; the R&D investment of independent innovation knowledge in the starting period kRf=600; the growth rate of the market share of Viin the first L2= 5 periods immediately after Vionly transfers the private knowledge ρ1=6%.The growth rate of the market share of Viin the first L2periods immediately after Vionly transfers the big data knowledge ρ2=8%.the growth rate of the market share of Viin the first L2periods immediately after Vionly updates its new product by using independent R&D knowledge in the starting period ρ3=10%; the update rate of private knowledge β1=88%; the update rate of big data knowledge β2=88%; the update rate of independent innovation knowledge β3=84%.The values of these parameters are shown in Tab.1.

Table 1: Parameter values

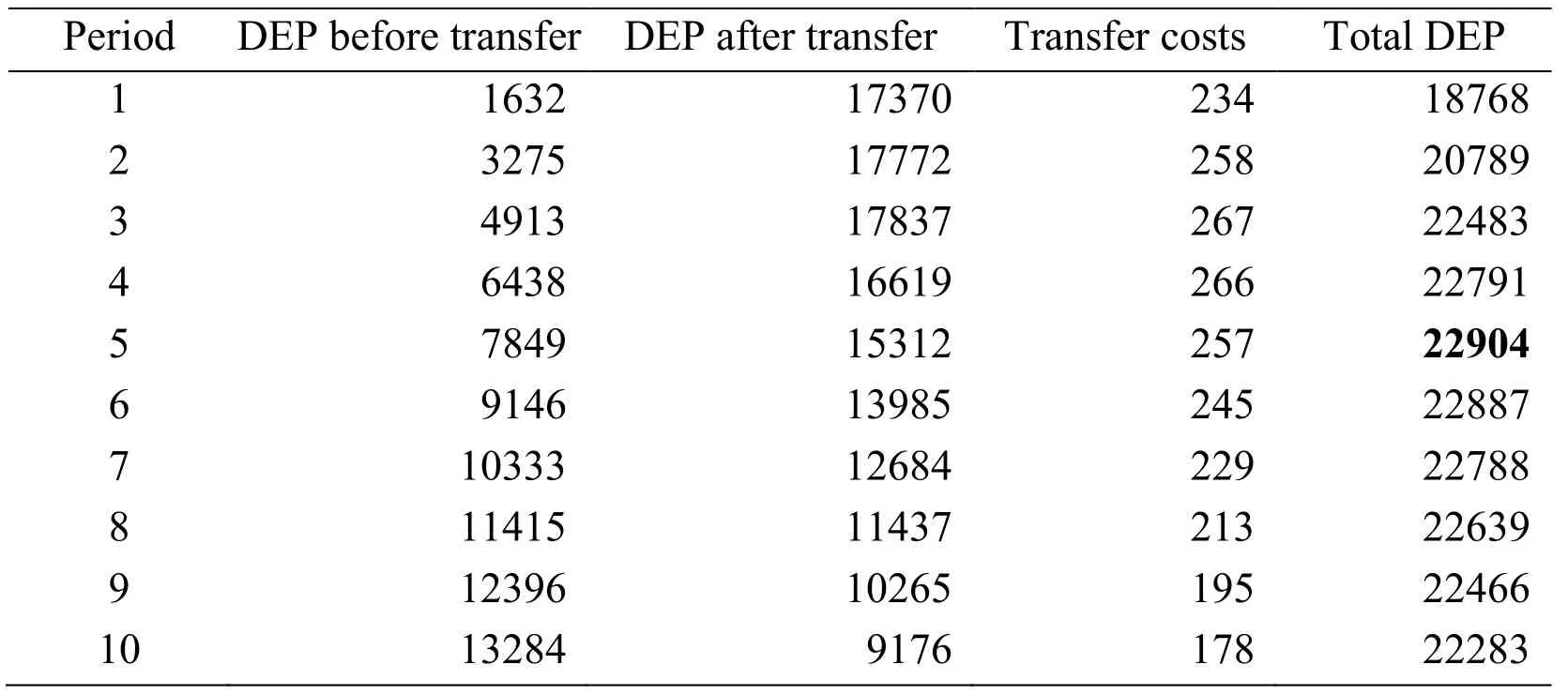

When ω1=0.5,ω2=0.5andω3= 0, it means that Vionly transfers knowledge from the external environment to update new products, and the proportion of big data knowledge and private knowledge are all 50%.Tab.2 shows the experimental results of the DEP before knowledge transfer (DEPb), the DEP after knowledge transfer (DEPa), the transfer costs, and the total DEP of the new product.The total DEPs are the same as the experimental results of Wu et al.[Wu, Chen and Li (2016)], and the model is valid.

Table 2: DEPs and Transfer costs when ω1=0.5,ω2=0.5, ω3= 0

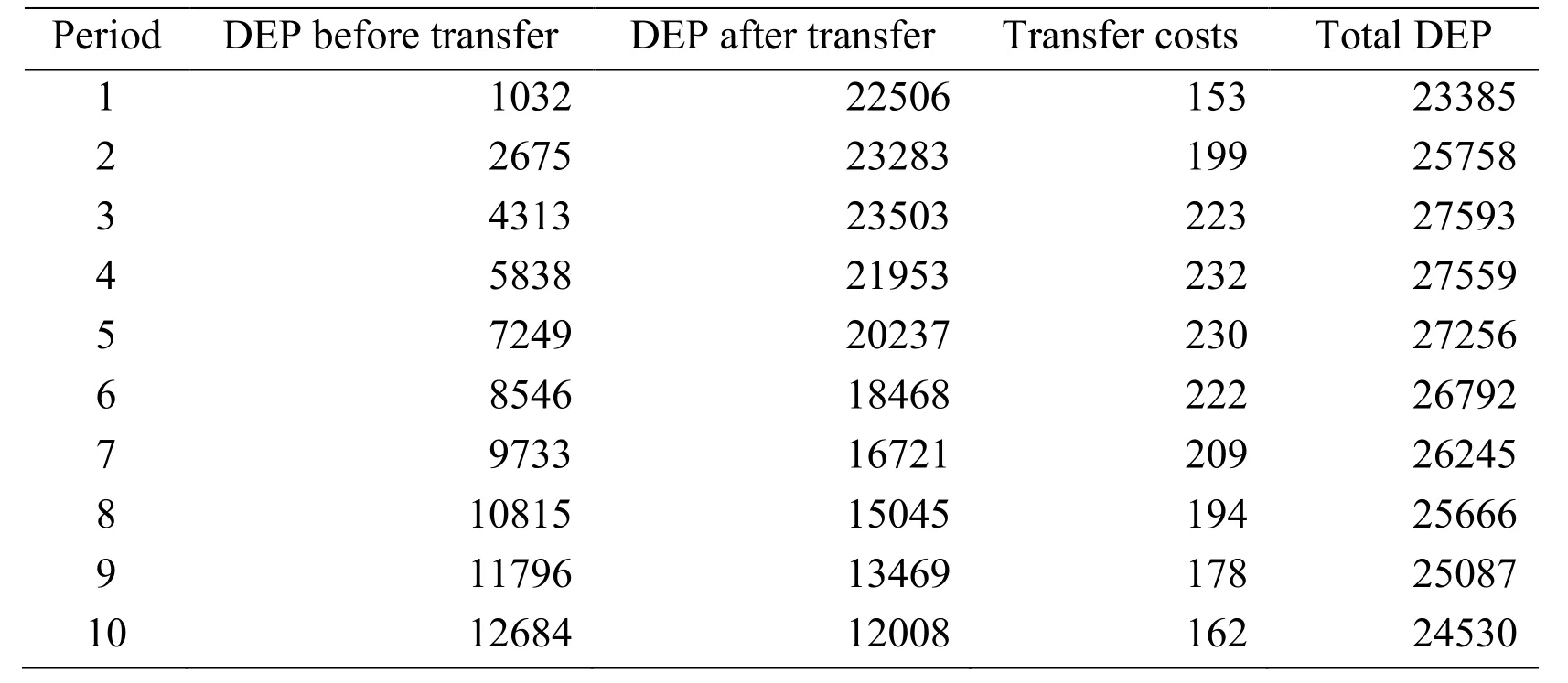

(2) Simulation with ω1,ω2and ω3

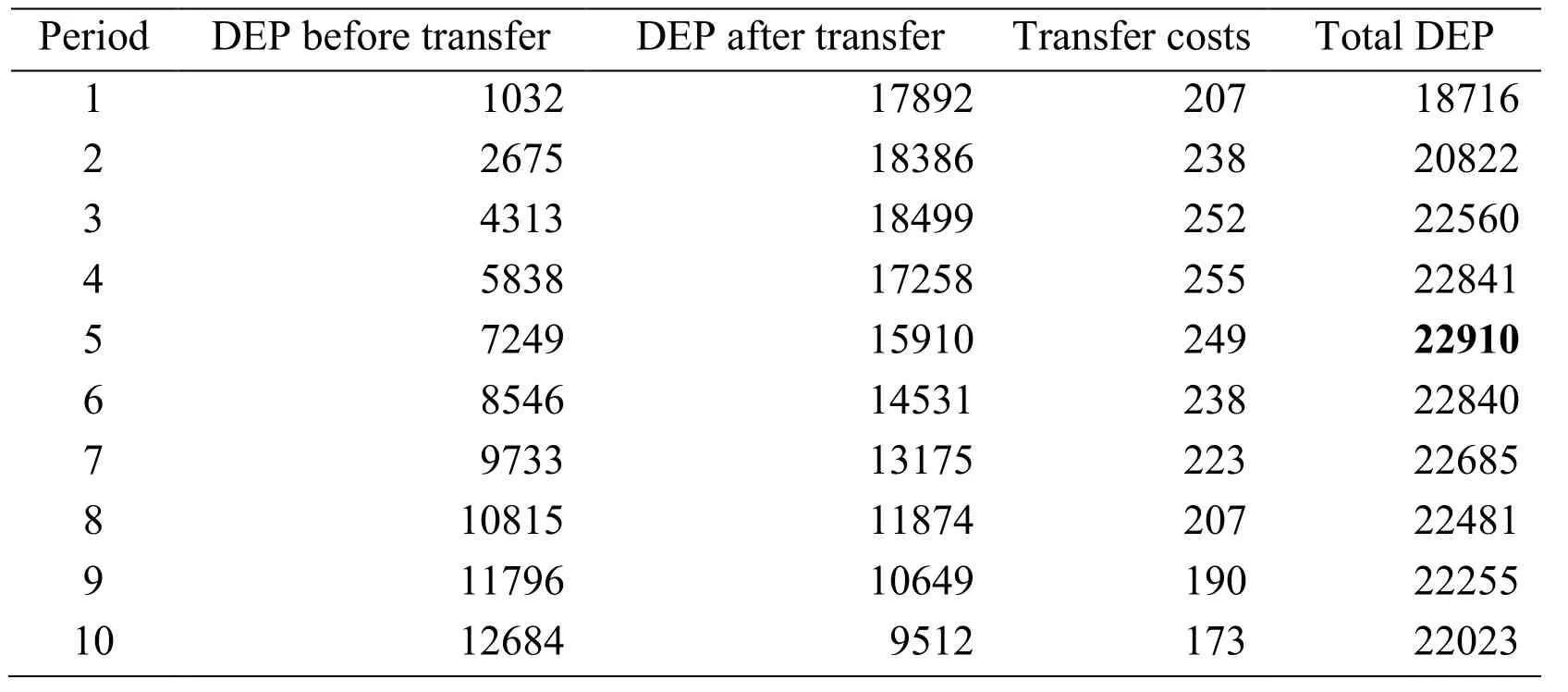

When ω1=0.4,ω2=0.4 and ω3=0.2, it means that Viupdates its product by using three types of new knowledge.Among the three types of new knowledge, big data knowledge is 40%, private knowledge is 40%, and independent innovation knowledge of Viis 20%.Tab.3 shows the experimental results of the DEPb, the DEPa, the transfer costs, and the total DEP of a new product when ω1=0.4,ω2=0.4 and ω3=0.2.

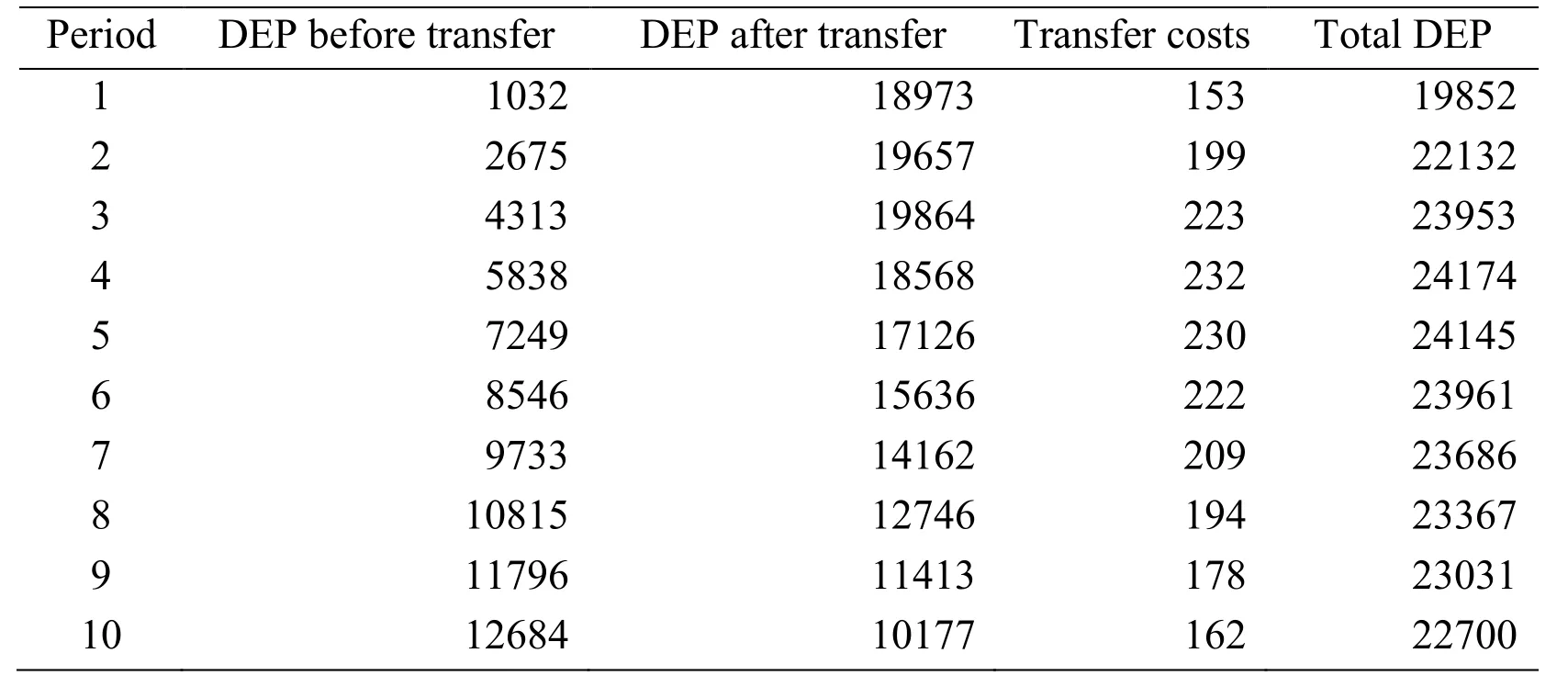

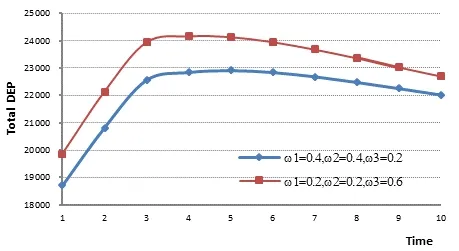

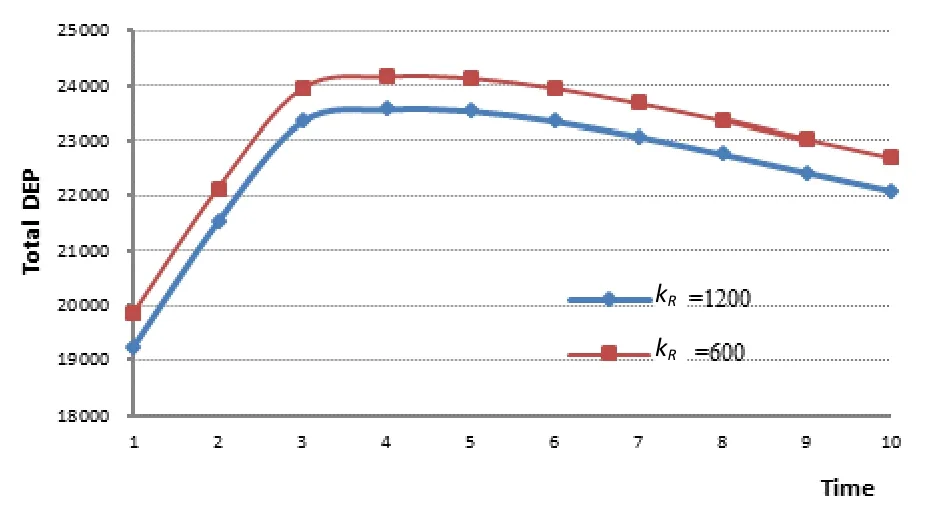

When ω1=0.2,ω2=0.2 and ω3=0.6, it means that big data knowledge is 20%, private knowledge is 20%, and independent innovation knowledge of Viis 60%.Tab.4 shows the experimental results of the DEPb, the DEPa, the transfer costs, and the total DEP of the new product.From the experimental results in Tabs.3, 4 and Fig.1, the optimal knowledge update time of new product T change from 5 to 4, and the total DEPs increase.It can be concluded that the performance of NPD increases with the weight of independent innovation knowledge, and the enterprise will update its product with new knowledge as soon as possible.This model is in line with the actual economic situation, and the model is valid.This model can help enterprises to determine the weight of different types of knowledge and predict the performance of NPD.

Table 3: DEPs and Transfer costs when ω1=0.4,ω2=0.4, ω3=0.2

Table 4: DEPs and Transfer costs when ω1=0.2,ω2=0.2, ω3=0.6

Figure 1: Changes of total DEP with ω 1,ω 2and ω3

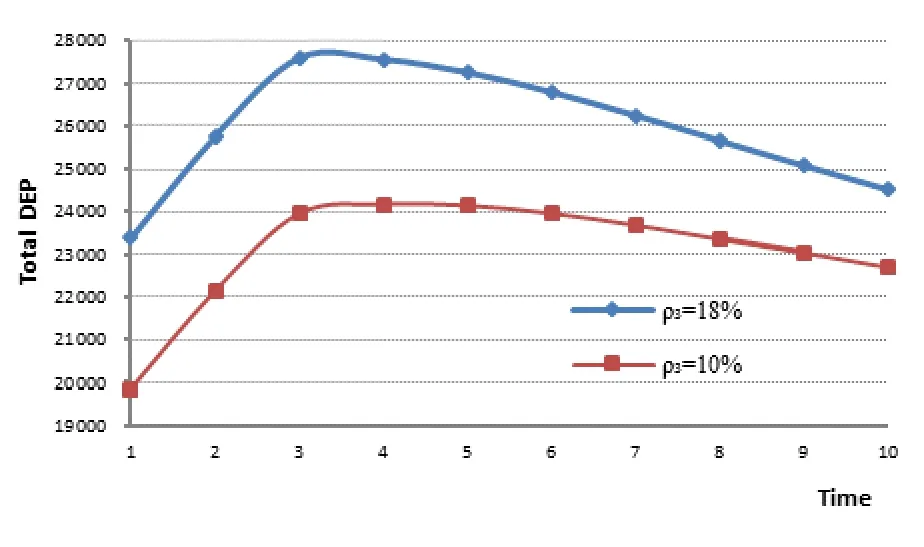

(3) Simulation with kR

kRis the R&D investment in the starting period.Let kRchange from 600 to 1200, all the other parameters are set at the same values as that when ω1=0.2,ω2=0.2 and ω3=0.6.It means that new independent innovation knowledge needs more R&D investment.From the experimental results in Tabs.4, 5 and Fig.2, all total DEPs have become smaller, and the optimal time of knowledge update has no obvious changes.It means that increasing R&D investment will lead to a decline in NPD performance, but the growth of R&D investment to a certain extent does not affect the speed of new product updates.When the R&D investment is much higher, enterprises tend to increase the proportion of knowledge transferred from the external environment.

Table 5: DEPs and Transfer costs with k R

Figure 2: Changes of total DEP with k R

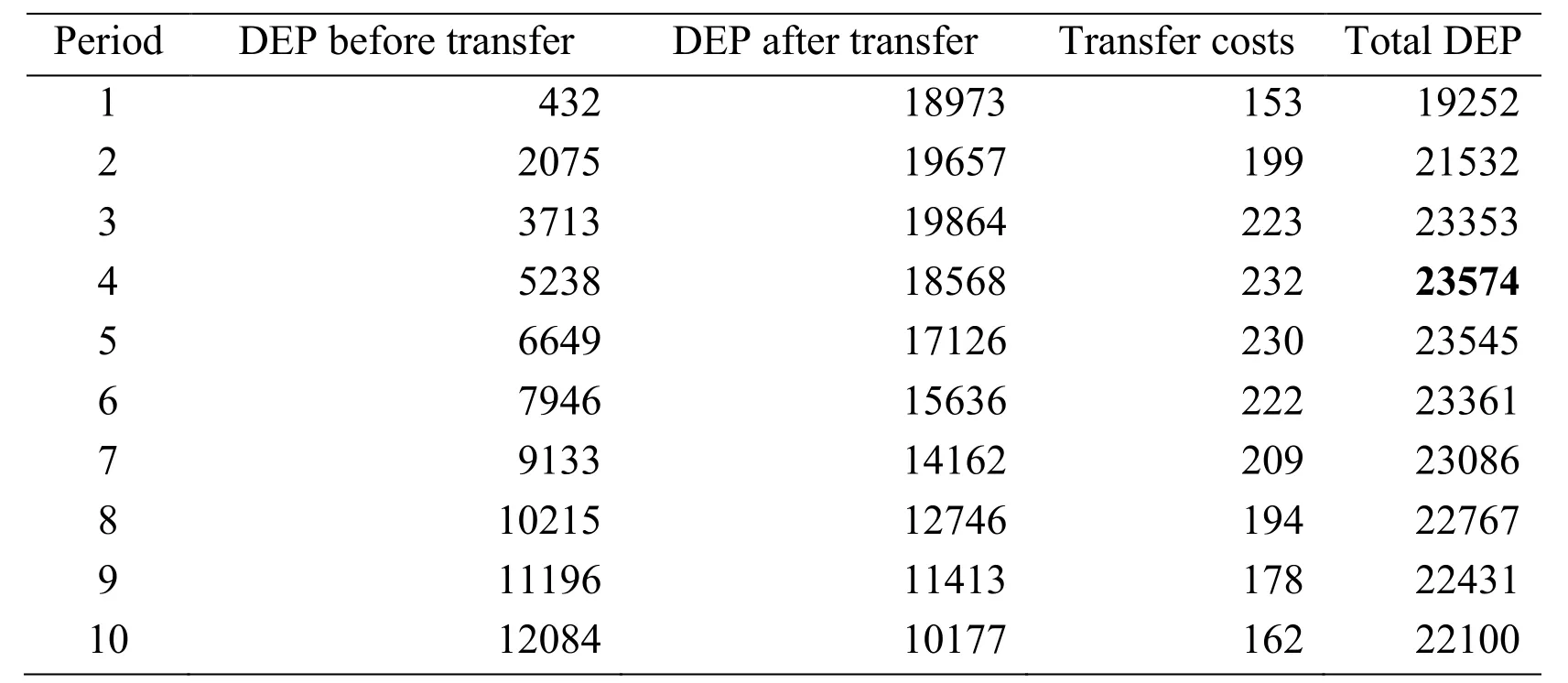

(4) Simulation of ρ3Let the growth rate of the market share of independent innovation knowledge ρ3change from 10% to 18%, all the other parameters are set at the same values as that whenand ω3=0.6.The meaning is that new independent innovation knowledge will bring a significant increase in market share.From the experimental results in Tab.4, 6 and Fig.3, the total DEPs have become larger.It means that the performance of NPD increases.The optimal time for a knowledge update of a new product changes from T = 4 to T = 3.The reason is that if the independent innovation knowledge can bring a larger market share in the future, enterprise will speed up NPD.

Table 6: DEPs and Transfer costs with ρ 3

Figure 3: Changes of total DEP with ρ 3

4 Conclusion

This paper categorizes the knowledge composition of new product innovation in the big data environment.A model of new product innovation is established by maximizing the present value of the total expected profit of the new product.The model can help enterprises to determine the weight of different types of knowledge and the scale of R&D investment, and it predicts performance of NPD when developing new products.The results show that the greater the weight of independent innovation knowledge, the greater the performance of NPD.Enterprises tend to transfer knowledge from the external environment when R&D investment is much higher, and enterprises will speed up independent innovation when independent innovation knowledge is expected to bring larger market share.

Acknowledgment:This research is supported by the National Natural Science Foundation of China (Grant No.71704016), the Natural Science Foundation of Hunan Province (Grant No.2017JJ2267), and the Project of China Scholarship Council for Overseas Studies (201508430121, 201208430233).

References

Ashish, A.(2011): Licensing tacit knowledge: intellectual property rights and the market for know-how.Economics of Innovation & New Technology, vol.4, no.1, pp.41-60.

Bowen, H.K.; Clark, K.B.; Holloway, C.A.; Wheelwright, S.C.(1994): Development projects: the engine of renewal.Harvard Business Review, vol.72, no.5, pp.110-120.

Carlile, P.R.(2002): A pragmatic view of knowledge and boundaries: boundary objects in new product development.Organization Science, vol.13, no.4, pp.442-455.

Cooper, R.G.; Kleinschmidt, E.J.(2010): Benchmarking the firm's critical success factors in new product development.Journal of Product Innovation Management, vol.12, no.5, pp.374-391.

Davila, T.(2016): An empirical study on the drivers of management control systems’ design in new product development.Accounting Organizations & Society, vol.55, no.10, pp.S311-S311.

Ding, X.(2008): The impact of intellectual property right risk on the inter-firm knowledge transfer in collaborative innovation.Science Research Management, vol.29, no.3, pp.16-21.

Dougherty, D.(1992): A practice-centered model of organizational renewal through product innovation.Strategic Management Journal, vol.13, no.S1, pp.77-92.

Horst, P.; Duboff, R.(2015): Don’t let big data bury your brand.Harvard Business Review, vol.93, no.11, pp.78-86.

Houacine, F.; Bouzefrane, S.; Adjaz,A.(2016): Service architecture for multi-environment mobile cloud services.International Journal of High Performance Computing and Networking, vol.9, no.4, pp.342-355.

Hu, M.Y.(2018): Literature review on imitation innovation strategy.American Journal of Industrial and Business Management, no.8, pp.1777-1788.

Jun, S.; Park, S.; Jang,D.(2015): A technology valuation model using quantitative patent analysis: a case study of technology transfer in big data marketing.Emerging Markets Finance & Trade, vol.51, no.5, pp.963-974.

Knudsen, M.P.(2010): The relative importance of interfirm relationships and knowledge transfer for new product development success.Journal of Product Innovation Management, vol.24, no.2, pp.117-138.

Koman, G.; Kundrikova, J.(2016): Application of big data technology in knowledge transfer process between business and academia.Procedia Economics & Finance, vol.39, pp.605-611.

Leonard-Barton, D.(2010): Core capabilities and core rigidities: a paradox in managing new product development.Strategic Management Journal, vol.13, no.S1, pp.111-125.

Levitt, T.(1996): Imitation innovation.Harvard Business Review, no.10, pp.63-70.

Li, T.; Chen, X.(2017): The internet company realize independent innovation from imitation.2016 International Conference on Logistics, Informatics and Service Sciences.

Liu, Y.L.; Peng, H.; Wang J.(2018): Verifiable diversity ranking search over encrypted outsourced data.Computers, Materials & Continua, vol.55, no.1, pp.37-57.

Manyika, J.; Chui, M.; Brown, B.; Bughin, J.; Dobbs, R.et al.(2012): Big data: the next frontier for innovation, competition, and productivity.Analytics, vol.76, no.4, pp.1-4.

McGuire, T.; Manyika, J.; Chui, M.(2012): Why big data is the new competitive advantage.Ivey Business Journal, vol.76, no.4, pp.1-4.

Parra, A.(2014): Sequential innovation and patent policy.SSRN Electronic Journal.

Posen, H.E.; Lee, J.; Yi, S.(2013): The power of imperfect imitation.Strategic Management Journal, vol.34, no.2, pp.149-164.

Schumpeter, J.A.(1979): Capitalism, socialism and democracy.Political Studies, vol.27, no.4, pp.594-602.

Suchanek, F.; Weikum, G.(2013): Knowledge harvesting in the big-data era.ACM SIGMOD International Conference on Management of Data.

Sukumar, S.R.; Ferrell, R.K.(2013): ‘Big data’ collaboration: exploring, recording and sharing enterprise knowledge.Information Services & Use, vol.33, no.3, pp.257-270.

Szulanski, G.(2000): The process of knowledge transfer: a diachronic analysis of stickiness, Organizational Behavior and Human Decision Processes, vol.82, no.1, pp.9-27.

Wu, C.R.(2017): Models of dualistic complementary knowledge transfer in big-data environment.Information Technology Journal, vol.16, no.1, pp.17-26.

Wu, C.R.; Chen, Y.W.; Li, F.(2016): Decision model of knowledge transfer in big data environment.China Communication, vol.13, no.7, pp.100-107.

Wu, C.R.; Zapevalova, E.; Chen, Y.W., Zeng, D.M.; Liu F.(2018): Optimal model of continuous knowledge transfer in the big data environment.Computer Modeling in Engineering & Sciences, vol.116, no.1, pp.89-107.

Wu, C.R.; Zapevalova, E.;Li, F.; Zeng, D.M.(2018): Knowledge structure and its impact on knowledge transfer in the big data environment.Journal of Internet Technology, vol.19, no.2, pp.581-590.

Wu, X.; Zhu, X.; Wu, G.Q.; Wei, D.(2014): Data mining with big data.IEEE Transactions on Knowledge & Data Engineering, vol.26, no.1, pp.97-107.

Computers Materials&Continua2019年7期

Computers Materials&Continua2019年7期

- Computers Materials&Continua的其它文章

- A DPN (Delegated Proof of Node) Mechanism for Secure Data Transmission in IoT Services

- A Hybrid Model for Anomalies Detection in AMI System Combining K-means Clustering and Deep Neural Network

- Topological Characterization of Book Graph and Stacked Book Graph

- Efficient Analysis of Vertical Projection Histogram to Segment Arabic Handwritten Characters

- An Auto-Calibration Approach to Robust and Secure Usage of Accelerometers for Human Motion Analysis in FES Therapies

- Balanced Deep Supervised Hashing