Making Digital Platforms Work for Asia and the Pacific

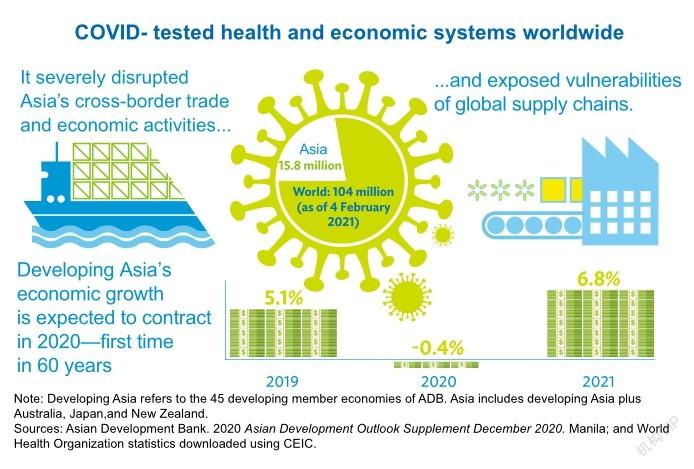

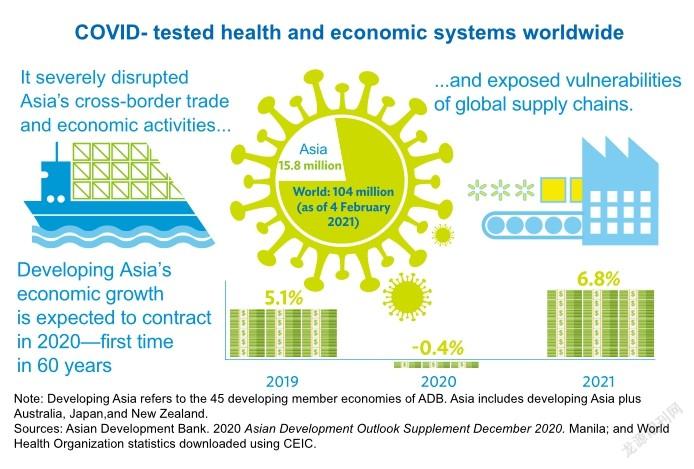

The coronavirus (COVID-19) pandemic has weighed heavily on health and economic systems worldwide; it has also severely disrupted Asias cross-border trade and economic activities, and exposed the vulnerabilities of global supply chains. Despite this, Asia still immensely benefited from open trade and investment, with the regions export-driven growth strategy and attractiveness to foreign direct investment (FDI) lifting millions out of poverty over the past half a century. The ongoing pandemic has also highlighted the benefits of rapid technological progress, digitalization, and increasing the services trade to bringing the global economy even closer together and providing new forms of global linkages. Intensifying these structural changes may be the basis of robust, resilient, and sustainable economic recovery. Moreover, the crisis created an opportunity for greater global and regional cooperation in order to contain and suppress COVID-19, strengthened global supply chains for essential commodities(including food, medical supplies, and vaccines), and made the world safer from natural hazards and pandemics by investing in projects with high social impact and economic returns.

The challenging trade environment and the landscape of the changing global value chain

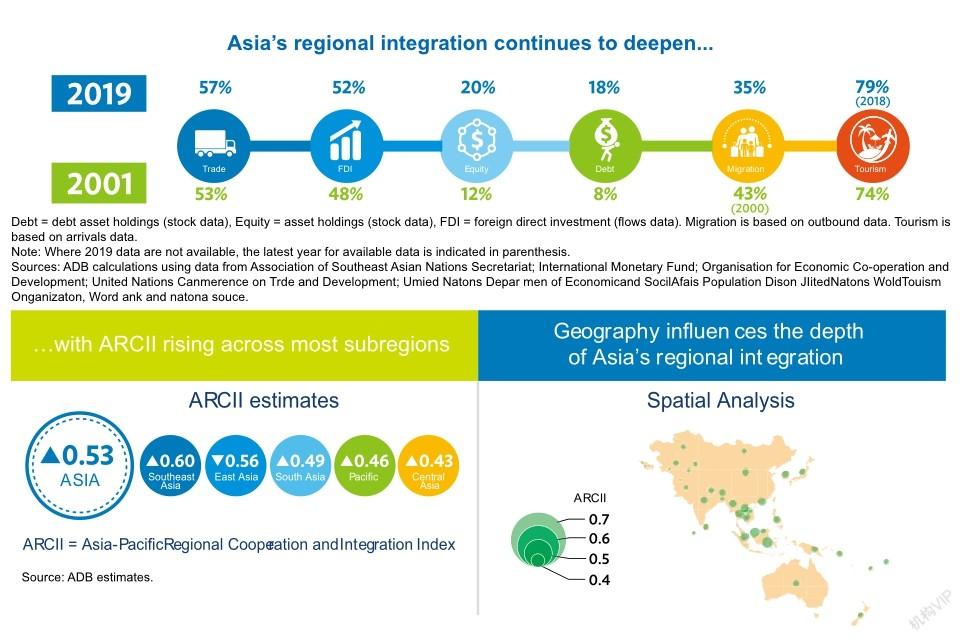

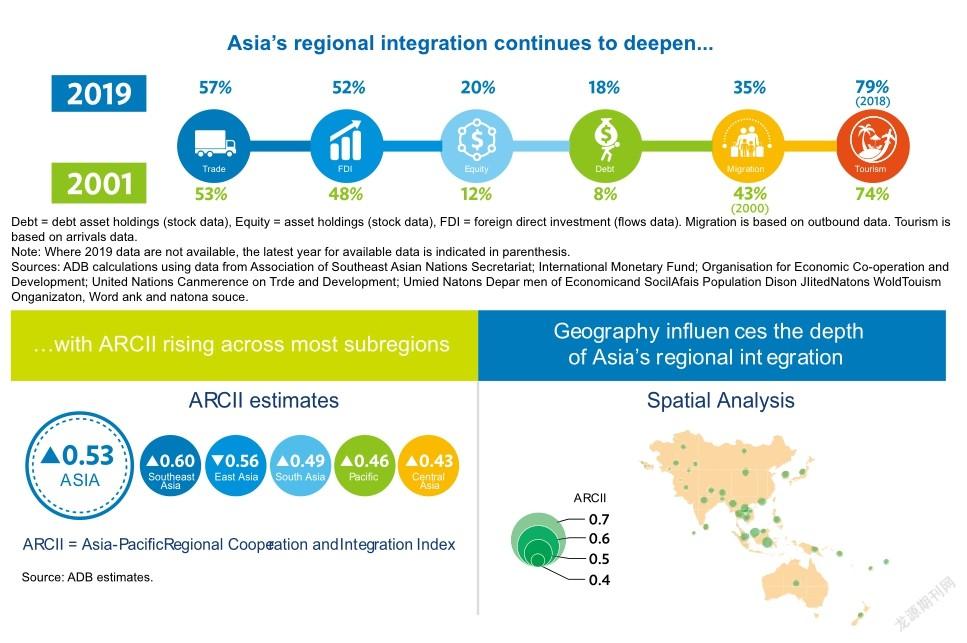

Asias trade growth was hit hard by the pandemic amid contracting global demand; nevertheless, recent high frequency data indicates a tempered yet gradual recovery. Having peaked in 2017, Asias trade growth began to slow down in the second half of 2018. This came in the wake of rising trade tensions between the United States (US) and the Peoples Republic of China (PRC), along with continued moderation in global economic growth. Asias merchandise trade volume has already contracted by 0.5% in 2019 after growing by 4.1% in 2018—a deeper slump than the 0.1% global trade contraction in 2019 (from 2.9% growth in 2018). By May 2020, Asias trade in volume had contracted by 10.1% yearon-year (y-o-y). Despite this, high frequency indicators—such as global shipping and packaging indexes and port calls—and recent monthly trade data suggest that Asias trade growth could recover faster than anticipated. However, the persistent pandemic and risk of a double-dip recession could weigh on a sustained recovery. The regions intraregional trade share remained stable at 57.5% in 2019, which was above the 56.5% average seen in 2012–2018. This remains higher than that of North America (40.9%) and lower than that of the European Union (EU) (63.2%).

Asia has relatively strong regional value chain linkages—as measured by the regional value chain to global value chain intensity ratio. After peaking in 2011–2013, expansion of the global value chain has been stagnating in recent years. The reshoring of supply chain networks to domestic economies, while only partial, could significantly reduce international trade compared with the status quo. By reshoring production networks, a country usually intends to decrease their reliance on intermediate goods imports and outsourcing of production and process them locally instead. Based on simulations using ADBs Multi-Regional Input–Output Tables (MRIOT), which can trace spillover impacts across trade supply chains, global trade is estimated to have contracted by 13–22% when 10–20% of overseas supply chains are restored. The pandemic will likely prompt an impetus to reengineer or diversify existing supply chains, and strengthening regional trade integration could help regional economies navigate the shifting global trade landscape in order to sustain trade growth. Against this backdrop, the region needs to embrace stronger trade liberalization and facilitation efforts, which includes pursuing trade agreements, in particular regional and mega trade deals.

Riding the tide of the pandemic through cross-border investment

Inward FDI to Asia fell by 7.7% in 2019 compared with 2018 (USD 510.5 billion), while the global FDI increased by 3.0%; investment flows both globally and to the region will likely fall further in 2020. The drop in Asias inward FDI in 2019 resulted mainly from weakening global demand for electronics and automotive products, as well as persistent trade tension between the US and the PRC. However, in 2019, Asias intraregional FDI share remained stable at 51.7%. An expected decline in reinvested earnings during the pandemic, which accounted for approximately half of the global FDI in 2009, will likely reduce FDI inflows in 2020. Asian economies were among the hardest hit globally in terms of reduced FDI inflows during the first quarter of 2020. Greenfield investments and mergers and acquisitions (M&As) in the region declined by 35.2% and 27.8% y-o-y, respectively(compared with global contractions of 27.0% and 49.2%). Globally, as well as regionally, investments in coal, oil, and gas plunged significantly in the first quarter of 2020, as did investments in hotels and tourism. This was followed by real estate, leisure, entertainment, and transportation. Nevertheless, recent firm-level activity in M&As in the region showed some signs of recovery during the second quarter, as countries started to reopen and ease some pandemic-related restrictions.

Asias outward investment rose 4.3% in 2019—at $531.4 billion, it accounted for 40.5% of global outward investments; outward investment dropped in the first quarter of 2020. Japan was the top source of global FDI in 2019, investing in the US, Australia, and Thailand, among others. Other top regional sources of global FDI were the PRC; Hong Kong, China; the Republic of Korea; and Singapore. Asias outward investment was not immune to the impact of the pandemic. Firm-level data shows Asias outward greenfield investment and M&As declined y-o-y by 27.0% and 64.3%, respectively, in the first quarter of 2020. The PRCs investment in cross-border projects in transportation and warehousing, chemicals, and electronic components declined, as did Japans M&A in pharmaceuticals. Nevertheless, Asias outward FDI showed signs of a rebound in the second quarter of 2020, in particular for M&As. Globally, some countries have tightened their FDI screening measures in order to safeguard key sectors from possible predatory takeovers amid the pandemic. While some were also intended to protect national security and public interest, FDI regulatory restrictions could hinder global FDI flows. While policymakers should be cognizant of potential investor-state disputes over policy measures taken in response to exceptional circumstances such as the pandemic, bilateral investment treaties could open more windows for new FDI inflows.

Digital platforms are transforming how we work, socialize, and create economic value. A digital platform creates a virtual place for communities to interact and exchange information, goods, and services. Examples of successful digital platforms include social media platforms such as Facebook, Instagram, LinkedIn, TikTok, and Twitter; search engines and marketing platforms such as Google, Yahoo!, and Baidu; video sharing and music streaming platforms such as YouTube and Spotify; e-commerce sites such as Amazon and Alibaba; and service-sharing platforms such as Airbnb, Grab, Uber, and GrubHub. These digital platforms use data, search engines, and algorithms to reduce the cost of acquiring and applying information, bypass intermediaries, reduce trade barriers, and use idle assets to lower production and distribution costs.

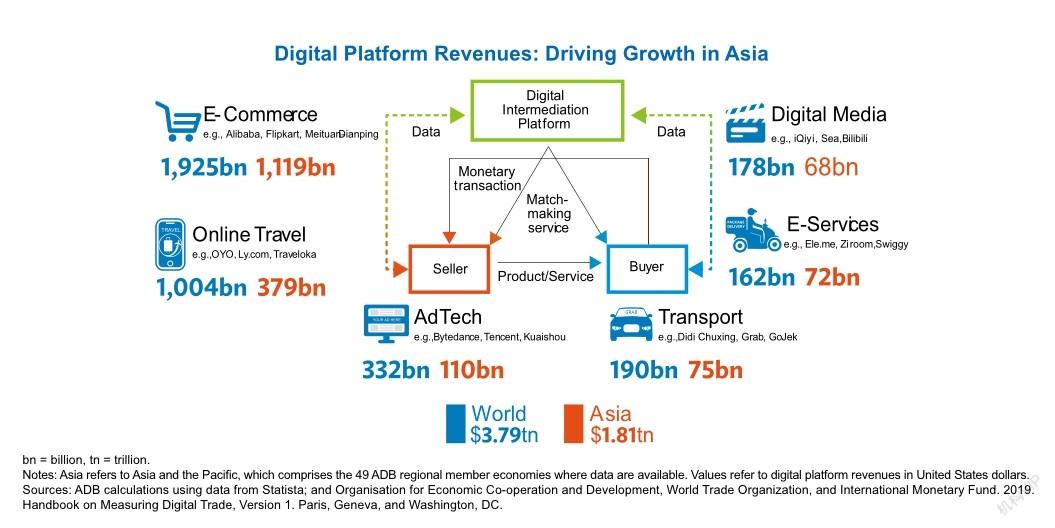

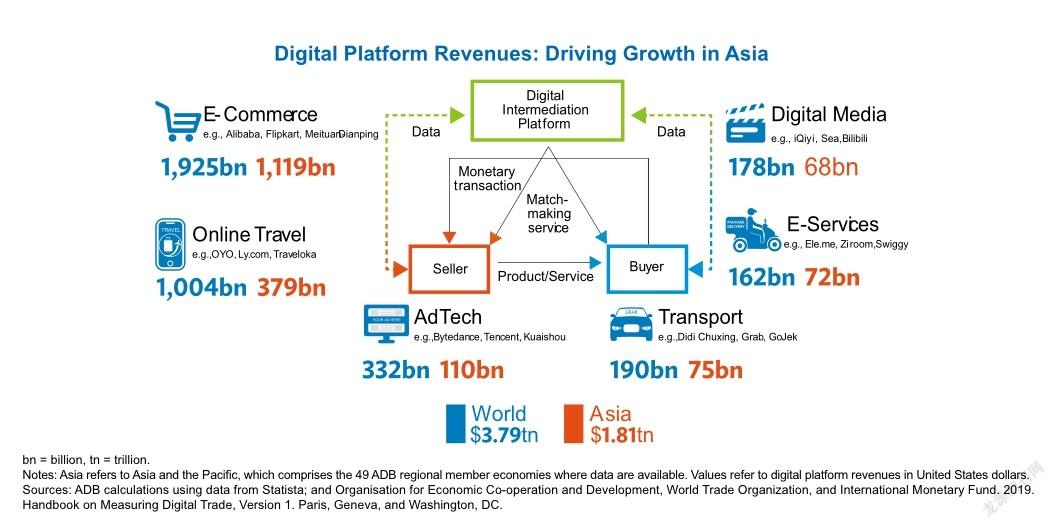

With the rise in digital platforms, new business models have proliferated, offering enormous economic opportunities. In 2019, digital platform business-to-consumer revenue reached USD 3.8 trillion, equivalent to 4.4% of global GDP. Asia accounted for approximately 48% (USD 1.8 trillion; equivalent to 6% of the regional GDP), the US accounted for 22% (USD 836.7 billion; 3.9%), and the Euro area accounted for 12% (USD 445.3 billion; 3.3%). Asia will continue its rise as a major player in the global digital platform market as wider access reaches more users and generates higher revenue growth.

The COVID-19 pandemic is accelerating the digital transformation of businesses of all sizes and across all industries. This accelerated digital transformation can potentially boost global output, trade and commerce, and employment. For example, a 20% increase in the size of the digital sector over the baseline by 2025 will increase global output by an average of USD 4.3 trillion yearly from 2021 to 2025 (equivalent to 5.4% of the 2020 baseline) or a cumulative impact of USD 21.4 trillion in 5 years. Asia would reap an economic dividend of more than USD 1.7 trillion yearly (equivalent to 6.1% of the 2020 regional GDP baseline) or more than USD 8.6 trillion over the next five years to 2025. Global trade will increase by roughly USD 2.4 trillion per year (5.5% of the 2020 global baseline trade) or an impact of USD 11.8 trillion in the next five years to 2025. Asias trade will increase by more than USD 1.0 trillion per year (6.8% of the 2020 regional baseline trade) or a USD 5 trillion increase in 5 years. There will be approximately 140 million additional jobs every year (5.0% of the 2020 global baseline for employment), which is equal to 65 million new jobs per year in Asia (or 3.9% of the regions 2020 baseline). By subregion, greater digital use will boost the Pacific island economies the most, followed by Central Asian and Southeast Asian economies. The reasons for this include the potential for: (i) digital connectivity to help developing countries overcome challenging geography; (ii) productivity and economic gains to allow for leapfrogging; and (iii) stronger digitally enabled services trade to support inclusive growth.

Policy support on multiple fronts can realize potential gains from the digital economy. The first is to improve the digital infrastructure and connectivity, in order to deliver affordable mobile and broadband services and expand broadband internet access and coverage. While digital connectivity offers vast opportunities for developing countries to participate in international trade and move up the value chain, traditional trade and logistics related to physical connectivity can remain a significant barrier to the delivery of goods, even when digitally purchased. Most notably, the gap in the logistics performance index between the bestand worst-connected countries remains wide. Continued digitization of customs clearance and border procedures is important, along with broadening access to safe and secure digital financial services. Investing in training for digital skills and literacy by providing access to information and communication technology devices and online teaching platforms is also critical. It is important to create a smart, robust, and transparent regulatory system to protect personal data, prevent illegal activities, and strengthen cybersecurity. A coordinated regional and international response is needed to develop digital tax policies and effectively plug tax loopholes in the digital economy.

Several key reform areas should ensure that appropriate policies and regulations are in place to manage undue advantages and unfair disruptions posed by the emergence of digital platforms. As with any new technology, digital platforms present a disruptive force to existing markets and market players. Due to the fact that they create new ecosystems where producers, service providers, workers, and consumers interact with new distribution channels, the massive network externalities generated thereby disrupt traditional markets and exert dominant market power. While access to unique big data and the ability to use same exclusively offers digital platforms the opportunity to innovate and create new products and services, the immense data advantage can generate a monopolistic market power, often raising privacy and cybersecurity issues for users and consumers.

Policy makers should be flexible when setting policies and regulations and should work together with the private sector to build open and innovative ecosystems for platform businesses, all while ensuring that there is adequate legislation or regulations for data privacy, consumer protection, and cybersecurity. Regulating rapidly evolving technologies is difficult. Legislating light-touch regulatory approaches to technologies that involve data processing and data protection may be helpful. This could be in the form of best practice guidelines, warnings, and advisories, along with better communication and closer coordination with regulated sectors. This will allow governments to supervise industry development while monitoring how the new technology develops and affects consumers. There are merits in adopting and issuing rules that allow certain, prequalified entities to soft-launch products in controlled environments or regulatory sandboxes. Policies that support innovation-driven entrepreneurship can also nurture platforms and ecosystems for platform-based businesses.

Upgrading education and labor market policies remains crucial for reaping the benefits of digital platforms and spreading the gains from the digital economy more widely. Digital platforms hold great promise for scaling up the coverage of education and learning, and are especially helpful in adapting to disruptions such as COVID-19, due to which over 1.5 billion students were unable to attend schedules face-to-face learning. With the rise of online learning amid the COVID-19 outbreak, EdTech tools and approaches can be game changers in education in many ways, and it is important to ensure that EdTech can be a catalyst in raising the quality of learning and addressing lags and deficits in learning outcomes. Creating an ecosystem for digital skills development and training, especially in technical and vocational education and training(TVET), will better prepare workers for the future. Developing arrangements for online quality assurance and credentials (such as micro-credentials and digital badges, among others) will also help. Digital solutions can also help to provide lifelong learning opportunities for all and facilitate workplace-based training as workers face multiple transitions between jobs.

Planning and coordination among key national institutions can help ensure that digital transformation benefits all. Innovation and digital platforms require new forms of coordination across public policy space and public-private partnerships. Currently, there is scope to better coordinate within government agencies in many economies in the region. Developing and implementing national strategies, enacting laws and regulations governing digital business activities, and adopting standards are all essential. It is also important to resolve ambiguity over regulatory coverage. More importantly, governments need to build relationships with various entities involved in creating, diffusing, and utilizing the innovation, data, and services from digital platforms. Coordination is critical to avoid confusion. A responsive information dissemination system can also play a pivotal role in helping micro, small, and medium sized enterprises understand the rapidly changing digital landscape, reduce costs, and increase their market reach.

Regional cooperation must be strengthened in order to better address cross-border issues and challenges. Cooperation should focus on sharing country-specific lessons and experience, conducting regional policy dialogs, and working together to collect data and produce knowledge products to understand how digital platforms can help or hinder inclusive and sustainable development. It is also crucial for intergovernmental forums and mechanisms to formulate regionally consistent frameworks, strategies, and regulations, especially in terms of cross-border data transfer and international taxation. Finally, with limited fiscal and financial resources, a regional approach to raising finance for technology may support digital transformation. Generally speaking, three key factors can help close the technology funding gap:(i) increasing the pipeline of technology projects; (ii) crowding in private capital; and (iii) mitigating the risks and costs of technology projects. Multilateral institutions can play an important role in building the trust and confidence of public, private, and personal stakeholders in this area of technological development.

- China’s foreign Trade的其它文章

- CCPIT Annual Meeting 2020 Opens in Beijing

- Moving Through Thorns

- China’s Anti-Pandemic Actions Convey Great Confidence

- Entering A New Stage of Development in the First Year of the 14th Five-Year Plan

- China’s Accomplishments in Hitting Poverty Alleviation Targets Grabs World Attention

- New Infrastructure Construction Uncovers Huge Business Opportunities