Re-examination of the effect of ownership structure on financial reporting:Evidence from share pledges in China

Zhizhong Huang,Qingmei XueBusiness School,Nanjing University,China

Re-examination of the effect of ownership structure on financial reporting:Evidence from share pledges in China

Zhizhong Huang,Qingmei Xue*

Business School,Nanjing University,China

ARTICLEINFO

Article history:

Accepted 21 November 2015

Available online 4 January 2016

Ownership concentration Share pledges

Earnings smoothing

Split share reform ABSTRACT

In this paper,we present evidence that firms with concentrated ownership manage earnings when their large shareholders have an incentive to do so. The large shareholders of Chinese public firms often pledge their shares for loans.Before the split share reform in 2006,loan terms were based on the book value of the firm.Since then,the share price has become critical for share pledged loans.We postulate that the reform triggered large shareholders' incentive to influence financial reports.Using a sample of non-state-owned enterprises,we test the effect of share pledges on earnings smoothing and how this effect changes after the reform.Our results suggest that share pledging firms smooth their earnings more than other firms,but these results are only found after the split share reform.Accordingly,our results provide more direct evidence on the effect of ownership concentration on financial reporting.

©2015 Sun Yat-sen University.Production and hosting by Elsevier B.V.This is an open access article under the CC BY-NC-ND license(http://creativecommons.org/licenses/by-nc-nd/4.0/).

1.Introduction

Concentrated ownership creates opportunities for controlling shareholders to expropriate wealth from other shareholders.Most research shows that concentrated ownership is associated with lower earnings quality(Fan and Wong,2002;Francis et al.,2005a,b).However,Wang(2006)argues that controlling shareholders may provide higher quality reporting because they are long-term investors and care about the reputation,wealth and long-term performance of their firms.These two different effects associated with controllingshareholders are summarized as the entrenchment effect and the alignment effect(Fan and Wong,2002;Wang,2006).Given the competing views and evidence in the literature,we conclude that the effect of ownership structure on financial reporting behavior is complicated and needs further investigation.

A unique Chinese setting provides an opportunity for us to re-examine this issue.Generally,Chinese public firms have one dominant shareholder whose ownership is much higher than the next largest shareholder.The large shareholders also tend to hold important positions in the management team.In recent years,large shareholders have often used their shares as collateral to obtain short-term loans.Prior to the split share reform in 2006,the pledged shares were mostly non-tradable.Although large shareholders retained their status after the split share reform,their incentives to influence financial reporting have changed.This setting allows us to compare the effects of controlling shareholders'incentives on their firms'discretionary financial reporting decisions.

The findings of numerous studies indicate that managers tend to manage earnings around major financing events,such as IPOs,seasoned equity offerings and seasoned bond offerings(see Leuz et al.,2003;Park and Shin,2004;Guthrie and Sokolowsky,2010;Caton et al.,2011).Consistent with the literature,we predict that for share pledge purposes,controlling shareholders tend to manage their firms'accounting performance to increase the value of their collateral.

Before the loans are made,controlling shareholders have incentives to manage earnings to increase their borrowing capacity(e.g.,higher loan amounts,lower interest rates,and lower contracting costs)(Ahn and Choi,2009).As required by law,pledge loan contracts should include a maintenance requirement.After a share pledged loan is made,if the share price drops,the value of the collateral will also decrease,and shareholders(borrowers)will have to make up for the decrease.This scenario is similar to a margin call when buying on margin.To avoid such costly consequences,shareholders will do whatever they can to uphold the share price.Chan et al.(2013)find that pledging firms make repurchases when prices drop.Because financial reporting influences the share price,we expect that shareholders will also manage their earnings to avoid dramatic price drops.Dye(1988)suggests that managers may smooth earnings to increase their firms'share price.Given that most shareholders pledge repeatedly,we predict that share pledged loans increase the degree of earnings smoothing.

However,if the share price is not the primary factor in deciding the loan terms,the shareholder will have no incentive to smooth earnings.In China,listed companies had dual class share ownership until the split share reform in 2006.The shares pledged by large shareholders,which were non-tradable,were evaluated by the book value of the firm.At this time,shareholders were indifferent to the share price.However,the split share reform in 2006 eliminated the discrepancies in the share transfer system.Since then,the value of pledged shares is based on their market price.Therefore,we predict that earnings smoothing is more likely in share pledging firms than other firms after the split share reform.

In our setting,we posit the same analytical relationship as Tucker and Zarowin(2006),who measure earnings smoothing by the negative correlation between the change in the discretionary-accruals proxy and the change in pre-discretionary income.Our hypothesis concerns the comparative smoothing of the share pledging firms and other firms.Using non-state-owned enterprises(SOEs)listed on the Chinese capital market as our sample,we test the moderation effect of share pledges on the above correlation.Consistent with our hypothesis,we find that share pledging firms smooth earnings more than other firms.This phenomenon is only observed after the split share reform.

Since the split share reform,shareholders have had the option of selling their shares or making a pledged loan.This raises the question of why some shareholders do not sell their shares.First,shareholders may not want to take the risk of losing their control rights.Because it is difficult to obtain approval for an IPO in China,listed companies are themselves valuable resources for capital raising(Liu and Lu,2007).Second,shareholders may consider the share price to be undervalued,either because they have private information or they are irrationally optimistic about company prospects(Chan et al.,2013).Although we cannot determine the exact reason for each pledge announcement,we find that shareholdings are positively correlated with earnings smoothing.The more shares held by large shareholders,the less they fear losing their control rights,and the more likely the shares are undervalued in the case of a pledge.Therefore,the earnings smoothing that we find in pledged firms is also consistent with the argument of Ronen and Sadan(1981)that the firms arecommunicating a better future.Further,we find evidence that share pledging firms have higher short-run market returns than the matched sample.

We examine how the change of incentives influences financial reporting decisions in firms with concentrated ownership.Our major conclusion is that ownership concentration only affects financial reporting if large shareholders have such a motivation.Our findings contribute to three strands of the literature.First,our research differs from the literature on ownership concentration and earnings management in that we use a special setting in which large shareholders'incentives are distinct,whereas previous research only postulates different incentives.Moreover,our tests focus on the effect of incentives on income smoothing,whereas previous research mostly tests the association between ownership concentration and earnings quality.Second,we also further our understanding of the effects of the split share reform.Most of the related research find that the split share reform has a positive effect(Hou and Lee,2014;Li and Zhang,2011).We show that the split share reform may activate the incentives for earnings management.Finally,we contribute to the growing body of research on the economic consequences of share pledges(Chan et al.,2013;Kao and Wei,2014;Kao and Chen,2007;Kao et al.,2004;Yeh et al.,2009).For example,Kao and Chen(2007)and Kao and Wei(2014)find that directors'share collateralization reduces the quality of financial information.However,Tan and Wu (2013)argue that pledged firms'earnings quality is better due to the quality control of financial institutions.We provide more insights into this issue by testing for earnings smoothing before and after the split share reform.

The remainder of this paper is organized as follows.In Section 2,we briefly introduce the Chinese capital market,share pledges,and the split share reform.In Section 3,we review the literature and discuss our hypothesis.In Section 4,we explain our research design.Our empirical results are reported in Section 5. The last section concludes the paper.

2.Institutional background

2.1.Chinese capital market and share pledges

In the Chinese capital market,which was founded in the early 1990s,the majority of listed firms are restructured from SOEs.In recent years,the number of non-SOE firms has increased notably as a result of the reform of the IPO regulations and the privatization of state-controlled listed firms(Xia,2008).For both SOEs and non-SOEs,the listed companies are normally the strongest part of the company group. All of the other subsidiaries of the group have limited financing sources.The formal and informal procedures of the banking system associated with lending to SOEs rely on collateral and personal relationships.Consequently,the large shareholders of many of the firms that have their shares traded on the security market pledge their shares for loans,especially for non-SOEs,whose large shareholders cannot easily obtain bank loans.

According to the listing rules of the Chinese stock exchanges firms should make announcements when their large shareholders(with more than 5%of shareholdings)pledge their shareholdings for loans.Since 2006,pledging has been active in some of the capital-intensive industries.For example,348 listed companies reported share pledges in 2010,and the number increased to 697 in 2012.The annual growth rate is about 45%.The value of shares pledged by the shareholders of listed companies in 2012 reached RMB620 billion. Accordingly,it appears to have become common practice that large shareholders of listed firms pledge their shares as collateral for loans.

A pledge is a method of transferring collateral to create a security interest in the collateral.The collateral provider,the borrower,retains legal ownership of the assets.The lender has the right to keep the assets in the event of default by the collateral provider.Although pledges enable shareholders to obtain low cost loans without losing control of their firms,there are a number of risks associated with the pledging of shares.In the case of a default,the financial institution can sell the shares on the open market to recover the dues,which can result in a fall in the share price and erosion of market capitalization.Shareholders also run the risk of losing management control if a large proportion of their holding is pledged.According to the Administrative Measures for the Disclosure of Information of Listed Companies,promulgated by The People's Bank of China and the China Securities Regulatory Commission(CSRC)in 2000,a share pledge agreement should include a maintenance requirement.If the share price drops below the maintenance requirement,the share-holder needs to either provide supplementary pledges or to make earlier payments.This margin call pressure may result in a change of corporate behavior.

2.2.Ownership concentration and split share reform

Ownership of listed companies in China is typically concentrated in the hands of large shareholders.For example,Chen et al.(2009)report that on average,across all listed firms,the largest shareholder owns 43.75%of a firm,while the second largest owns 8.16%.When the Chinese capital market was founded,a unique feature of the ownership structure of listed companies was the split share structure.Under the split share structure,the shares of Chinese listed firms were classified into non-tradable and freely tradable shares. Non-tradable shares exhibited the same voting and cash flow rights as tradable shares,but they could not be traded freely on the stock exchange.Non-tradable shares were held by the founders of the company.Consequently,large shareholders normally held large amounts of non-tradable shares.Although the non-tradable shares were designed to help the government control the SOEs,the same structure existed for non-SOEs.This structure distorted the pricing mechanism in the capital market and caused many corporate governance problems(Li and Zhang,2011).Large shareholders did not care about share prices,and tunneling by large shareholders was a serious problem for Chinese listed firms.

In 2005,the China Securities Regulatory Commission(CSRC)started the split share reform,which required non-tradable shareholders to pay tradable shareholders to gain the right to trade.By the end of 2006,95%of China's publicly listed companies were involved in the split share structure reform.The reform measures were fully completed in 2007(Li and Zhang,2011).However,there were no fundamental changes in ownership structure after the reform.

Since non-tradable shares became tradable,the use of share pledges has continually increased.Using the market share price as a reference,share pledge loan terms can include a margin call requirement.The split share reform is the cornerstone of the development of the Chinese capital market.

3.Literature review and hypothesis development

3.1.Ownership structure and discretionary earnings reporting

The research on ownership structure and discretionary financial reporting has yielded mixed results.The entrenchment view suggests that concentrated ownership decreases earnings quality.As discussed by Shleifer and Vishny(1997),controlling shareholders have incentives to maximize their own benefits at the cost of minority shareholders.Claessens et al.(2002)argue that large shareholdings have an entrenchment effect,which decreases firm value.Fan and Wong(2002)find that earnings are more informative for firms with less concentrated ownership in East Asian countries.Their evidence indicates that greater ownership concentration creates greater agency conflicts and information asymmetry.Francis et al.(2005a,b)provide similar evidence in the U.S.environment,and find lower earnings response coefficients for firms with ownership structures that have unequal voting rights.In the Chinese setting,Liu and Sun(2010)document evidence that controlling shareholders expropriate minority shareholders and lower the quality of financial reports.

The alignment view suggests that concentrated ownership increases earnings quality.A long line of research suggests that managers engage in earnings management because of capital market pressures or to avoid violation of contracts(see the review of Dechow and Skinner(2000)).Controlling shareholders are able to discipline managers in the case of opportunistic actions(Fan and Wong,2002;Shleifer and Vishny,1997),such as manipulating reported performance for compensation contracts.By aligning the interests of managers with shareholders,managers have less incentive and/or ability to manipulate short-term performance as the controlling shareholders care mostly about the long-term performance of the firm.Warfield et al.(1995)find that low managerial ownership creates a demand for contracts that rely on accounting information to constrain managers'opportunistic behavior.They find that greater managerial ownership is associated with higher earnings quality.Wang(2006)documents that founding families are less likely to expropriate wealth from other shareholders through managing earnings.He explains that founding families have a long-term orientation and seek to protect their reputation by not opportunistically managing earnings.

In summary,both theories agree that controlling shareholders have the ability to expropriate from the firm and manipulate earnings to cover their behavior.However,whether they have always had the incentive to do so remains an open question.As discussed by Ball et al.(2003),the incentives of financial statement preparers play an essential role in reporting high-quality financial information.The disparity between the two theories is mostly related to incentives.Few studies have provided causal evidence that a concentrated ownership structure leads to discretionary earnings reporting because it is difficult to directly depict the incentives.

We extend the existing research by examining a specific setting in which controlling shareholders develop an incentive to influence financial reports.Specifically,as detailed in the following part,we examine whether share pledging firms are more likely to smooth earnings before and after the split share reform.

3.2.Share pledges and earnings smoothing

Collateral is an important part of most of the loans made in China.When the collateral comprises tangible assets,financial institutions can control it,and the value does not change too much.However,when the collateral is shares,the controlling rights of the firm still belong to the borrower(large shareholder).The large shareholder can influence the value of the collateral by making all kinds of decisions for the firm.

As with other financing events,shareholders seek to improve their bargaining power in negotiating loan covenants with financial institutions.This may induce shareholders to increase the value of their pledges,namely the shareholdings.With other financing events,management tends to increase share value by managing pre-financing earnings.For example,numerous studies have investigated earnings management behavior around significant financing events,such as IPOs(e.g.Aharony et al.,2010;Teoh et al.,1998a),seasoned equity offerings(Teoh et al.,1998b),and initial bond offerings(Caton et al.,2011).Unlike the widely spread ownership in the U.S.and U.K.,Chinese listed firms are dominated by large shareholders,who are either government related or individuals.The large shareholders usually have effective control over the firm(Chen et al.,2008),and thus have both the incentive and ability to inflate earnings before share pledges.

After a share pledge,large shareholders may also have an incentive to manipulate the value of the pledged shares.If the share price drops below the maintenance requirement,the shareholders need to meet the margin call.This margin call pressure is similar to the pressure from a debt covenant.Numerous studies have provided evidence that debt is positively associated with income-increasing earnings management when firms want to reduce the probability of debt covenant violations(e.g.DeFond and Jiambalvo,1994;Dichev and Skinner,2002;Jaggi and Lee,2002).A share pledged loan is different because the debt covenant may not directly be based on the accounting numbers of the pledged firm.Moreover,if the share price drops,shareholders have other options to uphold the share price.For example,Chan et al.(2013)find that high pledge companies are more likely to repurchase,especially after a significant drop in share prices.However,because earnings announcements influence share prices,shareholders may also manage their earnings to avoid sharp price drops.If shareholders inflate earnings before a share pledge,the price will be more likely to drop afterward,which will increase the pressure of the margin call.Taken together,for share pledge purposes,large shareholders need to increase the share price,but they will not manipulate earnings in a way which would be hard to continue.Instead,they prefer increasing the share price steadily or at least ensuring a stable share price.

Using data from Taiwan,Kao and Chen(2007)find that the more shares collateralized by the board of directors,the greater the extent of earnings management.Kao et al.(2004)find that collateralized shares have a negative relationship with firms'accounting performance,which could be seen as the reverse effect after earnings management in the year of the pledge.However,Chinese large shareholders may not conduct earnings management in a once and for all manner.Financial institutions usually only provide short-term loans with shares as collateral.If large shareholders need long-term finance,they have to pledge repeatedly,which is normally the case.If they inflate earnings once,the subsequent reversal in earnings will harm their future bargaining power.Thus,they are likely to smooth earnings to facilitate share pledged loans.

Research indicates that firms smooth earnings to meet certain goals(Ronen and Sadan,1981).For example,managers may smooth earnings to meet a bonus target or to protect their job(Arya et al.,1998;Healy,1985).In our case,the intention of large shareholders is to increase the share price for share pledged loans.Smoothing earnings could convince investors that earnings have lower volatility,and hence represent reduced risk,thereby increasing the share price(Beidleman,1973;Trueman and Titman,1988).

Other research suggests that only firms with good future prospects can afford to smooth earnings(e.g. Ronen and Sadan,1981).Managers use their discretion to communicate their assessment of future earnings. As abovementioned,a possible reason why shareholders choose to pledge their shares rather than sell them is that they believe their shares are undervalued.The shareholders of such firms may be more confident about their future and believe they have the ability to smooth.Hence,share pledged firms may have both the motivation and ability to smooth earnings.

Although shareholders may intend to smooth earnings,the financial checking by banks possibly limits this opportunistic practice(Tan and Wu,2013).However,other research indicates that Chinese banks do not provide the same governance role as Western banks(Hu et al.,2011).In addition,banks make their loan decisions based on the current market value of the collateral.If the market value drops,they can ask for supplementary pledges based on the contract and law.Secured by such terms,banks have less incentive to check the fundamental value of the collateral.Their incentive would be even less after a share pledge.

3.3.Effect of the split share reform

The premise of the above arguments is that share pledged loans are based on the share price.However,before the split share reform,large shareholders often pledged their non-tradable shareholdings.The non-tradable shares could not be publicly traded on the open market,and thus there was no market price. However,the shares could still be transferred by auction or transfer agreement,mostly based on book value (Chen et al.,2008).Financial institutions accepted non-tradable shares as collateral for loans.Because non-tradable shares were less liquid,the banks had to bear higher risk.This is probably why there were much fewer share pledge announcements before the split share reform.

Moreover,Sun(2010)investigates the share pledges between 2001 and 2004,and finds evidence that the value of the collateral is based mostly on the book value per share of the listed firm.The profitability or size of the listed firm has no significant influence on the value of pledged non-tradable shares.Therefore,neither the earnings nor the market price of tradable shares are particularly relevant for shareholders or financial institutions in making their share pledged loan agreements.

The preceding discussion suggests that share pledging firms have different discretionary financial reporting incentives than other firms,but only after the split share reform.We formulate our hypothesis as follows:

H1.Share pledging firms smooth earnings more than other firms.

H1a.Share pledging firms smooth earnings NO more than the other firms before the split share reform.

H1b.Share pledging firms smooth earnings more than other firms after the split share reform.

4.Empirical design

4.1.Model of earnings smoothing and share pledges

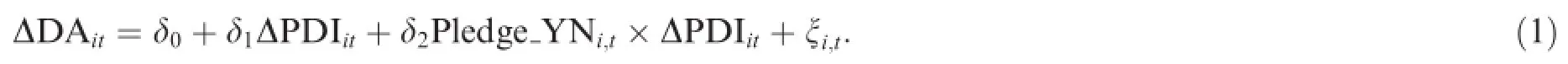

Our main tests focus on the association between share pledges and earnings smoothing.There are several models for estimating earnings smoothing in the literature(Burgstahler et al.,2006;Dou et al.,2013;Tucker and Zarowin,2006).As some of the share pledging firms in our sample pledge in one year and not in other years,we are unlikely to be able to calculate the variance,which means that we cannot use the models of Burgstahler et al.(2006)or Dou et al.(2013).Therefore,we follow the specification of Tucker and Zarowin(2006)in testing our earnings smoothing hypothesis.We measure earnings smoothing by the negative correlation between the change in discretionary-accruals proxy(‘‘ΔDA”)and the change in pre-discretionary income(‘‘ΔPDI”).The pre-discretionary income(PDI)is calculated as net income(scaled by lagged assets)minus discretionary accruals(PDI=E-DA).Thus,ΔE=ΔDA+ΔPDI.This measure assumes that there is an underlying pre-managed income series and that managers use discretionary accruals to make the reportedseries smooth.More income smoothing is evidenced by a more negative correlation between ΔDA and ΔPDI. The regression model is shown as Eq.(1):

We postulate that if the firms have their shares pledged,shareholders will have more incentive to smooth earnings.Thus,we use a dummy variable(Pledge_YN)to measure share pledges.Pledge_YN equals 1 if the company's shares have been pledged,and 0 otherwise.We expect that both δ1and δ2will be significantly negative.

To help illustrate our model,consider the following reasoning:

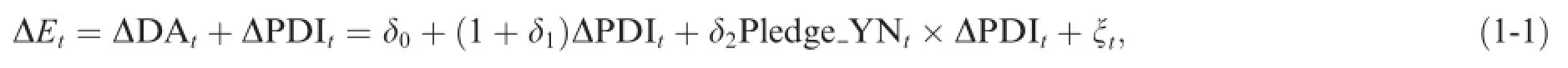

Because ΔEt=ΔDAt+ΔPDItby replacing ΔDAt with Eq.(1)we have model(1-1):

If δ1<0,then Var(ΔEt)/Var(ΔPDIt)<1,which means that the volatility of actual earnings is lower than that of pre-managed earnings.Therefore,the company will probably smooth its earnings.

If δ2<0,this indicates that the earnings smoothing coefficient for pledged firms(ISC2)is smaller than that of other firms(ISC1).Therefore,pledged firms smooth earnings more than other firms.As a conclusion,model 1 can be used to test whether pledged firms smooth earnings.

To test our hypothesis on the effect of the split-share reform,we partition our sample into two periods: 2004-2006 and 2007-2011.

4.2.Estimation of discretionary accruals

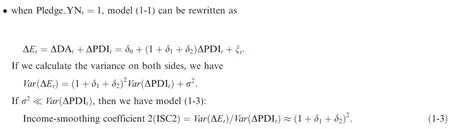

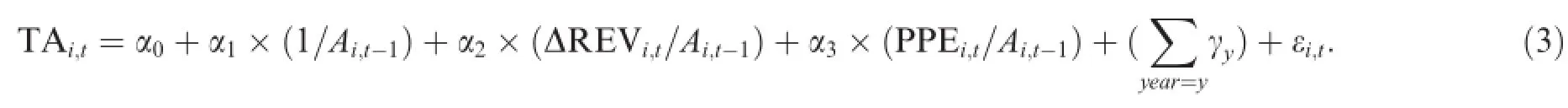

To estimate discretionary accruals(DA)in model 1,we use the cross-sectional version of the Jones model,modified by Kothari et al.(2005):

where TAi,trepresents the total accruals of firm i at time t,ΔREVitis the change in sales scaled by lagged total assets,Ait-1,and PPEitis net tangible long-term assets scaled by Ait-1·ROAitis the return on total assets in the current year,which is included because research shows that the Jones model is misspecified for wellperforming or poorly performing firms.

Because there are many arguments of DA,we also estimate a year-dummy DA following Bergstresser and Philippon(2006):

Next,we remove the components of accruals that are‘‘nondiscretionary”(NDA).We then estimate nondiscretionary accruals as the fitted value from the regression of total accruals in model 2.The DA are the deviations of actual accruals from NDA:

4.3.Sample selection and descriptive statistics

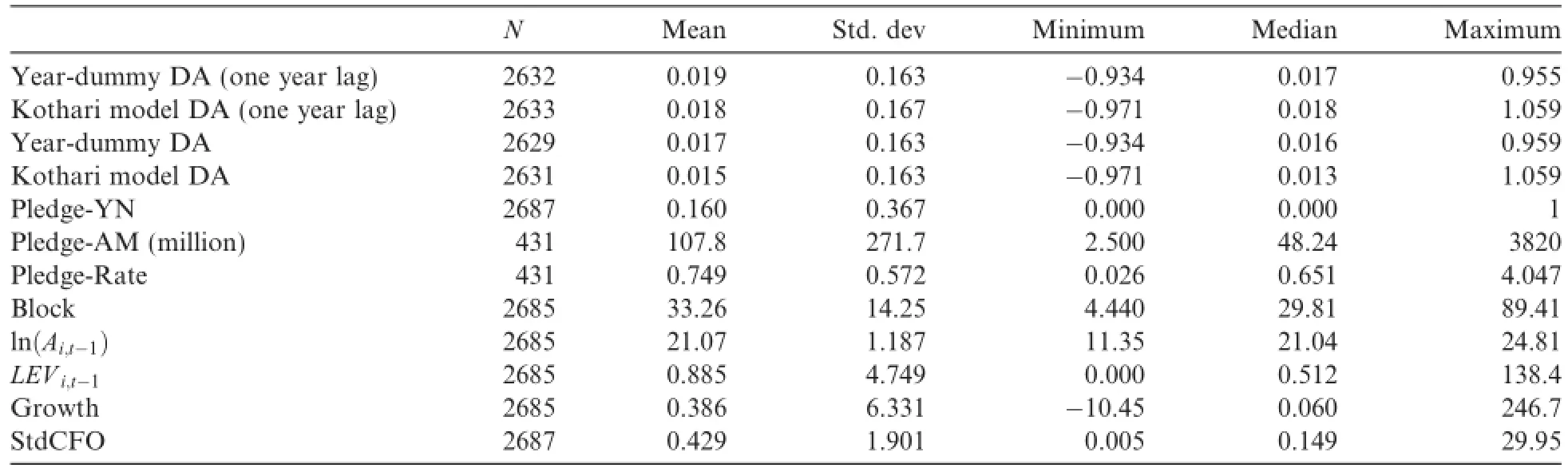

In the Chinese capital market,there are three types of firms:state-owned firms(SOEs),family firms,and firms controlled by towns and villages(Xia,2008).Comparatively,the shareholders of SOEs find it easier to get loans from banks(Tsai,2004).Share pledge announcements are made mostly by non-SOE firms.Further,because SOE firms have different agency problems and more government interference,their earnings management behavior could be influenced by the government.Therefore,we decide to test our hypothesis using non-SOE firms.Because listed companies are required to disclose their ultimate controller,it is easy to determine whether a firm is ultimately controlled by the state.We start with an initial sample of 3272 firm year observations(Table 1).Then we remove firms with missing data in calculating DA,leaving 2632 firm year observations(Table 2).

In this paper,we focus on the share pledge announcements made between 2004 and 2011 because there were very few share pledge announcements before 2004.We also want to observe the effect of the split share reform in2006.By the end of 2006,95%of China's publicly listed companies had participated in the split share structure reform(Li and Zhang,2011).Therefore,we partition our sample into two periods:2004-2006 and 2007-2011. Before the reform,there were relatively fewer share pledges(Panel A of Table 1)because the shares held by large shareholders were non-tradable and subject to stricter regulations.However,after the split share reform,the non-tradable shares became tradable,and the number of pledged shares increased dramatically.

Table 1 Distribution of share pledging firms between 2004 and 2011.

Table 2 Descriptive statistics(2004-2011).

The pledge data are available in the WIND database.Other accounting and financial data of the listed companies are obtained from the CCER database.

Panel B of Table 1 provides the distribution of our sample by industry.Companies in the manufacturing sector account for the largest number of pledged shares,followed by the real estate industry and machinery industry.Apparently,pledging is actively conducted in some of the capital-intensive industries probably due to their limited sources of funds.

Table 2 reports descriptive statistics for the sample firm-year observations.

Firms that pledged shares constitute 16 percent of our sample(the mean of Pledge-YN).On average,large shareholders pledged 74.9%of their shares in one year.The level of DA calculated using the Kothari model has a lower mean than year-dummy DA.Table 2 displays the mean and median values of the control variables.

5.Empirical results

5.1.Share pledges and earnings smoothing

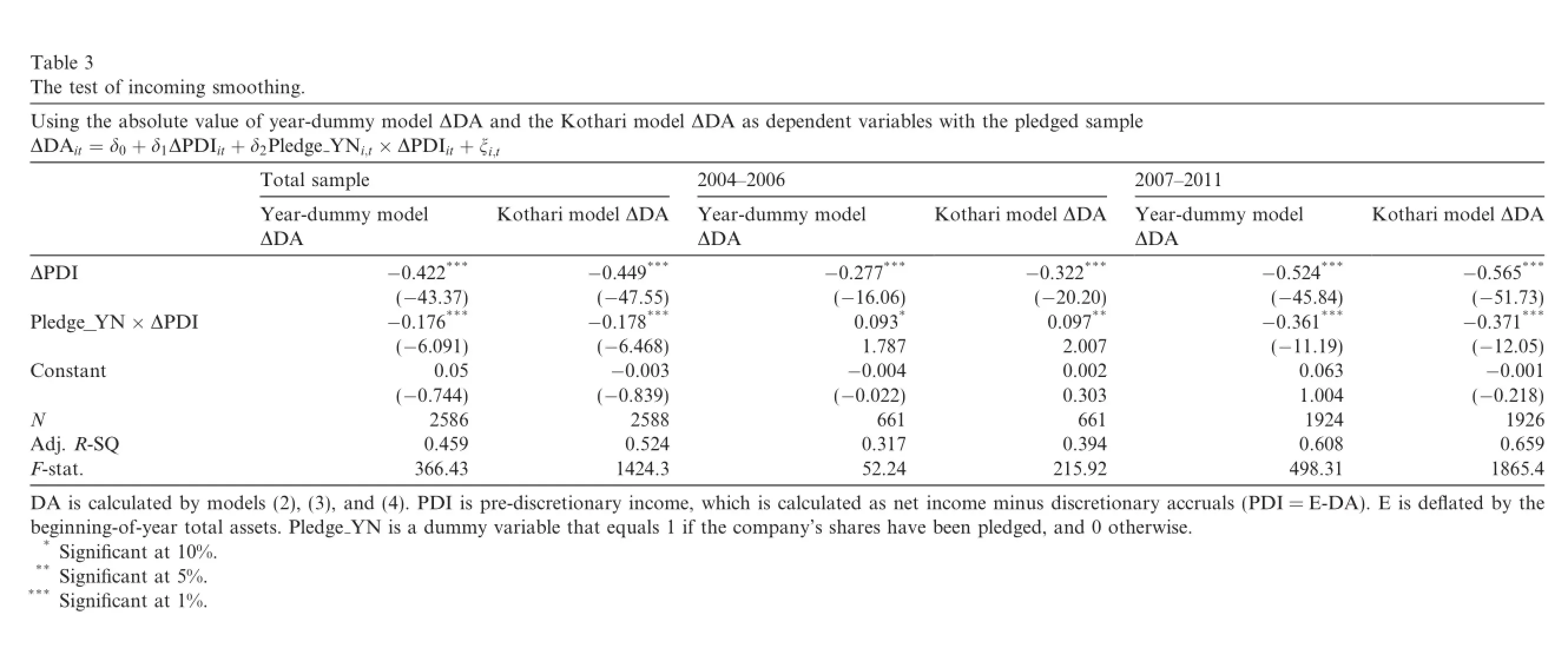

Table 3 provides the results of the multivariate regression analysis of the effect of share pledges on earnings smoothing.Columns(1)and(2)are the results for the full sample.Two models are presented,each with one proxy for share pledges:the binary variable(Pledge_YN).Both models are significant at the 1%level.The adjusted R2values are 0.45 or higher.The coefficient of ΔPDI is-0.422 with a p-value of<0.01,indicating that earnings smoothing is common in non-SOE firms.The coefficient on Pledge_YN×ΔPDI is-0.176 with a p-value of<0.01,suggesting that share pledging firms smooth earnings more than the others.

Table 3 shows the results for the two periods:before 2006 and after 2007.In both periods,the coefficients of ΔPDI are significantly negative.However,before the split share reform,the coefficient of Pledge_YN×ΔPDI is positive,which suggests that pledged firms do not conduct more earnings smoothing than other firms before the split share reform.This finding contrasts with that after the split share reform,in which pledged firms have a significantly negative coefficient of Pledge_YN×ΔPDI.During 2007-2011,the coefficient on Pledge_YN×ΔPDI is-0.361 with a p-value of<0.01,which indicates that the share pledges motivated firmsto smooth their earnings.Therefore,we conclude that the effect of share pledges on earnings smoothing is primarily driven by the sample after the split share reform.Our findings imply that when large shareholders have a strong motivation to manage earnings,the ownership structure facilitates them to do so.

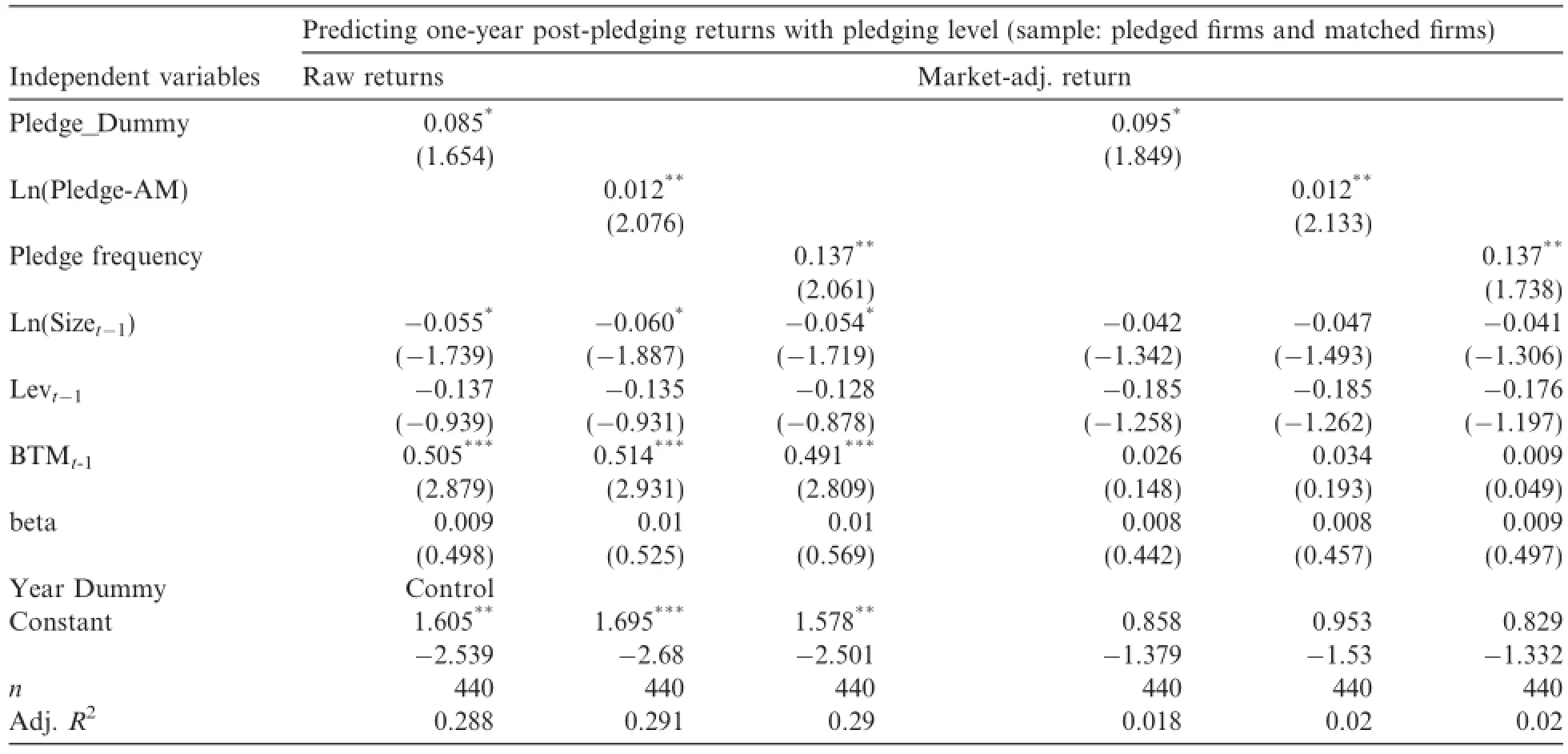

Table 5 Ordinary least-squares regressions predicting one-year post-pledging returns with share pledge and controls.

5.2.Additional analysis:Ownership concentration and earnings smoothing

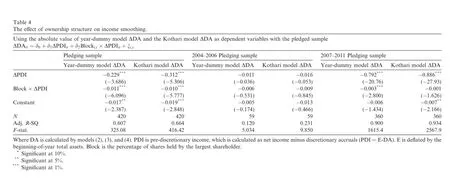

Although we have found evidence supporting our hypothesis that share pledging firms are more likely to smooth earnings,we still do not know whether the ownership structure played any role.Therefore,we use the share pledging firms as a sample,and test the effect of ownership concentration on earnings smoothing. The results are presented in Table 4.The results for the total pledging sample show that the estimated coefficient of ΔPDI is negative and statistically significant at the 1%level.This result is consistent with Table 3 that share pledging firms smooth earnings.We find that the coefficient on Block×ΔPDI is-0.01 with a p-value of <0.01,which suggests that the greater the share ownership,the more the shareholders smooth earnings.As shown in Table 3,we only find significant results during the 2007-2011 period with the year-dummy DA model.This suggests that large shareholders have a similar ability to smooth earnings before and after the split share reform.However,their financial reporting behavior is associated with their motivation to pledge.

5.3.Additional analysis:Share pledges and market return

We predict that when firms make share pledge announcements,they manage earnings to influence the share price.However,if the stock market can observe this earnings management,the share prices will not increase,and firms will have no reason to keep manipulating earnings.Teoh et al.(1998a)point out that IPO issuers report unusually high earnings before an IPO,and buyers are guided by such earnings and pay a high price for the shares.Therefore,we need to examine the market reaction and long-term return of share pledging firms to confirm our postulation.

We run an ordinary least squares regression of one-year post-pledging returns with the pledge indicators (see Teoh et al.,1998b),using the sample between 2009 and 2011.We compare the share pledging firms with the matched sample.The results in Table 5 reveal that pledging firms have better returns,and that the higher the value of the shares pledged,and the more frequent the share pledge,the better the returns.Following Teoh et al.(1998b),we use both raw returns and market adjusted returns for the test.Both measures of returns show similar results.

5.4.Robustness tests

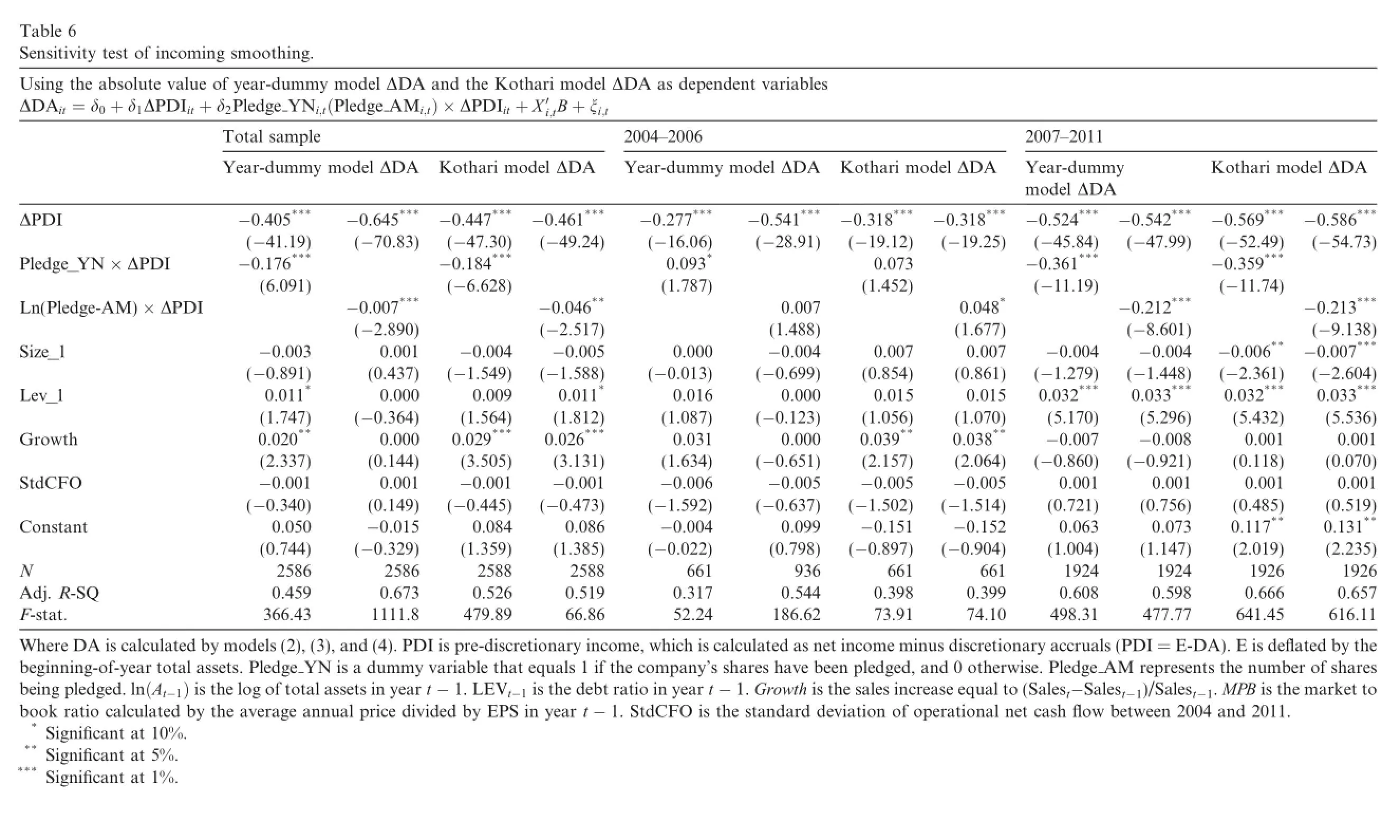

We conduct two sensitivity tests.First,we use a continuous variable(Pledge-AM)to measure share pledges. Pledge-AM is the amount that shareholders pledge,in billion RMB.In Table 6,the coefficient on Pledge-AM is-0.046,which suggests that the share pledge level is positively related to smoothing.We also include control variables in our main test model.A number of factors that are important determinants of DA have been identified in the earnings management literature.Research generally shows that total assets,leverage,growth,and operational cash flow may affect the magnitude of earnings management.The regression results are similar to our previous tests.

6.Conclusion

In this paper,we re-examine the relationship between ownership structure and discretionary financial reporting.The literature provides two different views on this relationship.Entrenchment theory holds that ownership concentration is associated with lower earnings quality.In contrast,alignment theory posits that controlling shareholders may provide higher quality reports.We investigate firms whose shares are pledged by their shareholders.Specifically,we test whether these share pledging firms smooth their earnings more than other firms and how their behavior changes with the incentives triggered by the split share reform.Before the split share reform,shareholders held large amounts of non-tradable shares.Pledging shares for loans was the only way to transfer their shareholdings.The share pledges were not based on the share price,but the book value of the firm.Thus,the firms had no incentive to smooth earnings.

After the split share reform,large shareholders could choose to sell their shareholdings or pledge their shareholdings for loans.The share price became the primary factor in deciding the amount of a loan.To facilitate loan financing and avoid violation of debt covenants and maintenance calls,shareholders wish to see an increase in the share price.Therefore,we predict that the market performance of share pledging firms is better than the others.If the share price drops after a share pledge,the large shareholder will do whatever it can to uphold the share price.Managing annual earnings is unlikely to serve as a timely measure.For example,companies may repurchase,release other good news,or manipulate quarterly earnings.However,accounting earnings represent the fundamental profitability of a firm,and annual earnings announcements affect share prices. Therefore,firms may need to strategically report their annual earnings.Firms pledge repeatedly,and thus we predict that share pledging firms smooth their earnings more than other firms.

We use Chinese non-SOE firms in our analysis because non-government controlling shareholders have more difficulty obtaining loans in the Chinese banking system.Comparing SOE and non-SOE firms,we find that non-SOE firms have a significantly higher probability of pledging than SOE firms.Another reason we exclude SOE firms from our sample is that SOE firms sometimes conduct special tasks for political reasons or according to macroeconomic policy.

Our results support our hypothesis.Using Tucker and Zarowin's(2006)model,we find that the relationship between the change in the DA proxy and change in pre-discretionary income is significantly negative for share pledging firms.Furthermore,this effect does not exist before the split share reform,but becomes significant after the reform is implemented.With the 2009-2011 sample,we also find a marginallypositive correlation between share pledges and market returns,indicating that share pledging firms have better market performance.

The findings presented in this paper contribute to the literature in several ways.First,we provide more direct evidence on the effect of ownership concentration on financial reporting.Second,our results imply that share pledges can trigger earnings management,which should serve as a reminder for investors and regulators. Like most studies,our paper is not without its limitations.It is difficult to measure earnings smoothing,and most of the existing models could not be used in our setting.Although we use a model with and without control variables,we admit that our measures may not fully capture the dynamics of earnings smoothing.Finally,we acknowledge that share pledging is a very special setting that can only be found in a few countries.

Acknowledgments

We would like to thank Dr.Xijia Su(the editor),Dr.Zheng Wang(the discussant),and participants at the 2014 Symposium of the China Journal of Accounting Research in Guangzhou for their helpful comments and suggestions.The research is supported by the National Natural Science Foundation(Project Nos.70902007 and 71372029).

References

Aharony,J.,Wang,J.,Yuan,H.,2010.Tunneling as an incentive for earnings management during the IPO process in China.J.Account. Public Policy 29(1),1-26.

Ahn,S.,Choi,W.,2009.The role of bank monitoring in corporate governance.evidence from borrowers'earnings management behavior. J.Bank.Finance 33(2),425-434.

Arya,A.,Glover,J.,Sunder,S.,1998.Earnings management and the revelation principle.Rev.Acc.Stud.3(1-2),7-34.

Ball,R.,Robin,A.,Wu,J.S.,2003.Incentives versus standards:properties of accounting income in four East Asian countries.J.Account. Econ.36(1-3),235-270.

Beidleman,C.R.,1973.Income smoothing:the role of management.Account.Rev.4(48),653-667.

Bergstresser,D.,Philippon,T.,2006.CEO incentives and earnings management.J.Financ.Econ.80(3),511-529.

Burgstahler,D.C.,Hail,L.,Leuz,C.,2006.The importance of reporting incentives:earnings management in European private and public Firms.Account.Rev.5(81),983-1016.

Caton,G.L.,Chiyachantana,C.N.,Chua,C.,Goh,J.,2011.Earnings management surrounding seasoned bond offerings:do managers mislead ratings agencies and the bond market?J.Financ.Quant.Anal.46(03),687-708.

Chan,K.,Chen,H.,Hu,S.,Liu,Y.,2013.Shares Pledged and Corporate Repurchase.National Chengchi University.

Chen,G.,Firth,M.,Xin,Y.,Xu,L.,2008.Control transfers,privatization,and corporate performance.efficiency gains in China's listed companies.J.Financ.Quant.Anal.1(43),161-190.

Chen,G.,Firth,M.,Xu,L.,2009.Does the type of ownership control matter?Evidence from China's listed companies.J.Bank.Finance 33(1),171-181.

Claessens,S.,Djankov,S.,Fan,J.P.H.,Lang,L.H.P.,2002.Disentangling the incentive and entrenchment effects of large shareholdings.J. Finance 57(6),2741-2771.

Dechow,P.M.,Skinner,D.J.,2000.Earnings management:reconciling the views of accounting academics,practitioners,and regulators. Account.Horizons 2(14),235-250.

DeFond,M.L.,Jiambalvo,J.,1994.Debt covenant violation and manipulation of accruals.J.Account.Econ.17(1-2),145-176.

Dichev,I.D.,Skinner,D.J.,2002.Large-sample evidence on the debt covenant hypothesis.J.Account.Res.40(4),1091-1123.

Dou,Y.,Hope,O.,Thomas,W.B.,2013.Relationship-specificity,contract enforceability,and income smoothing.Account.Rev.88(5),1629-1656.

Dye,R.A.,1988.Earnings management in an overlapping generations model.J.Account.Res.2(26),195-235.

Fan,J.P.H.,Wong,T.J.,2002.Corporate ownership structure and the informativeness of accounting earnings in East Asia.J.Account. Econ.33(3),401-425.

Francis,J.,LaFond,R.,Olsson,P.,Schipper,K.,2005a.The market pricing of accruals quality.J.Account.Econ.39(2),295-327.

Francis,J.,Schipper,K.,Vincent,L.,2005b.Earnings and dividend informativeness when cash flow rights are separated from voting rights.J.Account.Econ.39(2),329-360.

Guthrie,K.,Sokolowsky,J.,2010.Large shareholders and the pressure to manage earnings.J.Corp.Finance 16(3),302-319.

Healy,P.M.,1985.The effect of bonus schemes on accounting decisions.J.Account.Econ.7(1),85-107.

Hou,W.,Lee,E.,2014.Split Share Structure Reform,corporate governance,and the foreign share discount puzzle in China.Eur.J. Finance 7-9(20),703-727.

Hu,Y.,Li,S.,Lin,T.W.,Xie,S.,2011.Large creditors and corporate governance:the case of Chinese banks.Rev.Account.Finance 10 (4),332-367.

Jaggi,B.,Lee,P.,2002.Earnings management response to debt covenant violations and debt restructuring.J.Account.,Audit.Finance 4 (17),295-324.

Kao,L.,Chen,A.,2007.Directors'share collateralization,earnings management and firm performance.Taiwan Account.Rev.2(6),153-172.

Kao,H.,Wei,T.,2014.The effect of IFRS,information asymmetry and corporate governance on the quality of accounting information. Asian Econ.Financ.Rev.2(4),226-256.

Kao,L.,Chiou,J.,Chen,A.,2004.The agency problems,firm performance and monitoring mechanisms:the evidence from collateralised shares in Taiwan.Corp.Gov.:Int.Rev.12(3),389-402.

Kothari,S.P.,Leone,A.J.,Wasley,C.E.,2005.Performance matched discretionary accrual measures.J.Account.Econ.39(1),163-197. Leuz,C.,Nanda,D.,Wysocki,P.D.,2003.Earnings management and investor protection:an international comparison.J.Financ.Econ. 69(3),505-527.

Li,X.,Zhang,B.,2011.Has split share structure reform improved the efficiency of the Chinese stock market?Appl.Econ.Lett.18(11),1061-1064.

Liu,Q.,Lu,Z.J.,2007.Corporate governance and earnings management in the Chinese listed companies:a tunneling perspective.J.Corp. Finance 13(5),881-906.

Liu,G.,Sun,J.,2010.Ultimate ownership structure and corporate disclosure quality:evidence from China.Manage.Finance 36(5),452-467.

Park,Y.W.,Shin,H.,2004.Board composition and earnings management in Canada.J.Corp.Finance 10(3),431-457.

Ronen,J.,Sadan,S.,1981.Smoothing income Numbers:Objectives,Means,and Implications.Addison-Wesley Publishing Company.

Shleifer,A.,Vishny,R.W.,1997.A survey of corporate governance.J.Finance 52(2),737-783.

Sun,Q.,2010.Research on the share pledges of public firms and risks of banks.Account.Friends(3),83-84.

Tan,Y.,Wu,J.,2013.Does share pledge have governance effect?Evidence from Chinese public firms.Account.Res.(2),45-53

Teoh,S.H.,Welch,I.,Wong,T.J.,1998a.Earnings management and the long-run market performance of initial public offerings.J. Finance 53(6),1935-1974.

Teoh,S.H.,Welch,I.,Wong,T.J.,1998b.Earnings management and the underperformance of seasoned equity offerings.J.Financ.Econ. 50(1),63-99.

Trueman,B.,Titman,S.,1988.An explanation for accounting income smoothing.J.Account.Res.26,127-139.

Tsai,K.S.,2004.Back-alley Banking:Private Entrepreneurs in China.Cornell University Press.

Tucker,J.W.,Zarowin,P.A.,2006.Does income smoothing improve earnings informativeness?Account.Rev.81(1),251-270.

Wang,D.,2006.Founding family ownership and earnings quality.J.Account.Res.44(3),619-656.

Warfield,T.D.,Wild,J.J.,Wild,K.L.,1995.Managerial ownership,accounting choices,and informativeness of earnings.J.Account. Econ.20(1),61-91.

Xia,L.,2008.Founder control,ownership structure and firm value:evidence from entrepreneurial listed firms in China.China J.Account. Res.1,31-49.

Yeh,Y.,Shu,P.,Lee,T.,Su,Y.,2009.Non-tradable share reform and corporate governance in the Chinese stock market.Corp.Govern: Int.Rev.17(4),457-475.

19 September 2014

*Corresponding author at:Business School,Nanjing University,Nanjing 210093,China. E-mail address:xueqm@nju.edu.cn(Q.Xue).

China Journal of Accounting Research2016年2期

China Journal of Accounting Research2016年2期

- China Journal of Accounting Research的其它文章

- Can media exposure improve stock price efficiency in China and why?

- Troubled by unequal pay rather than low pay: The incentive effects of a top management team pay gap☆,☆☆

- Female CFOs and loan contracting:Financial conservatism or gender discrimination?-An empirical test based on collateral clauses