Analysis on the Financial Feasibility of One-way Investment Project

马逸达

摘要: According to the analysis, it is found that the textbook of Financial Management only pays attention to the analysis of the fixed assets update decision and other mutually exclusive projects in the decision-making process of one-way project though it makes the analysis of project investment at present. Therefore, the textbook does not generally analyze the feasibility of finance from the perspective of cash flow in terms of an one-way investment project. Generally speaking, it provides the corresponding theoretical and practical value for the decision-making of one-way investment project in this paper, so as to provide theoretical and practical significance for the follow-up research process.

關键词:one-way investment project; financial management; feasibility analysis

1.The investment dilemma of one-way investment project and the cause for the formation of it

(1)Narrow investment channels

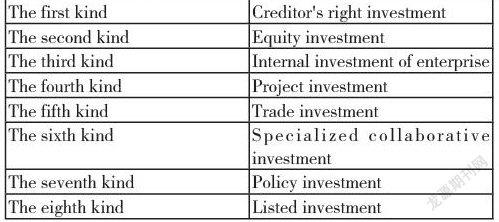

As for the investment of the enterprise, there are a total of eight paths as follows.

However, the investment method generally adopted is only the first two of the following table due to the limitation of the one-way investment project in our country, and the other six methods are basically not applicable.

From the above table, the first kind is a common way to see in one-way investment project. So far, about 80% of the investment in some of the one-way investment projects of China is from the credit of state-owned banks. However, the commercial banking industry only invests 1/5 to the one-way investment projects in our country in view of the current relatively high proportion of credit. Thus, it can be seen that the investment of the commercial banks of China is not optimistic, which does not care about it. Since the one-way investment project of our country has also encountered the "bottleneck" in the credit of commercial banks, it also makes it need to gradually expand the current private lending market, which thus results in a rising interest rate of private lending, and also leads to the frenzied influx of interest-driven funds. If it takes a case of Wenzhou, Zhejiang, China before June of 2011 as an example, it can be seen that relevant researchers have conducted a comprehensive investigation on one-way project in a certain area of Wenzhou, Zhejiang Province, who finds that more than 60% of the people have already participated in private lending from nearly 100 families. Besides, some relevant data also show that the scale of Wenzhou regional private lending market is more than 100 billion yuan, which generally accounts for about 18% of the total private capital, and is also completely equivalent to 20 per cent of the bank loan balance in Wenzhou. On the other hand, the annual interest rate of private lending in our country has been raised to the range from 120% to 180% at present. Due to the lack of strict supervision and management of private lending in our country, it makes the one-way investment project of our country have more pressure to repay the assets with the interest together in our country. As a result, it also completely implies that the one-way investment project of our country will not adopt this investment method first.

(2)High investment cost

The formula of the credit and the corresponding profit rate of the commercial banks that are regarded as the main investment form of the one-way investment project in our country in the current actual situation is drawn up as follows.

Loan interest rate =benchmark interest rate+term premium+risk premium+ reasonable profit margin+management cost rate

The one-way investment projects in our country are generally small in size with weak resistance to external risks. Besides, there are also less information records, which usually has a low credit rating. As a result, the risk premium of one-way investment projects in our country is generally not low. However, the commercial banking industry will consume the corresponding talent resources and material resources when the one-way investment project of our country is in the process of loan. But each amount of one-way investment project is generally small, and the commercial banking industry is equivalent to serving as a relatively high regulatory cost fund for an enterprise. When commercial banks manage the process summary of the mortgage loans for one-way investment projects in our country, it still needs to let one-way investment projects take mortgage guarantees measures. In this process, it is natural for one-way investment project to pay part of the evaluation funds and guarantee funds, so that the investment cost funds of one-way investment project can be expanded.

The more rigorous thing is that a large amount of funds are urgently needed for one-way investment projects in our country at present, but there is a great deal of shortage of credit resources in commercial banks. When one-way investment projects always suffer from certain difficulties in the process of investment, they will also choose some unconventional ways such as private lending to solve their own problems according to the actual situation. However, this method does not make any sense for the investment of one-way investment project, which thus makes one-way investment project break the capital chain in it.

2.The countermeasures to alleviate the investment dilemma of one-way investment project

(1)Establish innovate loan forms and products of credit franchisee

To improve the investment efficiency of the one-way investment project, we should also specialize in setting up institutional outlets for it, such as the one-way project in the United States. What the enterprises do is to make a clear distinction between the composition structure of the whole bank and the customers at all levels, which also need to make a clear corresponding relationship, and the corresponding relationship is shown as follows:

At the same time, it can make the relevant professionals have better training in the current basic investment environment, so as to make them have the ability to work in different financial institutions and contribute to the one-way investment projects in a better and faster way. Furthermore, the local government and the national government must formulate corresponding policies, so as to enhance the autonomy of franchisees to provide corresponding services to one-way investment projects in our country.

(2)Perfect information collection system and credit system to improve competitive strength

As a matter of fact, the problem of investment difficulties of the one-way investment projects in our country is mainly determined by the weakness of itself. However, the system created by the executives of one-way investment project is also relatively out of date, which neglects the concept of risk prevention and the enhancement of the ability of the individual. Moreover, the survival ability of one-way investment project is also relatively weak. At the same time, the financial system within the enterprise is not comprehensive, and the corresponding information is not transparent, so the overall social trust is not high, which is easy to produce the breach of trust of the enterprise, leading to the default rate is relatively high. These problems all indicate that the risk of lending to one-way investment projects by financial institutions in China is relatively high and the return rate is low. As a result, the first condition for perfecting the investment difficulties of one-way investment projects in our country is to let one-way investment projects try their best to improve the quality of individuals, which should also let the commercial credit be effectively strengthened, and let the category of products be innovated, so as to further increase the total amount of investment, and ultimately enhance the attractiveness of the external funds of one-way investment project. At the same time, it needs to create a comprehensive corporate financial system, so as to make commercial banks pass through in the overall judgment in a better quality and get investment opportunities.

3.Conclusion

Generally speaking, the investment problem of one-way investment projects in our country is difficult to solve, which is also a comprehensive problem of diversity. However, there must be a more thorough relationship between the fate of one-way investment project and the progress of the national economy, which also has a negative or positive impact on the steady operation of the economy and finance at the same time. Thus, the one-way investment projects in our country can achieve great progress in a rapid speed through the use of many ways and means as long as we can give full play of the whole society at all levels.

References

[1]趙曼.在公司治理视角下内部控制存在的问题及对策[J].管理观察,2018(06)

[2]张曦.公司治理视角下的增值型内部审计制度研究[J].会计师,2018(15)

[3]郑国洪,朱芳芳.大数据时代公司治理视角下的内部审计[J].审计月刊,2018(06)

[4]陈燊.公司治理视角下的风险导向内部审计研究[J].华北水利水电大学学报,2019(04)

[5]王洪丽.公司治理视角下企业内部控制体系建设研究[J].山东工会论坛,2018(04)

[6]张静.基于公司治理视角下的内部控制探讨[J].内江科技,2017(12)

[7]姚传云.公司治理视角下的内部控制机制探析[J].黑龙江科技信息,2017(01)