Troubled by unequal pay rather than low pay: The incentive effects of a top management team pay gap☆,☆☆

Yue Xu,Yunguo Liu,Gerald J.Loo

aSchool of Business,Sun Yat-sen University,ChinabC.T.Bauer College of Business,University of Houston,United States

Troubled by unequal pay rather than low pay: The incentive effects of a top management team pay gap☆,☆☆

Yue Xua,1,Yunguo Liua,*,Gerald J.Lobob

aSchool of Business,Sun Yat-sen University,China

bC.T.Bauer College of Business,University of Houston,United States

ARTICLEINFO

Article history:

Accepted 12 January 2016

Available online15February2016

JEL classification:

D230

D820

J310

TMT pay level

Pay gap

Property rights

SOE salary reform

ABSTRACT

We examine the relationships with firm performance of the internal pay gap among individual members of the top management team(TMT)and the compensation level of TMT members relative to their industry peers.We find that pay gap is positively related to firm performance and that this positive relation is stronger when the TMT pay level is higher than the industry median.However,we do not observe such effects in Chinese state-owned enterprises(SOEs),in which both the executive managerial market and compensation are government-regulated.We also document that cutting central SOE managers' pay level can increase firm value,whereas doing so for local SOE managers has the opposite effect.Our findings have important implications for research on TMT compensation as well as for policy makers considering SOE compensation reform.

©2016 Sun Yat-sen University.Production and hosting by Elsevier B.V.This is an open access article under the CC BY-NC-ND license(http://creativecommons.org/licenses/by-nc-nd/4.0/).

1.Introduction

Top management team (TMT)incentive-based contract design is a topic of considerable interest to academics and practitioners.It is an especially important issue in China because both the level of TMTcompensation has increased considerably and the compensation differentials among members of the TMT have widened significantly following the introduction of market-oriented reforms in China in 1978.Our focus in this study is on implications of the variation and the level of TMT pay for firm performance.

We define the variation in pay among the TMT as the difference between the CEO's pay and that of the other executives in the TMT,and refer to this difference as‘‘TMT pay gap.”TMT pay gap thus concerns the reward that non-CEO executives can expect if they are promoted to CEO.Prior research makes conflicting predictions about whether a large TMT pay gap promotes competition among TMT members and whether it enhances firm performance.Tournament theory,on the one hand,posits that a pay gap among different organizational levels provides a competition incentive such that the larger the pay gap,the better the firm's performance.Social comparison theory,on the other hand,stresses teamwork and cooperation within the TMT,and thus posits that a smaller pay gap can improve satisfaction and willingness to cooperate,thereby boosting firm performance.However,whether a team engages in competition or cooperation is an empirical issue(Harbring and Irlenbusch,2003),and this relationship is moderated by many factors,including task dependence and the individual incentive system(Shaw et al.,2002;Kepes et al.,2009).

In addition to TMT pay gap,the level of TMT pay is also an important factor that affects firm performance.We define‘‘TMT pay level”as the difference between the average pay of the TMT and the average pay of industry peer TMTs(Gerhart and Milkovich,1992),and refer to this difference as‘‘TMT pay level.”TMT pay level thus reflects the external competitiveness of the firm's compensation policy(He and Hao,2014).TMT pay level may have both a direct and an indirect effect on firm performance.First,as an important factor in the TMT's incentive system,TMT pay level has direct implications for firm performance.Second,TMT pay level may also have an indirect effect on firm performance because it moderates the relationship between TMT pay gap and firm performance.Excluding the effects of pay level from the model would thus result in a biased estimate of the relationship between TMT pay gap and firm performance.2For example,Knoeber and Thurman(1994)point out that Ehrenberg and Bognanno(1990a,b)ignore the incentive effect of prize level when using the behavior of professional golfers to examine tournament theory.Because the prize structure was identical across tournaments,larger prize gaps were always the result of higher prize levels.However,most of the related research in China does not consider this interactive effect of TMT pay level(Lin et al.,2003;Chen and Zhang,2006).Additionally,firms often use industry peers as a benchmark when negotiating contracts with top executives(Jiang,2011).Different TMT pay levels lead to an external comparison between firms,and top executives and then form corresponding levels of satisfaction with their compensation,which in turn influences the competition-cooperation relationship within the TMT.

As indicated earlier,we conduct our empirical analysis using compensation data from Chinese firms.The market-oriented reforms introduced in China in 1978 have led to substantial increases in the compensation levels of some executives,especially those at monopoly and public welfare firms.Further,the pay gap among Chinese firms'TMTs has considerably widened during this period(Zhang,2008;Li and Hu,2012).Concerned about the widening pay gap and increasing compensation level,China's Central Political Bureau passed a resolution on 29 August 2014 to reform the pay system for the responsible persons of centrally managed companies.The program focuses on five main areas:(1)improvement of the reward system,(2)adjustment of the pay structure,(3)strengthening of supervision,(4)regulation of the pay level,and(5)treatment standardization.The last two areas,in particular,are intended to address unreasonably high incomes and pay gaps to promote social justice.

‘‘Pay gap”can refer either to the income gap between executives and general staff or the gap between TMT members'pay.Chinese are generally more sensitive to the former gap,particularly since the round of pay cuts and layoffs in 2008 that saw executives retain high pay levels(Liu and Sun,2010).However,because the TMT is at the highest managerial level of the firm,the within-team pay gap is related to the distribution of limited compensation among executives,and thus plays an important role in the TMT incentive system.Moreover,if the overall TMT pay level is adjusted,the question is whether and how income should be distributed among team members to ensure the effectiveness of the compensation incentive mechanism.To answer this question,we explore the relationship between a TMT's overall pay level and the pay gap among its members.

Since 2005,it has been mandatory for China's listed firms to disclose their executives'compensation.In this study,we examine whether TMT pay level affects the relationship between a TMT pay gap and firmperformance based on executive compensation data from 2005 to 2012.Moreover,in the context of the current reform of China's state-owned enterprises(SOEs),we further analyze the relationship between TMT pay level and pay gap incentive efficiency under different ownership conditions.We find that TMT pay level can moderate pay gap incentive efficiency and that a pay gap within a TMT exerts stronger tournament effects when TMT members'pay level is higher than that of their industry peers.In Chinese SOEs,however,because both the market for executives and their compensation are regulated by the government,even a high pay level fails to stimulate tournament effects in the TMT.In central SOEs,cutting managers'pay level can increase the value of the firm.However,doing so in local SOEs is likely to dampen tournament incentive efficiency.For local SOEs that provide high TMT pay level,a larger TMT pay gap is associated with better firm performance.

This study makes several contributions.First,it enriches the literature on TMT pay incentives.These incentives comprise the entire team's pay level(the first distribution)and its internal pay gap(the second distribution)(Zhang et al.,2012).Many studies discuss these two aspects of incentives separately,but few combine them.Our findings show that the TMT pay level influences the team's internal distribution efficiency.When the pay level is higher than that of industry peers,a larger pay gap induces better tournament incentives and performance.However,when the pay level is lower than that of industry peers,a larger pay gap may be harmful to firm performance.

Second,our study adds to the literature on pay gaps.Tournament theory and social comparison theory do not coincide in terms of their predictions of the pay gap incentive effect.We argue that the applicability of the two theories depends on external equity.When top executives perceive external fairness,tournament theory is more applicable;when they perceive less external fairness,social comparison theory is more applicable.This finding also supplements Brown et al.(2003).

Third,our study contributes to the literature on Chinese SOE reform.Wu et al.(2010)and Li et al.(2014)report that excess compensation does not have incentive effects.Similarly,our findings show that excess pay does not promote internal competition in the TMT.For central SOEs,reducing top managers'pay level can stimulate managerial competition and enhance firm value,which lends support to the recently passed and implemented decision to reduce the compensation of central SOEs'top executives.At the same time,our results suggest that the reform policy for local SOEs should not simply follow than that of central SOEs. Reducing pay levels may not be the optimal decision for local SOEs,although adjusting the internal pay structure may enhance firm performance.

The remainder of the paper is organized as follows.Section 2 presents the literature review and hypothesis development,and Section 3 discusses the research design.Section 4 reports the descriptive statistics and the results of the empirical analyses,while Section 5 discusses the results of robustness tests.Section 6 presents the results of additional analyses and Section 7 concludes the paper.

2.Literature review and hypothesis development

2.1.Literature on pay gap and pay level

There is a sizeable body of research on the relationship between TMT pay gap and firm performance.One strand of research is tournament theory,developed by Lazear and Rosen(1981),which posits that although a non-CEO's salary may double within a day following the promotion to CEO,it would be difficult to argue that his/her ability has also doubled within a day.Thus,it is difficult to explain the pay gap in TMTs through recourse to traditional economic theory,which argues that pay levels are determined by marginal output(e.g.,Lin et al.,2003).Tournament theory argues that under the conditions of cooperative effort and task interdependence,it is not feasible to set executives'pay based on their marginal output when monitoring is difficult. Although marginal output-based pay for executives might seem more equitable,a large pay gap can encourage rank-order competition,thereby improving firm performance.Numerous studies provide empirical evidence consistent with the predictions of tournament theory.For example,Ehrenberg and Bognanno(1990a,1990b)study the behavior of professional golf players,and find that increases in the differential between prizes provide them with an incentive to exert more effort.Main et al.(1993)report a positive relationship between pay gap and return on assets for a sample of more than 200 firms and 2000 executives per year over a five-yearperiod.Rosen(1986),Eriksson(1999),Lambert et al.(1993)and Kale et al.(2009)also provide theoretical and empirical evidence of the theory's efficacy.

Another strand of research is social comparison theory,which,in contrast to tournament theory,argues that people pay close attention to equity in most situations.Particularly when a team is working jointly toward the same objective,team members are likely to not only being concerned about their own income,but also to compare it with those of their fellow team members to judge whether the income distribution is fair.If a TMT's internal pay gap is sufficiently large to seem inequitable to non-CEO executives,dissatisfaction with the income distribution may reduce their willingness to cooperate,thus damaging firm performance.Therefore,social comparison theory places greater stress on the importance of a compressed pay distribution in TMTs(Lazear,1989;Pfeffer and Langton,1993;Cowherd and Levine,1992).O'Reilly et al.(1988)suggest that a compressed pay distribution and smaller pay gap encourage collaboration among employees,and are thus beneficial to firm performance.Drago and Garvey(1998),Bloom (1999),Hibbs and Locking (2000)and Fredrickson et al.(2010)also provide empirical evidence in support of social comparison theory.

The two theories make contradictory predictions about the relationship between a TMT pay gap and firm performance.Tournament theory argues that a larger TMT pay gap provides an incentive for executive competition,whereas social comparison theory posits that a larger TMT pay gap causes non-CEO executives to feel deprived and is not conducive to cooperation.In reality,most members of organizations,particularly top executives,work toward a common objective and require interdependence or collaboration.Cooperation and competition coexist among executives in a TMT,and we thus need empirical evidence to determine which theory is dominant in a specific setting.For example,Lin et al.(2003)propose that in Chinese listed firms,tournament incentives'positive effect exceeds the negative effect brought about by feelings of unfairness and non-cooperative behavior.They thus conclude that tournament theory is more suitable for explaining the relationship between TMT pay gaps and firm performance in Chinese firms.

However,the literature in this area is not limited to studies seeking supportive empirical evidence for these two theories.Scholars have discussed the aforementioned relationship in a variety of contexts(Trevor and Wazeter,2006).Siegel and Hambrick(2005)examine the interactive effect of technological intensiveness and TMT pay gaps on firm performance,finding that in high-technology firms that require greater technological intensiveness,pay gaps are detrimental to firm performance.Kepes et al.(2009)report a positive relationship between pay gaps and firm performance when those gaps are attributable to the use of performance-based pay because employees feel that the distribution process is fair.Brown et al.(2003)use a large database of hospitals to examine the modulating effect of an organization's pay level on internal pay gap incentive efficiency.

As noted,‘‘pay level”in this paper refers to top executives'average pay level relative to that of their industry peers(Gerhart and Milkovich,1992).Milkovich and Newman(2002)describe pay levels as leading,matching or lagging the market.The traditional economic literature primarily uses efficiency wage theory,proposed by Akerlof and Yellen(1986),to explain why a firm's pay level affects its performance.If the firm's pay level exceeds that of its peers,it will find it easier to attract,retain and motivate outstanding talent.The Chinese literature explains the influence of pay level on firm performance primarily from the perspective of external equity.Wu et al.(2010)estimate the excess compensation of top managers as a measure of external equity,and find that high pay levels motivate non-SOE managers,but have no effect on SOE top managers.Qi and Zou(2014)use relative quantiles of top executives'average pay as a measure of external pay equity,reporting that a higher pay level always increases managers'perceptions of fairness,and thus motivates them to exert greater effort to boost firm performance.From the perspective of the managerial market,Li et al. (2014)demonstrate that only when a TMT's pay level leads the market does excess compensation for top managers provide positive incentives.Therefore,the TMT's pay level offers the same incentives to top managers as an internal TMT pay gap.Accordingly,in order to focus on the incentives of the latter,we must exclude the direct and indirect effects of pay level.In other words,a study on the effects of pay gaps on firm performance must control for pay level.

The Chinese literature on pay gaps considers both the gap between management and workers and that among managers within TMTs.The Chinese tend to be more sensitive to the former because of the traditional pull of the harmonious society principle,and thus the pay distribution within TMTs has received little attention.Interestingly,however,almost all existing papers on the consequences of an internal TMT pay gap areconsistent in supporting tournament theory(Lin et al.,2003;Chen and Zhang,2006),although they are somewhat limited by their failure to control for pay level.Zhang(2007)examines the relationship between within-TMT pay gaps and firm performance while holding pay level constant,and finds a negative relationship,which is consistent with the prediction of social comparison theory.3Chen et al.(2011)also control for the average pay level of the three top executives other than the CEO in their model.Their results are consistent with tournament theory.However,even when these top three executives'pay is controlled for,a larger pay gap always accompanies higher CEO pay,and thus it is still difficult to distinguish whether the positive relationship between a pay gap and firm performance stems from high CEO pay or a large pay gap.This result suggests that,for Chinese listed firms,the TMT pay level may be an influential factor in TMT pay gap efficiency.

At present,the Chinese literature on TMT pay level and pay gap is fragmented.Many studies discuss one or the other in isolation,but few consider them together.In a field survey of 376 general workers from 59 departments of Chinese firms,He and Hao(2014)find that within-department pay differences exert a negative effect on workers'emotional commitment only when the overall departmental pay level is lower than that of other departments.In this study,we combine TMT pay levels with a study of TMT pay gap efficiency,in an attempt to contribute to research on top management compensation mechanisms in Chinese listed firms.

2.2.Hypothesis development

As previously discussed,tournament theory emphasizes competition within the organization,whereas social comparison theory stresses cooperation and fairness within the organization.Colquitt et al.(2001)suggest that perceived equity is the result of a subjective judgment process and that subjectivity is reflected primarily in the choice of reference object.Many studies propose that employees compare their salaries with several reference objects(Brown,2001;Hills,1980;Law and Wong,1998).Oldman et al.(1986)divide the comparison with reference objects into internal organizational justice and external organizational justice.A within-TMT pay gap influences internal organizational justice,whereas TMT pay level influences external organizational justice.These two kinds of justice are not independent,but rather interact with each other (Trevor and Wazeter,2006).It has been mandatory for Chinese listed firms to disclose their executives' compensation since 2005,which makes it easier for top executives to obtain payment information on their peers and to engage in external comparison.

Lazear and Rosen(1981)propose a two-player tournament model in which the players'effort and performance levels are positively related to the size of the reward,but have nothing to do with the prize level.Their model assumes the prize level to be exogenously given,which limits the possibility of players making external comparisons.However,this assumption does not hold for workers'wages in most firms.Efficiency wage theory(Akerlof and Yellen,1986)states that providing employees with a market-leading wage is beneficial to the firm because employees are more willing to remain in a high-paying organization.Messersmith et al.(2011)find that top executive turnover is less likely when executives receive a higher proportion of overall TMT compensation.Not only is original talent retained,but other outstanding managers are also attracted to the team. Therefore,when there is a within-TMT pay gap,a high TMT pay level exerts a natural incentive effect on the CEO and,more importantly,the negative effect on non-CEOs arising from the internal pay gap is partially offset.Bloom and Michel(2002)suggest that if a firm's payment level is higher than the market's,many of the negative consequences of an internal pay gap are alleviated.Frank(1985)proposes that it is easier for employees to accept an unfair wage distribution when their wages are higher than their marginal output. Trevor and Wazeter(2006)find that when employees are in a lower pay position internally,a higher pay position externally enhances their perception of pay equity.Hence,an internal pay gap is less likely to exert negative effects and more likely to create tournament incentives.

However,if the TMT's pay level lags the market,all of the team's top executives are likely to perceive a low degree of external equity,that is,to perceive themselves at a disadvantage relative to their industry peers. Although a large internal pay gap may somewhat alleviate the CEO's dissatisfaction,it will worsen that of non-CEOs,who are in a poorer pay position relative to both internal and external referents.Such double discontent with their compensation may well reduce their willingness to cooperate(Deutsch,1985;Pfeffer and Langton,1993)or even encourage them to desert the firm(Bloom and Michel,2002).Both outcomesare potentially damaging to firm performance.Moreover,if the managerial market is effective,those who feel underpaid will move to other companies,where they can obtain ability-matched compensation,and those who choose to remain on a poorly paid team may be incompetent and thus struggle to find a better paid job. Messersmith et al.(2011)provide evidence to show that reducing overall TMT compensation increases executive turnover.Therefore,a low TMT pay level and large within-team pay gap induce a number of negative effects,such as a lack of cooperation and higher turnover among non-CEOs,thereby offsetting the positive tournament incentives of the pay gap to a large degree.It is possible that the negative effect of an internal pay gap is dominant when overall pay is below a certain level.

The preceding discussion suggests that a TMT pay gap can produce positive tournament incentives,especially when the TMT pay level is above than that of peer firms.It also suggests that a TMT pay gap can produce negative effects,especially when external equity perceptions brought about by comparison with other TMT pay levels influence internal equity perceptions induced by the pay gap.Although it is unclear whether the positive tournament effects or the negative effects of internal inequities dominate,it is clear from the above discussion that the positive tournament effects of the TMT pay gap will be more positive when the TMT pay level is above than that of peer firms,and the negative effects are more negative when the TMT pay level is below than that of peer firms.This implies that the difference in the relationship between the TMT pay gap and performance will be positive for higher versus lower TMT pay levels.Therefore,we formulate our first hypothesis as follows:

H1.The relationship between TMT pay gap and firm performance is likely to be more positive when TMT pay level is higher than that of peer firms.

Although there is considerable evidence supporting the predictions of tournament theory,its efficacy in China is unclear because of the unique features of China's institutional environment that considerably differ from those of mature market economies.For example,China has many SOEs whose top managers earn higher average pay levels than their non-SOE counterparts,and the TMT pay gap is significantly lower in SOEs than in non-SOEs.The primary reason for this discrepancy is that the compensation of SOE top managers is regulated by the Chinese government.

Given these differences,a question of interest is whether tournament theory is capable of explaining the incentives of top managers in Chinese SOEs.Chinese scholars(e.g.,Zhou and Zhu,2010)suggest that the tournament incentive mechanism is actually encouraged by China's institutional environment.Because the government is the ownership representative of the people,it has a natural information disadvantage.Also,SOE managers are multitaskers.It is thus difficult for the government to find appropriate measures to evaluate SOE managers,and tournament promotion based on relative performance is a widely used measure.Moreover,competence for the CEO position is also judged by political promotion,as most SOE managers are appointed by the government and also have an administrative ranking within the government.Although China has attempted in recent years to implement non-administrative SOE reform,many top managers still treat promotion within the SOE as a way to further their political careers.Yang et al.(2013)study the‘‘quasi-official”promotion mechanism in central SOEs.They assess whether internal promotion within an SOE's TMT is more political than that within a non-SOE's TMT and whether the CEOs of SOEs are able to obtain more political profits,4It should be noted that political profits here do not equate to non-monetary income.Non-monetary income refers to such benefits as reputation and status after promotion to CEO,whereas political profits refer specifically to the benefits to the executive's post-promotion political career.such as political rent-seeking opportunities and transfers to government departments.Therefore,even a very small within-TMT pay gap in an SOE can create tournament incentives and motivate managers.

Of course,under China's tradition of egalitarian thought,the requirement for a fair income distribution may offset the positive effects of such a pay gap to some extent.However,we are not concerned with predicting the direction of a pay gap's net effects,but rather with determining how the TMT pay level,relative to the market or to industry peers,affects TMT pay gap incentives in firms with different ownership types.

First,the compensation that SOE top managers receive is government-regulated and separated from market conditions.Thus,their disclosed pay level is not necessarily indicative of the competitiveness of theirpayment capacity.Second,because monetary compensation is regulated,managerial perks have become an alternative means of compensating SOE managers(Chen et al.,2005).Thus,these managers'disclosed compensation does not fully reflect their incentives.They have more implicit incentives that are not sensitive to pay comparisons with peers.For example,Li et al.(2014)suggest that even if SOE managers obtain a higher pay level than their industry peers,excess payment does not bring any added incentives.However,if SOE managers,most of whom are appointed by the government,obtain a lower pay level than their peers,even if they also have an external perception of unfairness,they are unlikely to slack off at work or desert their positions because they are concerned about their careers in the state-owned system.In summary,the TMT pay level in SOEs has little effect on the input and output of top managers.

As previously noted,the premise that the TMT pay level moderates the effects of a TMT pay gap on firm performance is based on the assumption that top managers compare themselves with external referents,thereby exacerbating the perception of internal injustice induced by the pay gap.In non-SOEs,compensation information on top managers is relatively more transparent and focused on monetary incentives(Lu et al.,2012),and the median values of pay in the same industry are more often used as a benchmark(Jiang,2011).Hence,non-SOE managers are more concerned with peer comparisons than their SOE counterparts. Moreover,because of the relatively high marketization level of non-SOE managers,professional managers can flow freely in the market,and can thus choose job-hopping,slacking off at work or deserting their position in response to a pay gap-induced perception of injustice,which in turn damages firm performance.SOE managers,in contrast,are not sensitive to the competitiveness of their pay level,and thus external compensation comparisons have little effect on internal TMT competition and cooperation.This discussion leads to our second hypothesis:

H2.The effect of TMT pay level on the relationship between TMT pay gap and firm performance will be more pronounced for non-SOEs than for SOEs.

3.Research design

3.1.Data and sample selection

Executive compensation data and other firm characteristic data are sourced from the China Stock Market& Accounting Research(CSMAR)database.It has been mandatory for Chinese listed firms to disclose their executives'compensation details since 2005.Accordingly,our sample period spans 2005-2012,and the sample contains all Chinese listed firms with available data in that period.We define TMT members as all those who occupyamanagementposition.Membersofboardsofdirectorsandsupervisors,whoreceiveonlyafixedbonus,are excluded.The top managers in our sample include general managers,deputy general managers,chief engineers,chief accountants,and chief financial officers.The general manager,president or CEO of the firm are definedastheCEO5The titles of the chief managers in Chinese listed firms are not consistent,with some called general manager and some called president. In this paper,we uniformly refer to them as CEOs.(Liaoetal.,2009),andallothermanagersasnon-CEOs.AftercollectingexecutivecompensationdatafromtheCSMARdatabase,wescreenedthedatamanuallyaccordingtopositiontitles.Thescreening steps wereas follows:(1)obtain thecomprehensivemanagement file andtheexecutive individualcompensationfile fromtheCSMARdatabaseandchecktheCEOcompensationdata;(2)dropobservationsiftheCEOchangedin the current year6If the CEO changed in the current year,then the reported CEO compensation in that year did not constitute data for a whole year,possibly leading to large deviations in calculating pay gap.;and(3)drop observations if CEO compensation was not disclosed or the CEO received only a fixed bonus.After screening,we had11,589 valid CEO observations.We then screened non-CEO compensation data from the executive individual compensation file by the aforementioned position titles.

After removing(1)163 financial companies,(2)566 companies for which we could not calculate the TMT pay gap because CEO compensation was lower than the median compensation for non-CEOs,7As in Liao et al.(2009),this condition might arise if the CEO receives only part of his or her compensation from this firm or if specialists who are entitled to higher compensation are hired as non-CEOs.(3)193observations whose debt to asset ratio was greater than 1,(4)1197 observations with missing values,8Missing-value observations stem primarily from our need for data from two consecutive years.If a firm was listed in the sample period,the listing year is that firm's first year,and no data are available for the previous year.and(5)284 observations that received special treatment,we were left with 9186 valid firm-level observations for our empirical analysis.

3.2.Variable definitions and model specification

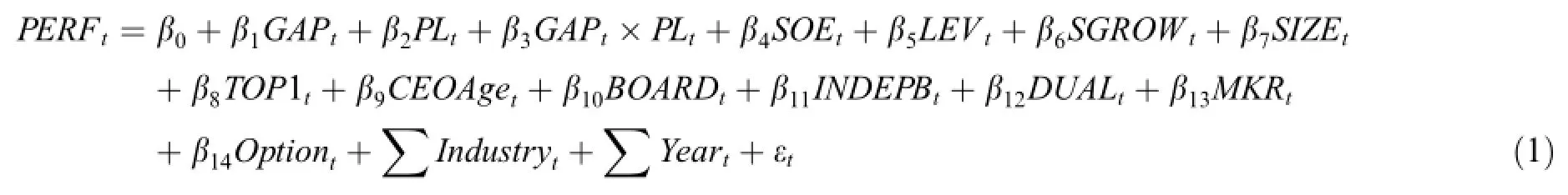

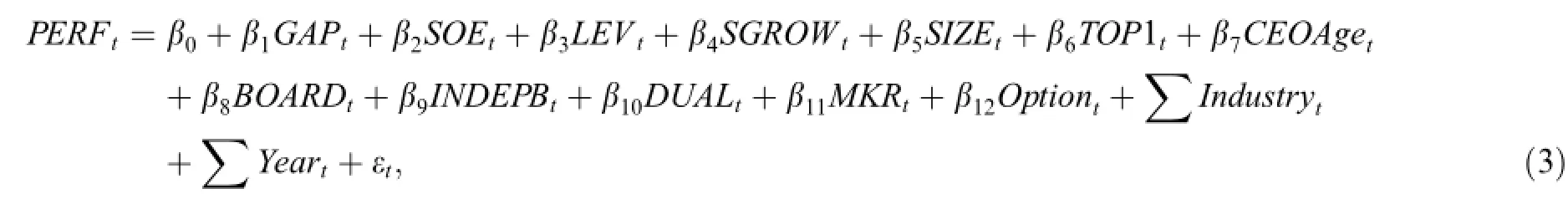

In accordance with the foregoing theoretical analysis and relevant research(Kale et al.,2009;Chen et al.,2011;Zhang,2007),we use the following model(1)to examine how a firm's TMT pay level influences the relation between an internal TMT pay gap on firm performance:

where PERF is either a measure of accounting performance(ROA)or market performance(TOBINQ).

GAP refers to the TMT pay gap,our main variable of interest.Following Bognanno(2001),Kale et al. (2009),Chen et al.(2011)and Kini and Williams(2012),we define GAP as the reward received after a non-CEO executive is promoted to CEO.We use two measures of GAP.The first measure,GAP_1=ln (CEO pay-median pay of non-CEOs),9The results are similar when we use the mean of non-CEO pay,instead of the median.where‘‘ln”refers to the natural logarithm,and the second measure,GAP_2=CEO pay/median pay of non-CEOs,in accordance with Lin et al.(2003),Zhang(2008)and Hambrick and Siegel(1997).

PL measures the TMT average pay level relative to the median of the average pay levels of all other firms in the same industry.It represents the external competitiveness of the TMT's pay.PL equals 1 if the firm's average TMT pay is higher than the yearly median level of firms in the same industry,and 0 otherwise.

The other control variables,including firm characteristics and firm governance,are defined as in the literature(Chen et al.,2011;Lin and Lu,2009).For example,an SOE(ownership status)value of 1 indicates that the firm is state-owned,whereas an SOE value of 0 indicates it is not.Xu et al.(2006)suggest that whether the controlling shareholder is state-owned or non-state-owned has a significant influence on firm performance. The liability-asset ratio(LEV)is equal to total liabilities divided by total assets.Myers(1977)and Jensen (1986)both find LEV to affect firm performance,although the former reports a negative effect and the latter a positive effect.Sales growth(SGROW)represents the firm's rate of growth,and is equal to the difference between current-year sales and previous-year sales divided by previous-year sales.The other control variables are defined in Table 1.We also control for industry and year fixed effects.

Endogeneity is a serious concern when studying the relationship between pay gap and firm performance.Li and Hu(2012)suggest that there is a natural positive relationship between these two variables in Chinese SOEs.Kale et al.(2009),Chen et al.(2011),Lin and Lu(2009)and Kini and Williams(2012)all adopt instrumental variable(IV)estimation or two-stage least-squares(2SLS)estimation to control for the endogenous relationship between pay gap and firm performance.We choose lagged TMT pay gap(LGAP)and median TMT pay gap in the same industry(MedianGAP)as the IVs for GAP.Kale et al.(2009)suggest that TMT pay gap is positively associated with the median GAP of industry peers.

There is also concern about endogeneity in the relationship between TMT pay level and firm performance,as firms with a higher pay level are likely to have better performance.To address this concern,we follow Fang (2012)and Wu et al.(2010)and estimate a TMT's excess pay level after removing the effects of firm performance,firm characteristics and other factors.We use the following model(2)to estimate the excess pay level (Core et al.,1999;Fang,2012).

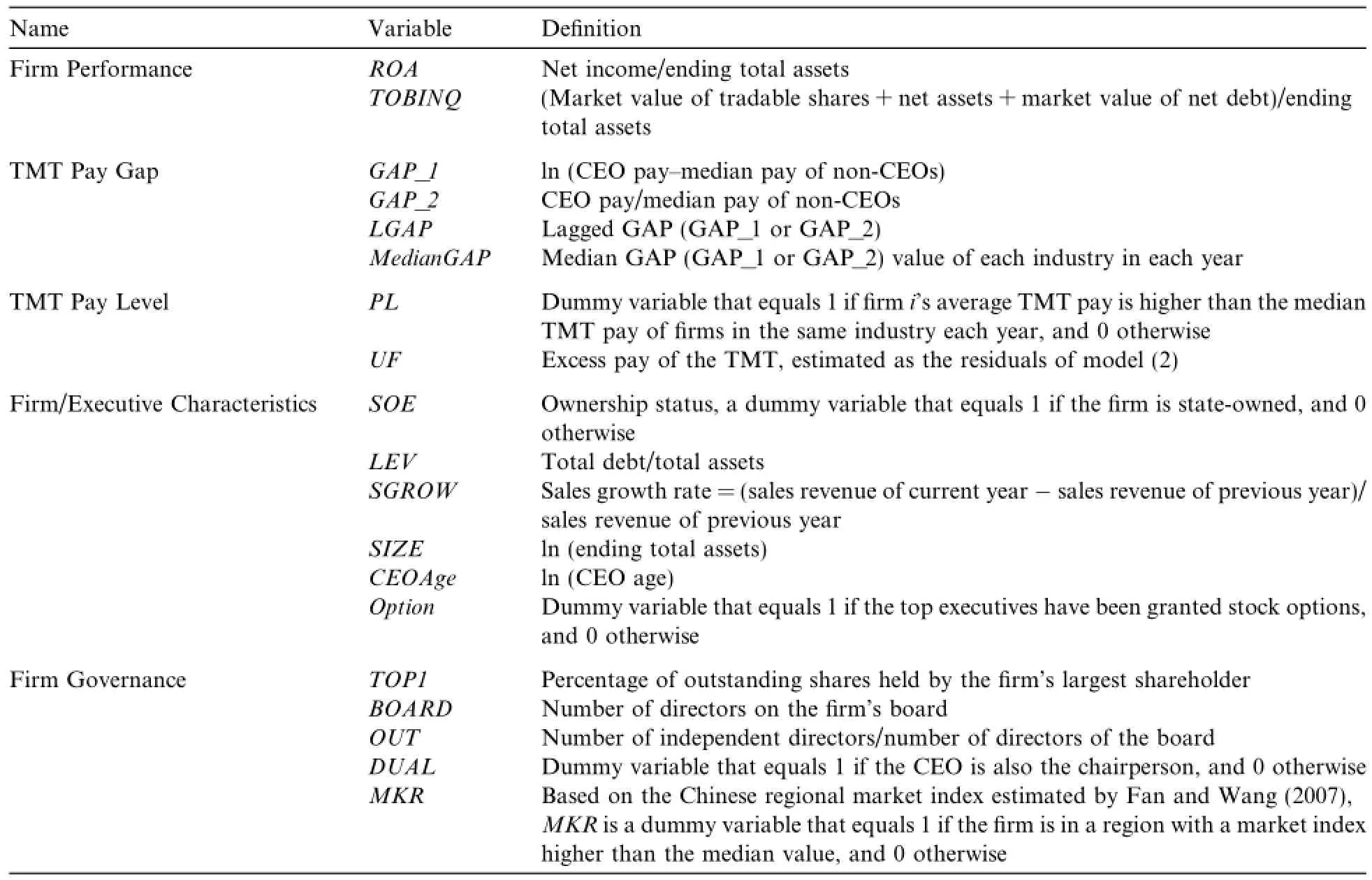

Table 1 Variable definitions.

where LnCOMPtis the natural logarithm of the TMT's average pay,ROAt-1is lagged firm performance,MHOLD is the TMT's average shareholding ratio,BM is the ratio of book value to market value of equity,and the other variables are as defined in Table 1.

We first estimate model(2)for each industry-year and use the residuals from this model as our estimate of excess pay of the TMT.We also use this excess pay measure as the IV estimator for TMT pay level.

Returning to model(1),the interaction between TMT pay level and TMT pay gap may also suffer from an endogeneity problem.If we use the IVs for GAP and PL,the interaction term GAP×PL should also use the interaction of these IVs.Therefore,we use four IVs,namely LGAP,MedianGAP,UF and LGAP×UF,for the three endogenous variables,GAP,PL and GAP×PL,in model(1).All of our IVs satisfy relevance and validity criteria.10These tests include unidentifiable inspection,the weak identification test and the Sargan test.

According to H1,if a higher TMT pay level is accompanied by better TMT pay gap-induced tournament incentives,the regression coefficient on GAP×PL should be positive and significant,11Because a TMT pay gap may have positive or negative effects,we do not predict GAP's direction in model(1)as Siegel and Hambrick (2005)do.and,according to H2,that positive relationship should be stronger in the non-SOE subsample.

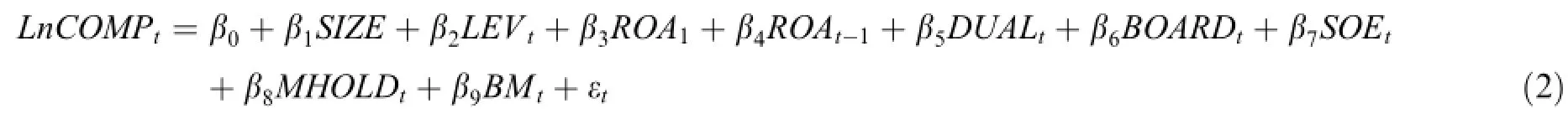

Table 2 Descriptive statistics for main variables.

4.Empirical results

4.1.Descriptive statistics

Table 2 presents descriptive statistics of the main variables in the 2005-2012 sample period.The mean (median)values of performance measures ROA and TOBINQ are 0.040(0.037)and 1.727(1.370),respectively,and those of GAP_1 and GAP_2 are 11.552(11.594)and 1.642(1.429),respectively.All of the variables are reasonably distributed without extreme observations.The unscaled values of TMT pay gap(PAY_GAP)indicate an average difference between CEO pay and median non-CEO pay of about 180,000 yuan.However,the difference varies widely across the sample,ranging from 5000 yuan to 1,500,000 yuan.The average PL value is 0.527,which means 52.7%of firms offer a TMT pay level that is higher than the median pay level in the same industry.The mean across industries in the range of average TMT pay in an industry(PL_DIF)is about 1,750,000 yuan,showing that even in the same industry,average TMT pay can differ widely.Table 2 also shows that 56.1%of the sample firms are SOEs,and that 18.5%of the firms have a CEO and chairperson who are the same individual(mean DUAL=0.185).Further,70%of firms operate in regions with a high rate of marketization,and only 5.4%grant stock options to their top executives(average Option value=0.054).

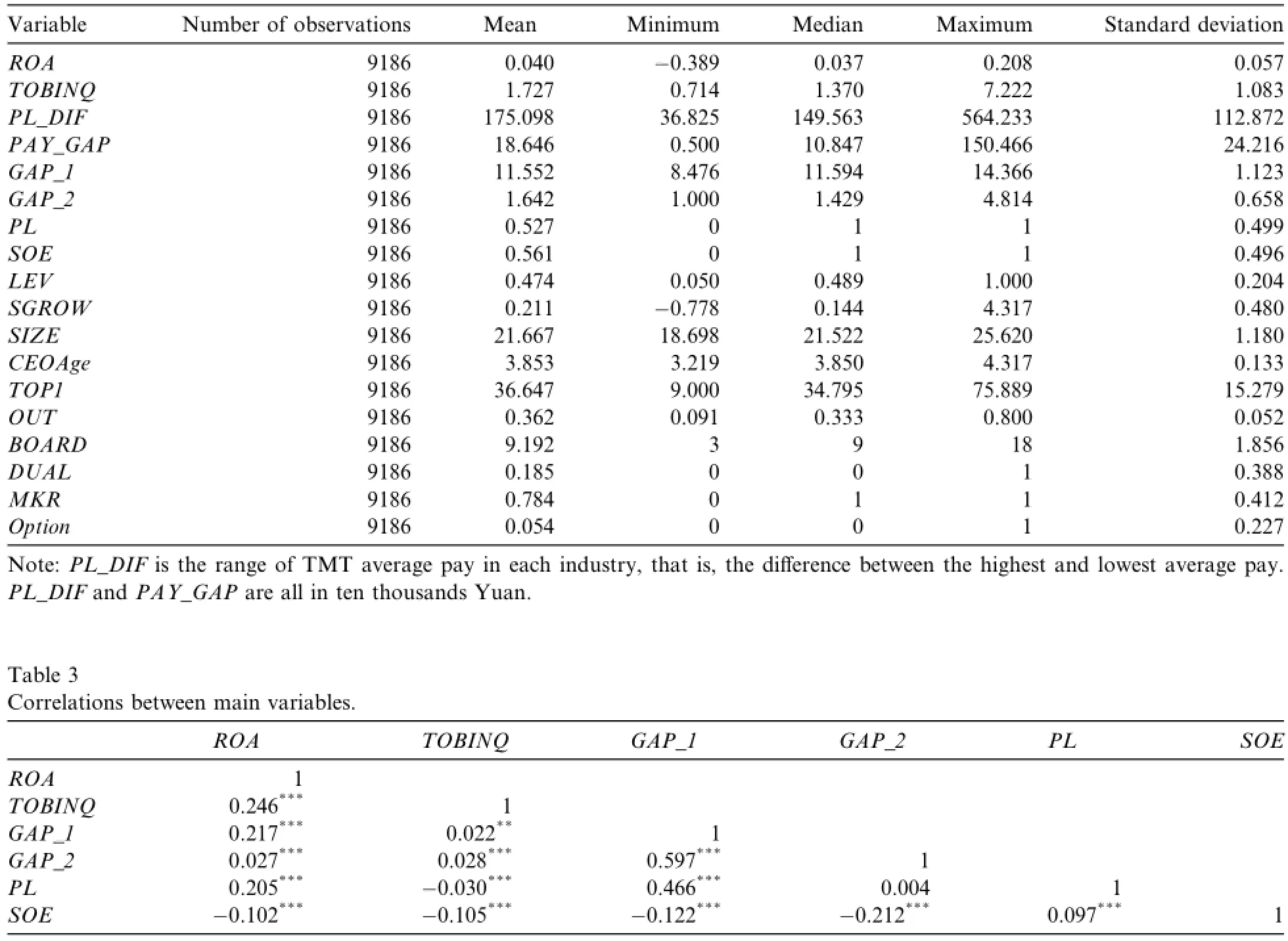

Table 3 presents the correlation coefficients between the main variables.GAP is positively related to firm performance.The correlation coefficient between GAP_1 and GAP_2 is 0.597,significant at the 1%level,which means that the two measures of pay gap are closely related.Further,TMT pay level PL is positively related to GAP_1 and uncorrelated with GAP_2.SOE is negatively related to GAP.

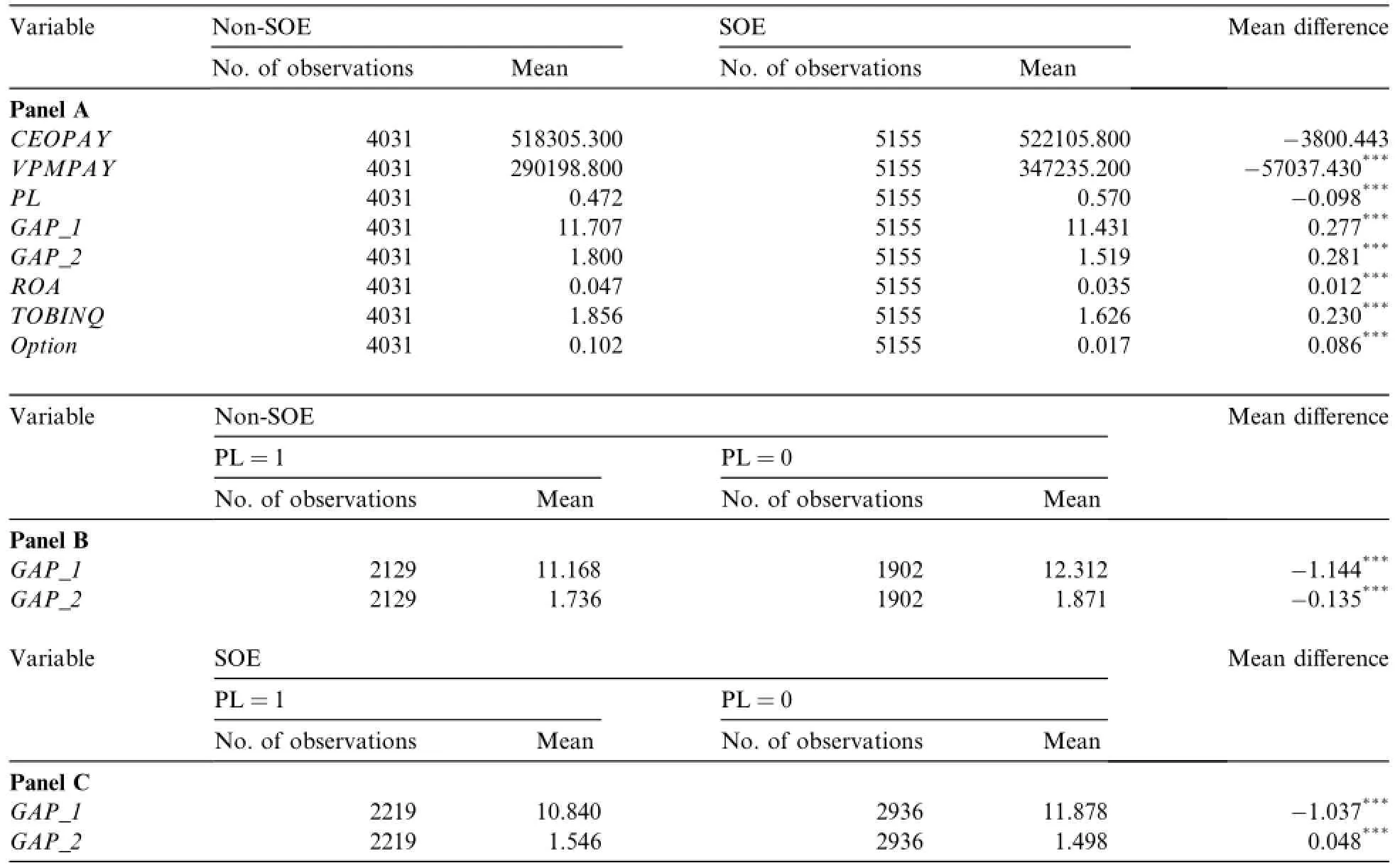

Table 4 Univariate comparisons of SOE and non-SOE subsamples.

Table 4 reports the results of univariate analysis for the different ownership subsamples.Panel A presents the comparison for the main variables.Average CEO pay does not differ between the SOE and non-SOE subsamples,although the average non-CEO pay of the non-SOE sample is significantly lower than that of the SOE sample.These results show clearly that the TMT pay gap is much greater in non-SOEs than in SOEs,and are also consistent with the view that TMTs in SOEs are more egalitarian.Further,SOE TMTs enjoy a higher pay level,but exhibit weaker firm performance,than their non-SOE counterparts.Panels B and C show the relationship between TMT pay gap and pay level in non-SOEs and SOEs,respectively.In non-SOEs,a higher TMT pay level is accompanied by a larger pay gap,whereas in SOEs,a higher TMT pay level is associated with a larger absolute pay gap(GAP_1)but a smaller relative pay gap(GAP_2).

4.2.Top management team pay level and pay gap

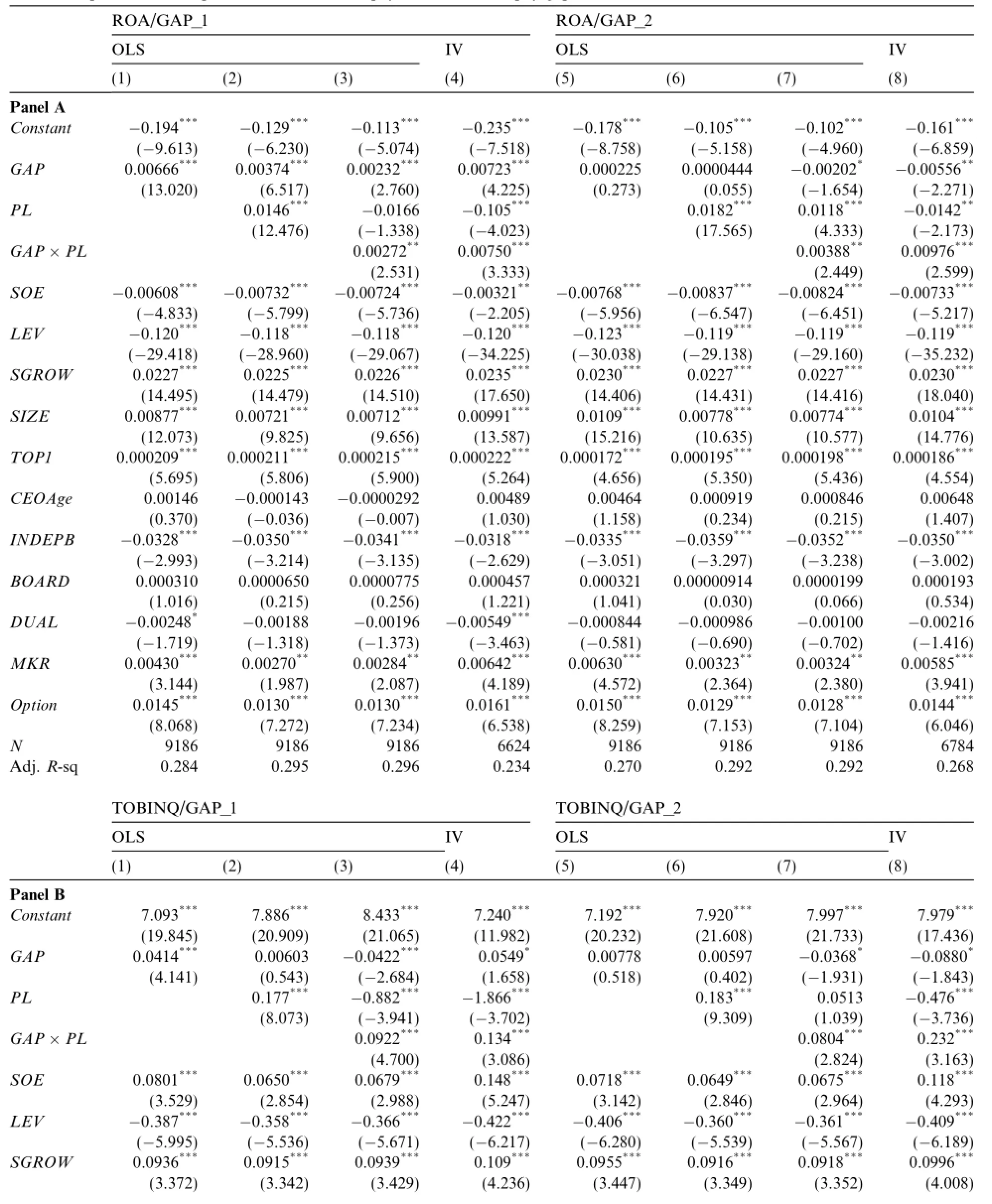

Table 5 presents the estimation results of model(1).Panels A and B show the regression results for accounting performance(ROA)and market performance(TOBINQ),respectively,with columns 4 and 8 reporting the IV regression results.12We use the IVs stated above.We present only the second-stage IV regression results here.The results in column 1 of Panels A and B show that if TMT pay level(PL)is not controlled for,GAP is significantly positively related to firm performance at the 1%level,which is consistentwith the majority of the Chinese literature.However,after PL is added to the model,the regression coefficients of GAP decrease,and the R-square of the models increases.For example,in column 2 of Panel A,the coefficient relating GAP to ROA decreases to 0.00374 from 0.00666(in column 1),and the R-square increases from 28.4%to 29.5%.Similarly,in column 2 of Panel B,the coefficient's influence on TOBINQ declines from 0.0414 (significant at the 1%level)to 0.00603(not significant at conventional levels),and the R-square rises from 35.9%to 36.4%.These results indicate that,in addition to TMT pay gap,TMT pay level is also positively related to firm performance.

Table 5 Relationship between firm performance and TMT pay level and TMT pay gap.

Table 5(continued)

The model in columns 2 and 6 do not consider that,in addition to its main effect,TMT pay level may also relate to firm performance through its interaction with TMT pay gap.The models in columns 3 and 7 of Panels A and B,allow such an interaction.The estimation results indicate that the coefficients of GAP×PL are significantly positive at the 1%level,which suggests that the pay level can positively affect pay gap-induced incentives.These results are consistent with hypothesis H1.They indicate that the positive tournament effects of the pay gap are greater when the pay level is above the industry median.

In terms of economic significance,taking the sample's average total assets as an example,if a TMT's pay level is higher than that of its industry peers,then every 10,000-yuan increase in the pay gap raises net profits by about 42,600,000 yuan.If,in contrast,a TMT's pay level is lower than the industry average,every 10,000-yuan increase in the pay gap boosts net profits by about 19,800,000 yuan only.These results,which are economically significant,demonstrate that the tournament incentives induced by a pay gap are more pronounced when the TMT receives average pay that exceeds the industry median pay.

Columns 4 and 8 of Panels A and B present the results of the IV regressions.The coefficients of GAP×PL are again significantly positive,which means that after controlling for the endogeneity of GAP,PL and GAP×PL,TMT pay level still exerts a positive effect on pay gap efficiency,i.e.,a higher pay level is more likely to induce positive pay gap incentives.In summary,Table 5 results are consistent with the prediction of H1.

Table 6 Relationship between firm performance and TMT pay level and TMT pay gap for SOE and non-SOE subsamples.

4.3.Influence of ownership status

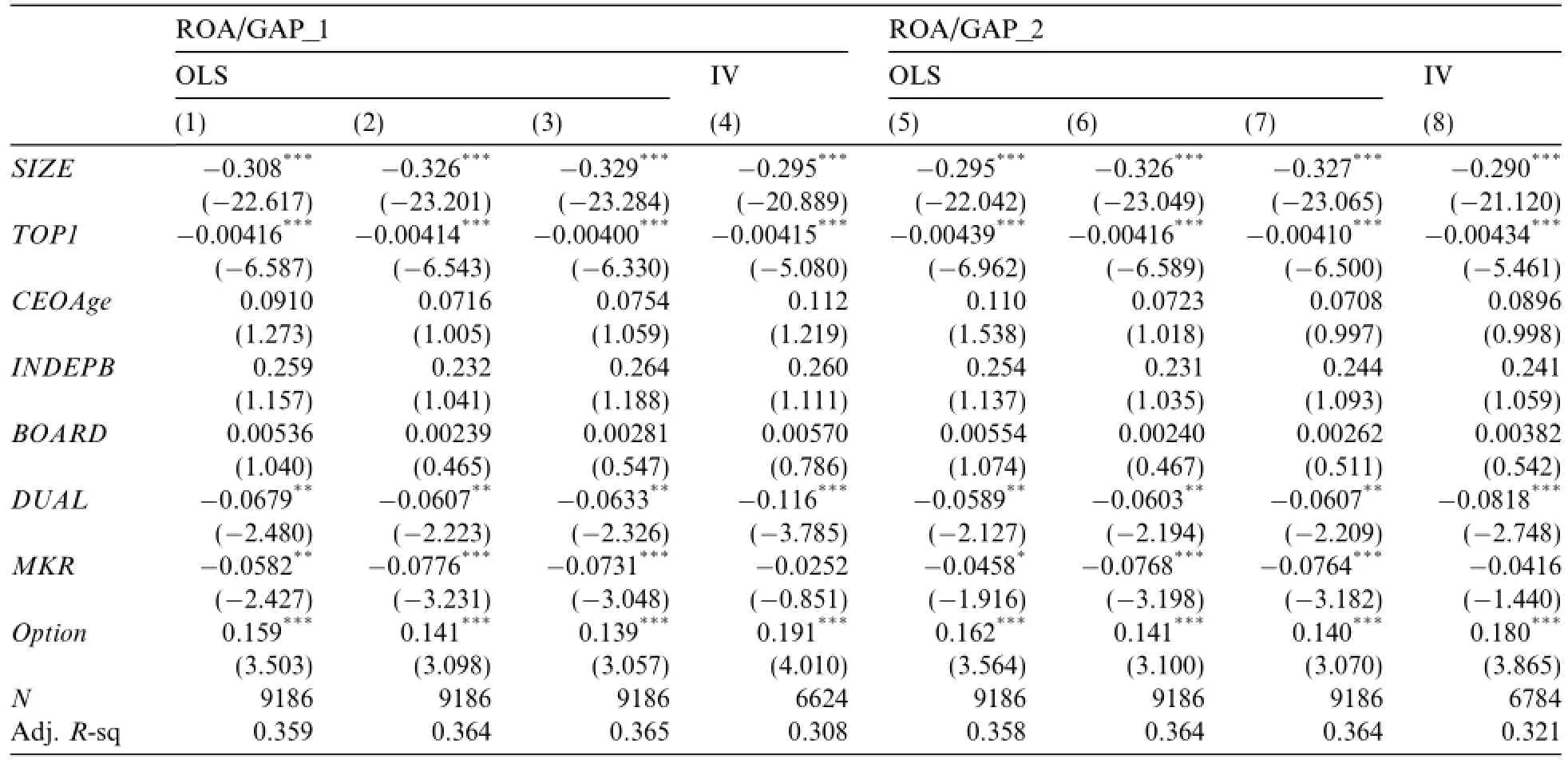

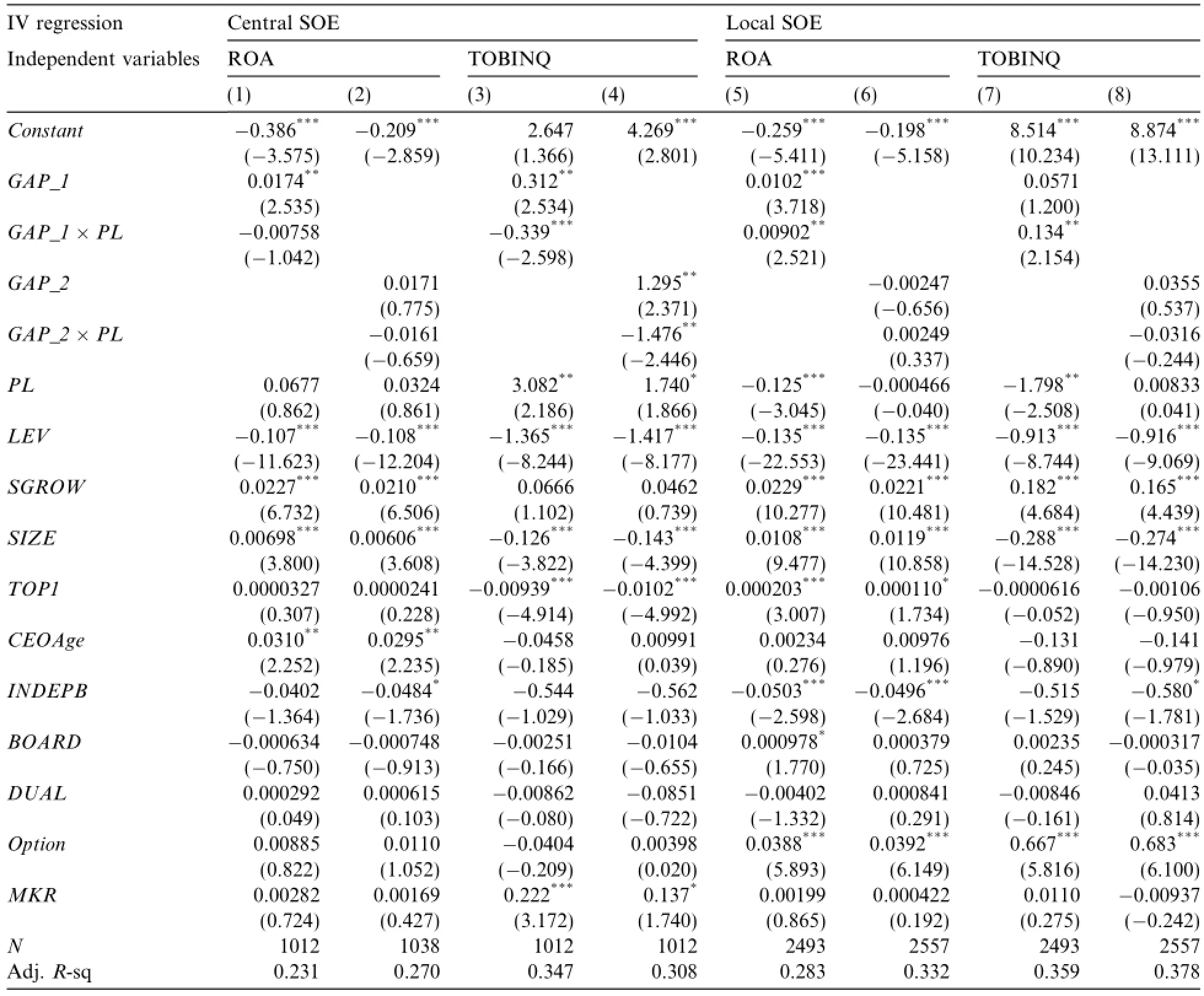

The results on the relationship between TMT pay gap and firm performance under different ownership conditions are presented in Table 6.To control for endogeneity,the table presents the IV regression results using only the IVs stated above.Columns 1-4 show the results for ROA,and columns 5-8 the results for TOBINQ.

Table 6 shows that the coefficients of GAP×PL are significantly positive for the non-SOE subsample but are not significant for the SOE subsample.This result is consistent with H2,and suggests that the TMT pay level in non-SOEs is more likely to moderate the influence of a within-TMT pay gap on firm performance. However,the SOE TMT pay level has no effect on pay gap efficiency,possibly because the top executives of government-regulated SOEs are not sensitive to their external pay standing among their industry peers. Hence,an external compensation comparison does little to change competition and cooperation within SOE TMTs.

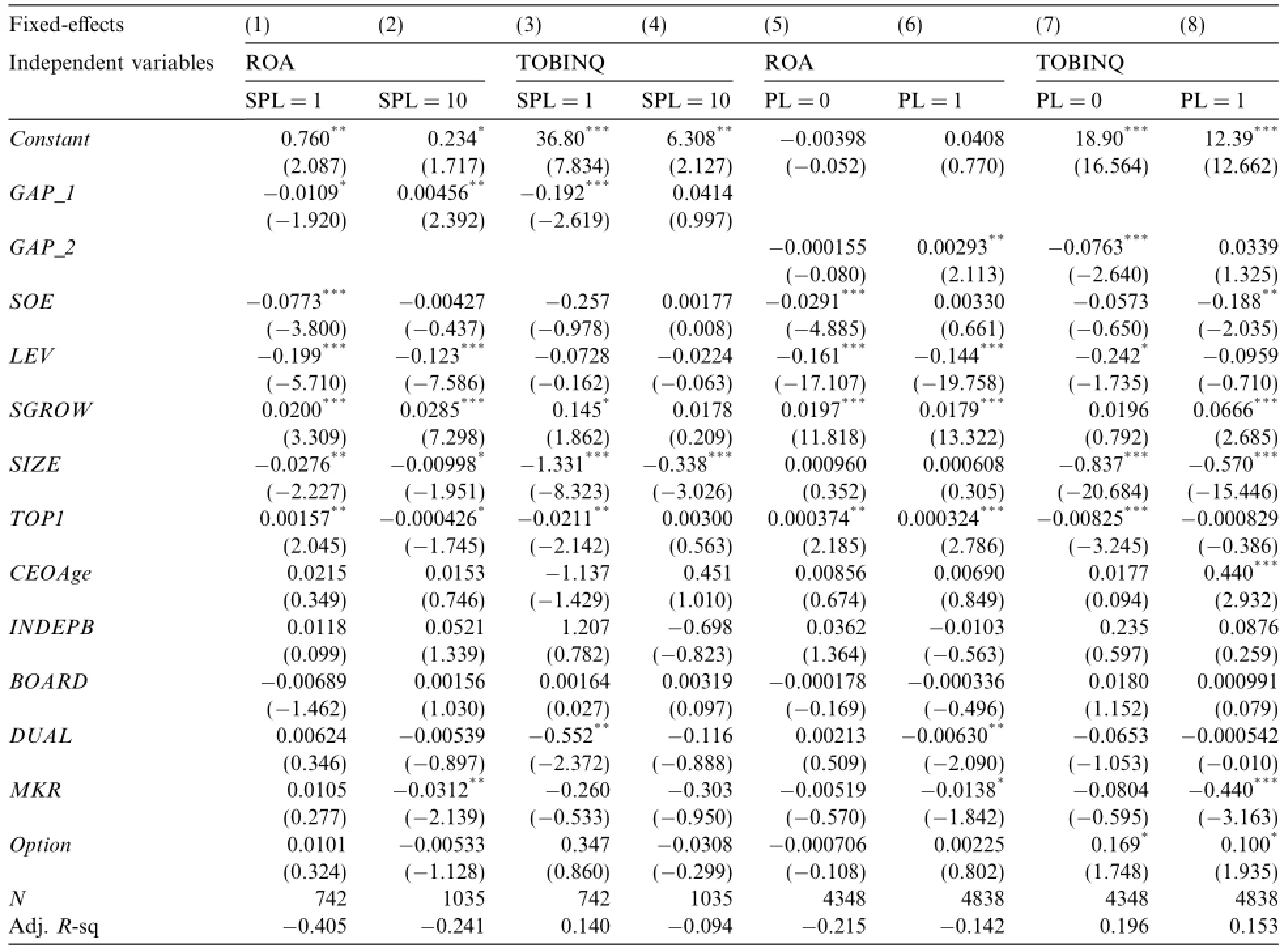

Table 7 Relationship between firm performance and TMT pay gap for the lowest and highest deciles of TMT pay level.

5.Robustness tests

5.1.Subdivision of TMT pay level

Our main focus is on the effects of a TMT pay gap on firm performance under different TMT pay level conditions.As previously noted,firms often use their industry peers as a benchmark when agreeing contracts with top executives(Jiang,2011).Accordingly,we divide the TMT pay level into two groups,one with a pay level higher than the industry median and the other with a pay level lower than the industry median,and find a stronger positive pay gap effect on firm performance when the TMT pay level is higher than the industry median.

In Table 5,the coefficients of the relative pay gap measure GAP_2 are all significantly negative,meaning that when TMT members'pay level is lower(higher)than that of their industry peers,GAP_2 is negatively (positively)related to firm performance.Hence,we can say that the median pay level in a given industry may be the flex point for the effect of a relative pay gap(i.e.,GAP_2)on firm performance.However,the same cannot be said for the absolute pay gap measure(i.e.,GAP_1).GAP_1 is positively related to firm performance in both the higher and lower pay level groups,although more strongly so in the former.To ensure thatan absolute pay gap's influence on firm performance also experiences a flex point,we further subdivide TMT pay level.We first arrange it in ascending order for each year and each industry,and then divide the sample into 10 pay level groups.Firms in the first group(SPL=1)have the lowest pay level relative to their peers,i.e.,lower than 90%of firms in the same industry,whereas those in the tenth group(SPL=10)have the highest such pay level,i.e.,higher than 90%of firms in the same industry.We then estimate model(3)separately for each of the 10 groups to examine the absolute TMT pay gap's influence on firm performance.13The control variables in(3)are the same as those in model(1),and(3)also controls for fixed effects.

Table 8 Relationship between firm performance and TMT pay gap for the lowest and highest deciles of TMT pay level for SOEs and non-SOEs.

We also estimate model(3)for the PL=0 and PL=1 subsamples separately to examine the relative TMT pay gap's(GAP_2)influence on firm performance.The results are presented in Table 7.

Columns 1-4 of Table 7 show GAP_1's effects on firm performance in the highest and lowest pay level groups.In the lowest group(SPL=1),GAP_1 is negatively related to firm performance,whereas in the highest(SPL=10),it is positively related.These results are consistent with H1.Columns 5-8 show GAP_2's influence on firm performance in the higher-and lower-than-industry-median pay level groups.If a firm's pay level is lower(higher)than the median level,GAP_2 is negatively(positively)related to firm performance.These results are consistent with those in Table 5,and further suggest that the direction of a pay gap's influence on firm performance changes from negative to positive with an increase in pay level,which is consistent with H1.

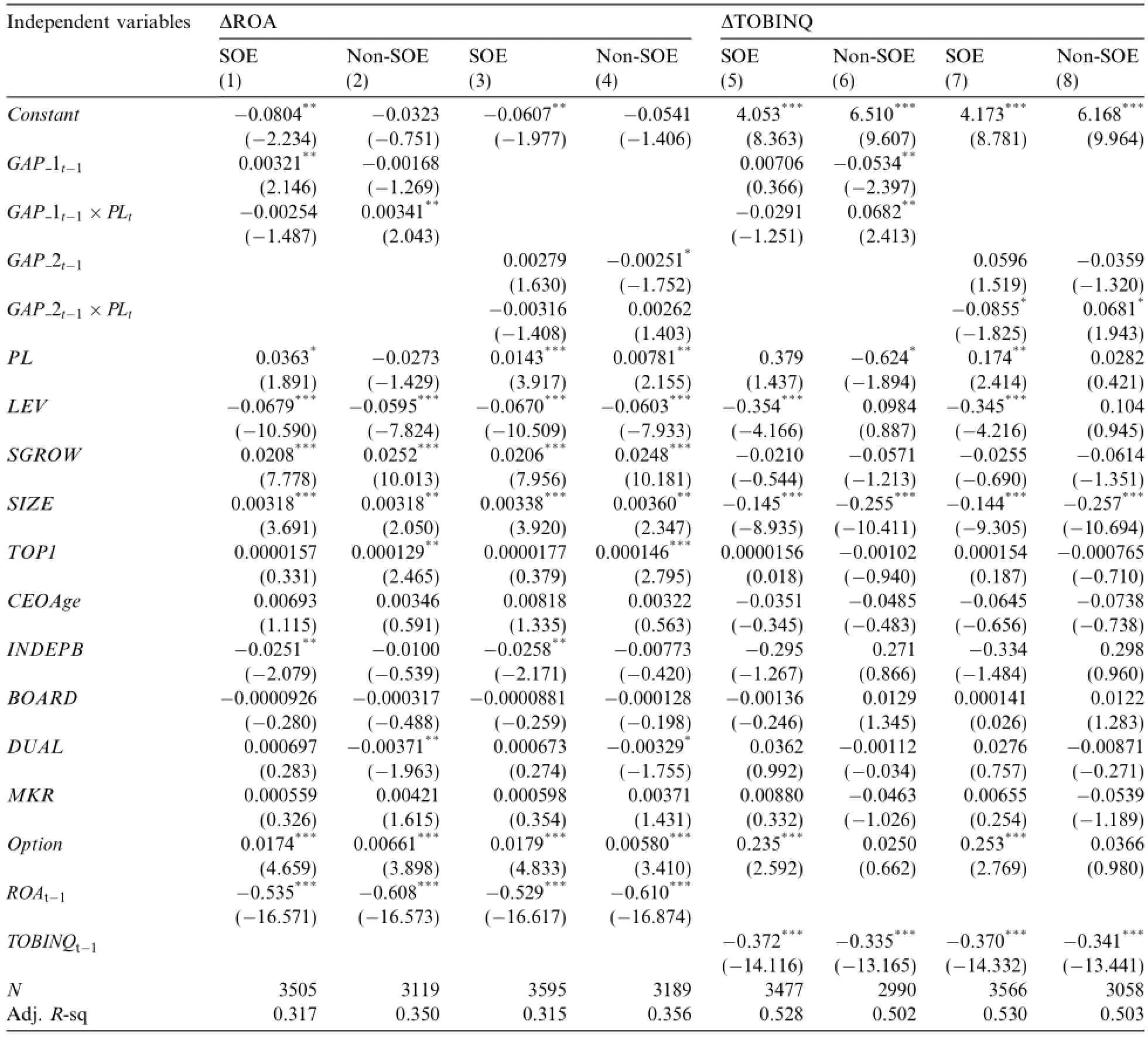

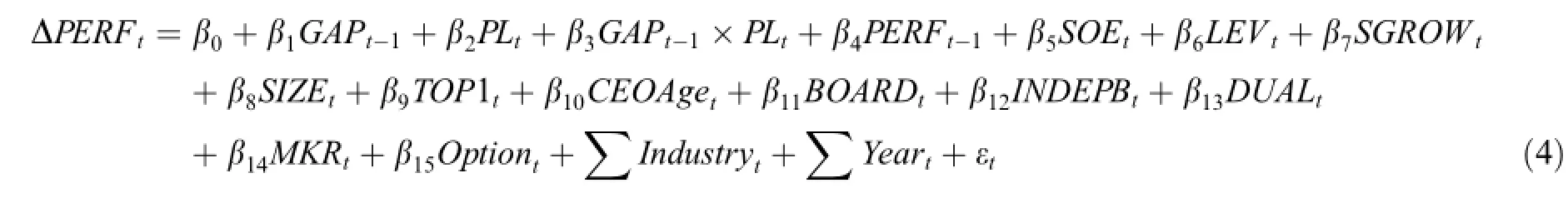

5.2.Endogeneity of TMT pay level and TMT pay gap

In addition to the 2SLS regression approach with IVs,we use a model with change in performance (ΔPERF)as the dependent variable and lagged pay gap as the independent variable to control for endogeneity. A TMT pay gap in the previous year is less likely to be caused by performance growth in the current year,and the TMT pay level is less endogenous with performance growth than with current year performance.Hence,we adopt model(4)to examine the influence of the previous year's pay gap on performance growth under different ownership conditions.

The variables are defined as before,and we also control for the previous year's performance.The results of model(4)for the different ownership conditions are presented in Table 8.They show that the interaction term GAPt-1×PLtis significantly positive for the non-SOE subsample and insignificantly negative for the SOE subsample.Hence,when the pay level of a TMT in a non-SOE is higher than the industry median,a larger TMT pay gap brings about more performance growth.For SOEs,in contrast,a higher pay level does not induce better TMT tournament incentives.When these firms'TMTs receive less pay than their peers,a within-TMT pay gap may be conducive to performance growth.14It is later suggested that the interaction's negative coefficients are all in central SOEs.

The results are consistent if we remove observations for which the TMT's pay standing relative to industry peers changed.We also use a lagged pay level with pay gap to re-examine model(1)under different ownership conditions,and the results are consistent with those in Tables 6 and 7.All of these results provide further support for H2.

We also use several other methods to re-measure TMT pay level and find consistent results.To exclude the effects of high CEO pay,we re-define TMT pay level without the CEO's pay and find consistent results.Additionally,we also use only the top three executives'pay or excess TMT pay to measure the TMT pay level,and find consistent results.

6.Additional analyses

According to the descriptive data in Table 4,the TMT pay levels in SOEs are much higher than those in non-SOEs in the same industry.Many Chinese scholars have suggested that the excess pay levels of SOEs are not conducive to firm efficiency because top executives'pay is regulated by the government(Wu et al.,2010;Liet al.,2014).We find that excess pay levels in SOEs also do not influence internal TMT competition or cooperation,and thus should be addressed as the next step in China's ongoing comprehensive SOE reform.On 29 August 2014,the country's Central Political Bureau passed the Pay System Reform Program of Central Management Companies'Responsible Person,which was formally implemented on 1 January 2015.The program requires that the first 72 central SOE top executives receive a pay cut,thereby setting an example for local SOE pay reform.However,the program does not provide the detailed rules on how the pay cuts should be carried out or stipulate whether the internal pay distribution should be considered.Moreover,it is also important to discuss what notifications local SOEs should be given when they consider central SOEs'approach to top executive compensation reform.

Table 9 Relationship between firm performance and TMT pay gap and TMT pay level for central SOEs and local SOEs:2SLS-IV estimation.

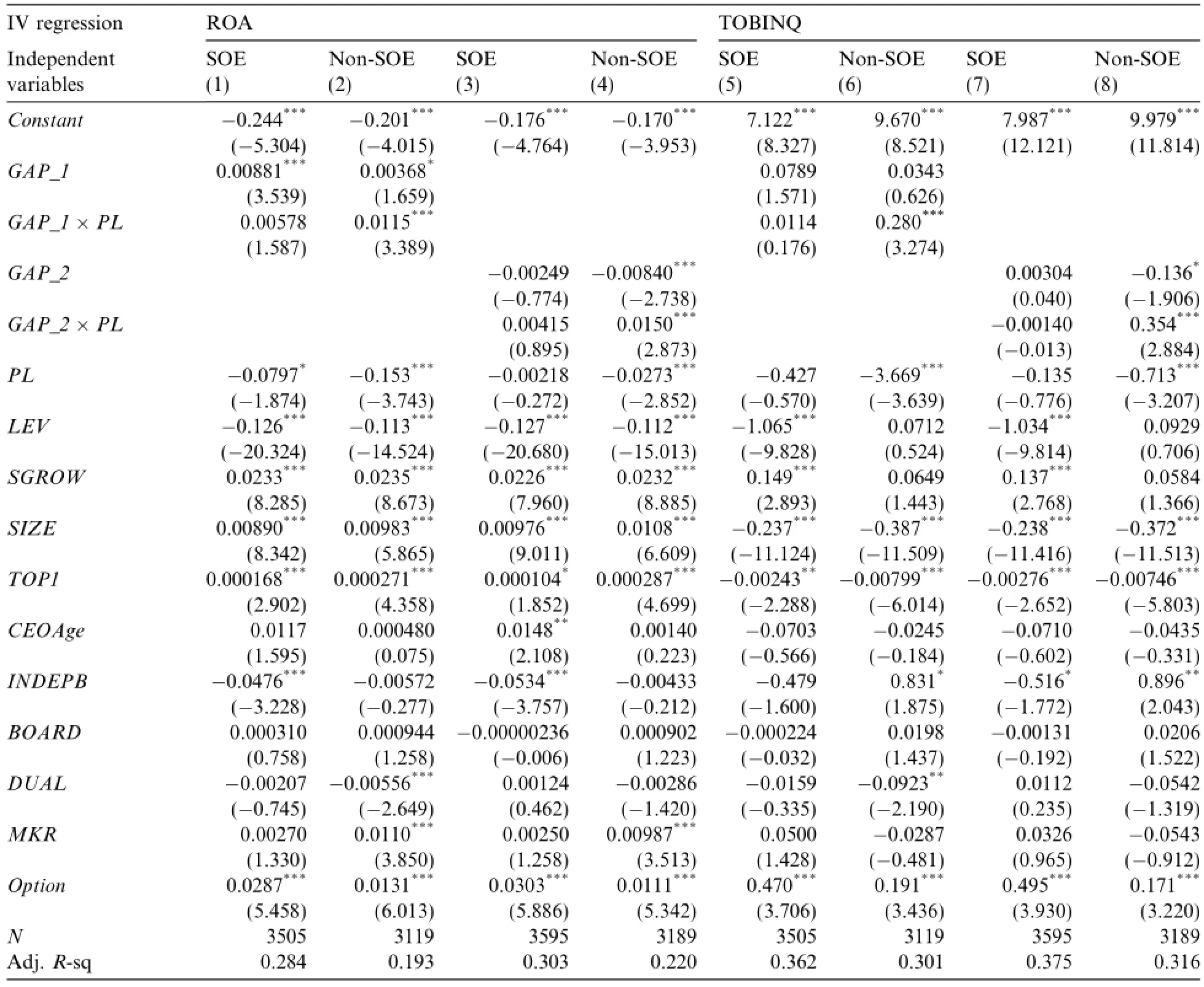

As previously noted,if a company's pay incentive system is effective,the TMT pay level will moderate the TMT pay gap's efficiency.Thus,firms should consider choosing a suitable pay gap to ensure a certain pay standing in the industry.Because SOEs are regulated by the government,their industry pay standing is notrelated to the market.Hence,cutting their top managers'pay should not directly hurt the efficiency of an internal pay gap.However,this is not true for all SOEs because,in China,central and local SOEs are subject to different constraints(Xia and Fang,2005),different levels of government intervention(Pan et al.,2008),and different pay systems.Although they both belong to the state-owned system,their top managers'preferences concerning monetary compensation differ,leading to different degrees of sensitivity to the firm's external pay standing.Thus,we re-estimate model(1)separately for central SOEs and local SOEs.The results are presented in Table 9.For consistency,we present only the results of the 2SLS regression with the IVs stated above.

Columns 1-4 of Table 9 report the results for central SOEs.The effect of a TMT pay gap on accounting performance(ROA)does not differ in the different pay level groups,although the pay gap's effect on market performance(TOBINQ)is stronger when the pay level is lower,which suggests that reducing the compensation of top managers in central SOEs is actually beneficial to firm value.When these SOEs implement pay cutting measures,their internal TMT pay gap could be raised.

Columns 5-8 of Table 9 present the results for local SOEs,showing that a higher TMT pay level is beneficial to the incentives induced by an absolute pay gap,but has little effect on those induced by a relative pay gap.These results suggest that in a local SOE,the TMT's pay level influences within-team competition and cooperation to some degree.Thus,when local SOEs engage in top manager compensation reform,direct pay cuts may not be the best approach.For those with a high pay level,increasing the internal pay gap may be a good solution to boost efficiency.

In summary,our results suggest that the pay cutting policy currently being implemented in China's SOEs will not damage the internal efficiency of a central SOE TMT,but local SOEs should not blindly follow the pay cutting decisions of their central counterparts.Because the pay level in local SOE TMTs can also affect within-team pay gap efficiency,the redistribution of payments within the TMT may be the optimal solution. In addition,we find the TMT pay level in local SOEs to have modulating effects in regions with a higher marketization level and in more competitive industries.We do not tabulate the results of these regressions because of space limitations.

7.Conclusion

Although the incentive effects of a TMT pay gap have received considerable research attention,the results of prior research are conflicting.These conflicting results are consistent with the two dominant theories in this area,namely tournament theory and social comparison theory,which make conflicting predictions.One explanation for the conflicting findings is that each of these theories holds,but only under specific conditions.TMT pay level concerns an external comparison and TMT pay gap an internal comparison.Most of the literature examine the efficiency of these two components of the pay system separately,with few studies noting that an external comparison also influences the internal comparison.Moreover,firms often use the market pay level in their industry as a benchmark in designing their own TMT pay contracts.

The mandatory requirement that Chinese listed firms provide information on their top executives'compensation,makes it possible to conduct external comparisons and to also study whether these external comparisons have implications for the managerial incentive and firm performance effects of internal comparisons. Using compensation data from 2005 to 2012,we examine the effects of TMT pay level on within-team pay gap efficiency.Our results show that a higher TMT pay level than that of the team's industry peers stimulates within-team competence,and thus indicates that tournament theory may be more suitable than social comparison theory for explaining the incentives of a pay gap.A lower TMT pay level than industry peers,in contrast,renders top executives more sensitive to an internal pay gap because they perceive their pay to be unfair. Accordingly,social comparison theory provides a more suitable explanation under these circumstances. Therefore,when firms are designing contracts for top executives,it is important that they both adjust the pay level to suit the market and ensure an appropriate within-TMT pay distribution,which is vital to the pay system as a whole.For example,the Chinese listed firm Everfine Photo(stock ID:300306)emphasizes in its 2012 annual report that‘‘the firm has implemented[a]new reward system,[and]the top managers' pay···keep[s]up with the market,and should make dynamic maintenance of the pay gap and pay level every year according to the market level···.”

However,because of government regulation,providing SOE top managers with excess compensation is not only unfavorable to firm performance(Wu et al.,2010),but also fails to stimulate internal TMT competition. As noted earlier,a reform of the pay system for central SOEs has been in effect since 1 January 2015,and consequently the majority of these firms'top executives will receive a pay cut.Our findings suggest that such pay cuts will not adversely affect the incentives induced by an internal pay gap and may even boost firm value,although the same does not hold true for local SOEs.The top managers of central and local SOEs face different degrees of government intervention,market competition and other factors,with the former group's pay system being more market-oriented.Directly cutting pay is likely to be detrimental to the incentives induced by an internal TMT pay gap in local SOEs.For high-paying local SOEs,widening the internal pay gap may be a solution to boosting efficiency.

References

Akerlof,G.A.,Yellen,J.L.,1986.Efficiency Wage Models of the Labor Market.Cambridge University Press,Cambridge.

Bloom,M.,1999.The performance effects of pay dispersion on individuals and organizations.Acad.Manage.J.42(1),25-40.

Bloom,M.,Michel,J.G.,2002.The relationships among organizational context,pay dispersion,and managerial turnover.Acad.Manage. J.45(1),33-42.

Bognanno,M.L.,2001.Corporate tournaments.J.Labor Econ.19(2),290-315.

Brown,M.,2001.Unequal pay,unequal responses?Pay referents and their implications for pay level satisfaction.J.Manage.Stud.38,879-896.

Brown,M.P.,Sturman,M.C.,Simmering,M.J.,2003.Compensation policy and organizational performance:the efficiency,operational,and financial implications of pay levels and pay structure.Acad.Manage.J.46(6),752-762.

Chen,D.,Chen,X.,Wan,H.,2005.Compensation regulation and job consumption in state-owned enterprises.Econ.Res.J.2,100-111 (in Chinese).

Chen,J.,Ezzamel,M.,Cai,Z.,2011.Managerial power theory,tournament theory,and executive pay in china.J.Corp.Finan.17(4),1176-1199.

Chen,Z.,Zhang,M.,2006.Research on top executives'pay distributions.China Account.Rev.1,15-28(in Chinese).

Colquitt,J.A.,Conlon,D.E.,Wesson,M.J.,Porter,C.O.,Ng,K.Y.,2001.Justice at the millennium:a meta-analytic review of 25 years of organizational justice research.J.Appl.Psychol.86(3),425-445.

Core,J.E.,Holthausen,R.W.,Larcker,D.F.,1999.Corporate governance,chief executive officer compensation,and firm performance.J. Financ.Econ.51(3),371-406.

Cowherd,D.M.,Levine,D.I.,1992.Product quality and pay equity between lower-level employees and top management:an investigation of distributive justice theory.Adm.Sci.Q.37,302-320.

Deutsch,M.,1985.Distributive Justice:A Social-Psychological Perspective.Yale University Press,New Haven,CT.

Drago,R.,Garvey,G.T.,1998.Incentives for helping on the job:theory and evidence.J.Labor Econ.16(1),1-25.

Ehrenberg,R.G.,Bognanno,M.L.,1990a.Do tournaments have incentive effects?J.Polit.Econ.98(6),1307-1324.

Ehrenberg,R.G.,Bognanno,M.L.,1990b.The incentive effects of tournaments revisited:evidence from the European PGA tour.Ind. Labor Relat.Rev.43(3),74S-88S.

Eriksson,T.,1999.Executive compensation and tournament theory:empirical tests on Danish data.J.Labor Econ.17(2),262-280.

Fan,G.,Wang,X.R.,2007.Marketization Index in China:A Report on the Process of Marketization in Different Regions.Economic Science Press(in Chinese).

Fang,J.X.,2012.Top executives'excess compensation and corporate governance policy.Manage.World 11,144-155(in Chinese).

Frank,R.H.,1985.Choosing the Right Pond:Human Behavior and the Quest for Status.Oxford University Press,New York.

Fredrickson,J.W.,Davis-Blake,A.,Sanders,W.M.,2010.Sharing the wealth:social comparisons and pay dispersion in the CEO's top team.Strateg.Manage.J.31(10),1031-1053.

Gerhart,B.,Milkovich,G.T.,1992.Employee compensation:research and practice.In:Dunnette,M.D.,Hough,L.M.(Eds.),Handbook of Industrial and Organizational Psychology,vol.3.Consulting Psychologists Press,Palo Alto,CA,pp.481-569.

Hambrick,D.,Siegel,P.,1997.Compensation patterns within top management groups:on the harmful effects of executive pay disparities in high-technology firms.Organ.Sci.16(3),259-274.

Harbring,C.,Irlenbusch,B.,2003.An experimental study on tournament design.Labour Econ.10(4),443-464.

He,W.,Hao,P.,2014.Does departmental pay dispersion really deteriorate employee affective commitment?The moderators of pay level,pay-for-performance intensity and workforce diversity.Nankai Bus.Rev.4,13-23(in Chinese).

Hibbs Jr.,D.A.,Locking,H.,2000.Wage dispersion and productive efficiency:evidence for Sweden.J.Labor Econ.18(4),755-782.

Hills,F.S.,1980.The relevant other in pay comparisons.Ind.Relat.19,345-351.

Jensen,M.C.,1986.Agency costs of free cash flow,corporate finance and takeovers.Am.Econ.Rev.76(2),323-329.

Jiang,W.,2011.Marketization level,industry competition and the growth of managerial compensation.Nankai Bus.Rev.5,58-67(in Chinese).

Kale,J.R.,Reis,E.,Venkateswaran,A.,2009.Rank-order tournaments and incentive alignment:the effect on firm performance.J.Financ. 64(3),1479-1512.

Kepes,S.,Delery,J.,Gupta,N.,2009.Contingencies in the effects of pay range on organizational effectiveness.Pers.Psychol.62(3),497-531.

Kini,O.,Williams,R.,2012.Tournament incentives,firm risk,and corporate policies.J.Financ.Econ.103(2),350-376.

Knoeber,C.R.,Thurman,W.N.,1994.Testing the theory of tournaments:an empirical analysis of broiler production.J.Labor Econ.12 (2),155-179.

Lambert,R.A.,Larcker,D.F.,Weigelt,K.,1993.The structure of organizational incentives.Adm.Sci.Q.38,438-461.

Law,K.S.,Wong,C.,1998.Relative importance of referents on pay satisfaction:a review and test of a new policy-capturing approach.J. Occup.Organ.Psychol.71,47-60.

Lazear,E.P.,1989.Pay equality and industrial politics.J.Polit.Econ.97,561-580.

Lazear,E.P.,Rosen,S.,1981.Rank-order tournaments as optimum labor contracts.J.Polit.Econ.89(5),841-864.

Li,W.,Cen,Y.,Hu,Y.,2014.Does external pay gap encourage top management?An empirical study based on managerial market and ownership type.Nankai Bus.Rev.4,24-35(in Chinese).

Li,W.,Hu,Y.,2012.Who is encouraged by pay dispersion in state-owned enterprises?Econ.Res.12,125-136(in Chinese).

Liao,L.,Liao,G.,Shen,H.,2009.Operating risk,promotion incentive and corporate performance.China Ind.Econ.8,119-130(in Chinese).

Lin,B.,Lu,R.,2009.Managerial power,compensation gap and firm performance—evidence from Chinese public listed companies. Global Financ.J.20(2),153-164.

Lin,J.,Huang,Z.,Sun,Y.,2003.TMT pay gap,firm performance and corporate governance.Econ.Res.4,31-41(in Chinese).

Liu,C.,Sun,L.,2010.A study on relation of salary difference and firm performance:evidence from state-owned enterprises.Nankai Bus. Rev.2,40-51(in Chinese).

Lu,Z.,Wang,X.,Zhang,P.,2012.Do Chinese state-owned enterprises pay higher wages?Econ.Res.3,28-39(in Chinese).

Main,B.G.,O'Reilly III,C.A.,Wade,J.,1993.Top executive pay:tournament or teamwork?J.Labor Econ.11(4),606-628.

Messersmith,J.G.,Guthrie,J.P.,Ji,Y.,Lee,J.,2011.Executive turnover:the influence of dispersion and other pay system characteristics. J.Appl.Psychol.96(3),457-469.

Milkovich,G.T.,Newman,J.M.,2002.Compensation.Irwin,Chicago,IL.

Myers,S.C.,1977.Determinants of corporate borrowing.J.Financ.Econ.5(2),147-175.

Oldman,G.R.,Kulik,C.T.,Stepina,L.P.,Ambrose,M.L.,1986.Relations between situational factors and comparative referents used by employees.Acad.Manage.J.29,599-608.

O'Reilly III,C.A.,Main,B.G.,Crystal,G.S.,1988.CEO compensation as tournament and social comparison:a tale of two theories.Adm. Sci.Q.33(2),257-274.

Pan,H.,Xia,X.,Yu,M.,2008.Government intervention,political connections and the mergers of local government-controlled enterprises.Econ.Res.4,41-52(in Chinese).

Pfeffer,J.,Langton,N.,1993.The effect of wage dispersion on satisfaction,productivity,and working collaboratively:evidence from college and university faculty.Adm.Sci.Q.38,382-407.

Qi,H.,Zou,Y.,2014.The empirical research on incentive effect of the external fairness of executive compensation on agents'behavior. Account.Res.3,26-32(in Chinese).

Rosen,S.,1986.Prizes and incentives in elimination tournaments.Am.Econ.Rev.76(4),701-715.

Shaw,J.D.,Gupta,N.,Delery,J.E.,2002.Pay dispersion and workforce performance:moderating effects of incentives and interdependence.Strateg.Manage.J.23(6),491-512.

Siegel,P.A.,Hambrick,D.C.,2005.Pay disparities within top management groups:evidence of harmful effects on performance of hightechnology firms.Organ.Sci.16(3),259-274.

Trevor,C.O.,Wazeter,D.L.,2006.A contingent view of reactions to objective pay conditions:interdependence among pay structure characteristics and pay relative to internal and external referents.J.Appl.Psychol.91,1260-1275.

Wu,L.,Lin,J.,Wang,Y.,2010.The external fairness of CEO's emolument,the nature of stock rights and company performance. Manage.World 3,117-126(in Chinese).

Xia,L.,Fang,Y.,2005.Government control,institutional environment and firm value:evidence from the Chinese securities market.Econ. Res.5,40-51(in Chinese).

Xu,L.,Xin,Y.,Chen,G.,2006.The types of controlling shareholders and the performance of China's listed companies.World Econ.10,78-89(in Chinese).

Yang,R.,Wang,Y.,Nie,H.,2013.The promotion mechanism of‘‘quasi-official”:evidence from Chinese central state-owned enterprises. Manage.World 3,23-33(in Chinese).

Zhang,Z.T.,2007.Top management team coordination needs,compensation dispersion and firm performance:a perspective of tournament theory.Nankai Bus.Rev.2,4-11(in Chinese).

Zhang,Z.T.,2008.An empirical study on the impact of the internal pay gap on future performance.Account.Res.9,81-87(in Chinese).

Zhang,Z.,Wang,Y.,Liu,N.,2012.Study on the design factors and modes of team compensation scheme.Econ.Manage.8,89-96(in Chinese).

Zhou,Q.,Zhu,W.,2010.On the incentive effects of SOE tournament.China Econ.Q.2,5715-5796(in Chinese).

7 March 2015

☆We acknowledge the support of the National Natural Science Foundation of China(71372150,71572197,and 71032006).

☆☆We acknowledge the helpful comments and suggestions provided by Professor Bin Miao from the National University of Singapore,the anonymous reviewers,and participants at the CJAR special issue symposium in Suzhou in April 2015.

*Corresponding author.Mobile:+86 186 6608 0107.

E-mail addresses:xinyan1991@126.com(Y.Xu),sysulyg@gmail.com(Y.Liu),gjlobo@uh.edu(G.J.Lobo).1Mobile:+86 135 7030 8719.

China Journal of Accounting Research2016年2期

China Journal of Accounting Research2016年2期

- China Journal of Accounting Research的其它文章

- Can media exposure improve stock price efficiency in China and why?

- Re-examination of the effect of ownership structure on financial reporting:Evidence from share pledges in China

- Female CFOs and loan contracting:Financial conservatism or gender discrimination?-An empirical test based on collateral clauses