Empirical Research upon the Influence of Interest Rate Changes upon the Real Estate Market Price

Zhou Nan

(Economics Department Changsha Commerce and Tourism College,Changsha Hunan 410006)

The rising of house prices in recent years has caused the overheated real estate investment and the real estate investment prices holding high.At present stage,some scholars at home and abroad and specialists think that the bubbles in Chinese real estate market or local bubbles can be the uncertain elements in China’s real estate market and cause danger to the sound trend of national economy.Due to the intimate relation between real estate market and financial system,adjustment of monetary policy will exert great influence on the function of real estate market.What influences will have the change of interest rate policy,an important part of monetary policy,on real estate market?

Ⅰ.Variable selection and data processing

1.Variable selection

In this paper,one-year benchmark interest rate for loan(RC),rediscount rate(RD),one-year refinancing rate for financial institutions(RL),one-year benchmark one-year deposit rate(RS)and national average real estate sales prices(HP)are selected as variables.

2.Data processing

First,subtract the corresponding monthly rate of inflation from the monthly data of RS,RC,RR,RD and RL,we can get real interest rate.Due to the fact that the real estate market price index is in exponential form instead of currency form,it does not need to be adjusted.

Then,perform arithmetic weight in the monthly data rates,and transform them into quarterly data.Logarithm process of the variables is omitted.

Ⅱ.Empirical analysis of the influence of interest rate changes upon the real estate market price

To ensure the accuracy,Granger causality test is adopted by using different lag periods in this paper,the result of which shows that RL and HP are the only pair of variables which are Inter-Granger causality,indicating that the real estate sales price has some feedback influence on one-year refinancing rate for financial institutions,which is likely to be caused by the fact that the central bank has adjusted the interest rate policy of refinancing rate for financial institutions so as to control the real estate bubbles because of the higher expectation of house prices.

The ADF of the five variables are bigger than their critical value on the 1%and 5%significance level by making analysis of the stability of RS,RC,RD,RL and HP,which means that the level value sequences of the five variables are not stable.The further test of first difference of the five sequences finds that the ADF of D(RS),D(RC),D(RD),D(RL)and D(HP)are smaller than their critical value on the 1%and 5%significance level and roots of unity hypothesis is refused,which means that the five sequences are stable after first difference.Conclusion can be reached that they are all integrated of order1,namely I(1)order.

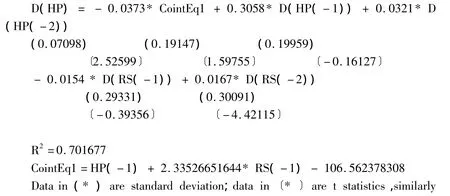

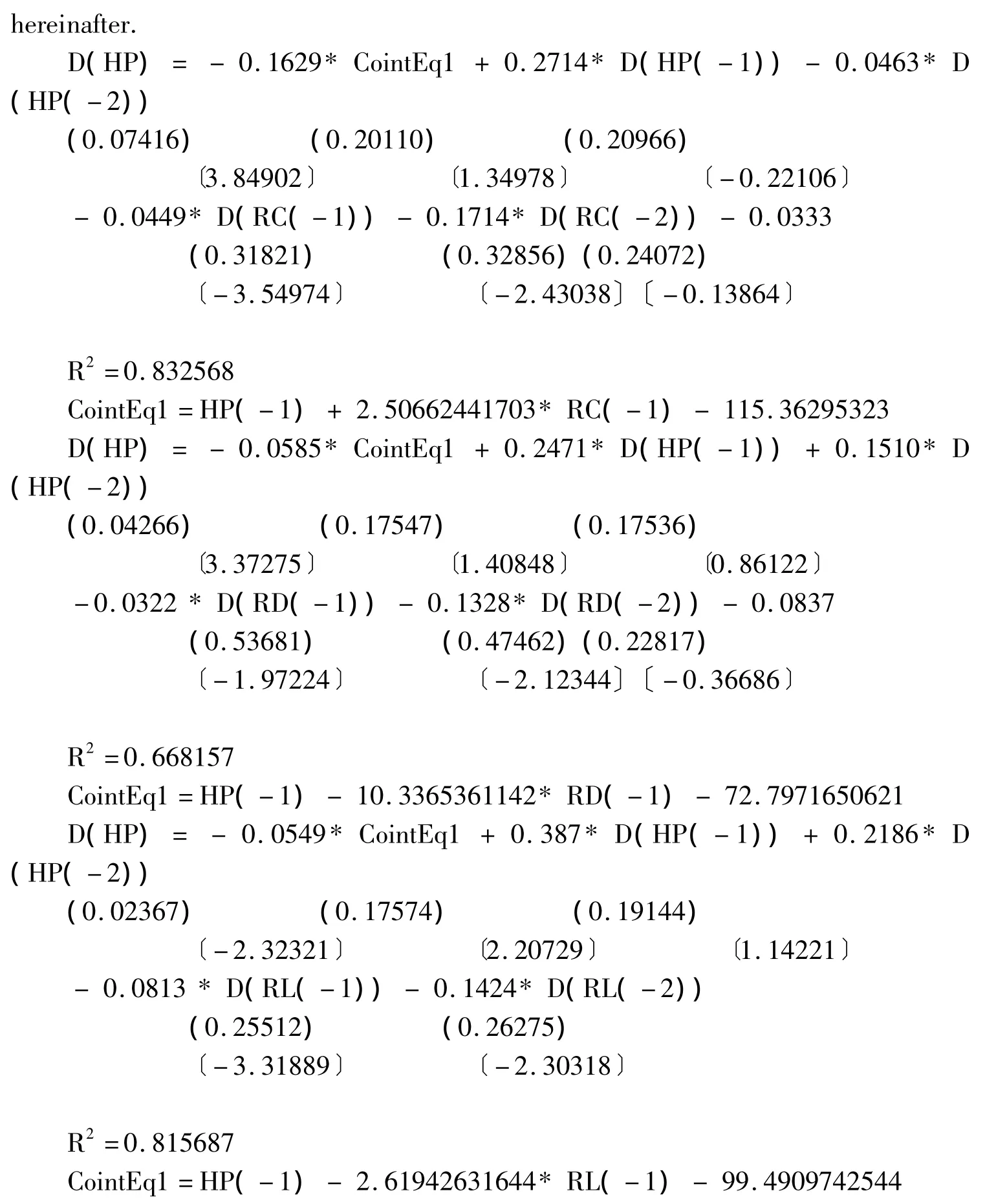

The following are the correction equations by establishing the error correction model based on VAR:

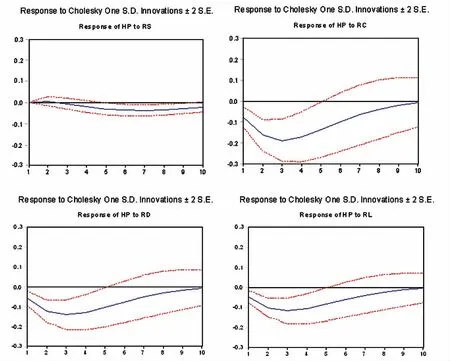

In Chart 1,horizontal axis shows the impact lag period number,and vertical axis shows the increasing rate of HP.The full line indicates impulse response function,representing the response of the increasing rate of real estate on the interest rate variable impact,and the imaginary line indicates the confidence interval of the corresponding function values plus or minus two standard deviations.Chart1 shows the influence of RS,RC,RD and RL on real estate prices.

From impulse response test of VEC in the chart below,we will see clearly whether the interest rate change at present has significant influence upon the real estate.Transmission mechanism,the market orientation may both influence the real estate price.

Chart 1 Impulse response test of VEC

Ⅲ.Countermeasures and suggestions for improving the stability of estate market price in China

Based on the above analysis,it can be found that the interest rate change at present has no obvious influence on the real estate price due to the poor transmission mechanism caused by the low market orientation of interest rate in China.Therefore,in order to ensure the stability of real estate price,the revolution of interest marketization should be further accelerated and the transmission mechanism of interest rate policy improved,fully exerting the dominant function of interest rate in adjusting the real estate price.

1.Gradually establishing the market-oriented regulatory mechanism

With the accelerating of interest marketization,marketable interest rate will play a more and more important role in the adjustment of house prices.However,the process of interest marketization cannot be accomplished in an action.On one hand,interest marketization reform must be further deepened,and the regulation of interest rate by the government be further open so as to realize more effective and reasonable fund allocation.On the other hand,banks should own more liberty,and promote new credit business by decision-making power of housing mortgage rates.

2.Adopting more than one method to regulate the structural disequilibrium

The price index of land transaction in China showed downward tendency from 2004 to 2007,and the slowing down of upward price momentum implies that the adjustment policy of land supply of China is exerting function.However,land policy can only influence the supply of real estate market,and cannot affect the need of real estate market directly,failing to realize the stability and balance of overall market.Corresponding fiscal and monetary policy should also be adopted while employing land policy,and more importantly,the corresponding tax policy,interest rate policy and loan policy should be made so as to promote the stable and sound development of real estate market.

3.Giving full play to the lever effect of rate of interest

Real estate bubbles are to a large extent the result of the excessive support of bank credit.Therefore,it is advisable to take into consideration the adjustment function of interest rate on business bank credit fund when adjusting real estate price and limiting price bubbles by credit policy in order to enhance the management of credit,improve the quality of real estate credit and further control the credit crisis of banks.

First,the subdivision of market should be paid attention to and the proportion of various loans should be properly controlled in the credit business of real estate.Second,treat the consumption demand and investment speculative demand differently.Third,fully release the price elasticity of demand by controlling credit volume.Combine proportional control and total quantity control when it is necessary to effectively exert the use of the lever of interest rates,and make proper adjustment according to the actual operation conditions.

4.Opening up diversified financing channels

We should learn from other countries,expand the financing channels of real estate enterprises and explore the various forms of direct financing and indirect financing.Besides the direct financing by stock market,the substantial big developers should also be allowed to issue corporate bond.MBS should be introduced at proper times to make indirect financing,and the second degree market of real estate should be built.

Notes:

〔1〕相生:《信息对称视角下我国房地产价格上涨的对策研究》,《知识经济》2011年第20期。

〔2〕张恒国:《我国货币政策与房价的实证分析》,《中国证券期货》2011年第10期。

〔3〕吴燕华:《我国货币政策对房地产价格调控的动态影响分析》,《现代财经》2009年第10期。

〔4〕胡岳岷:《我国房地产价格影响因素及其作用效应的计量检验》,《税务与经济》2011年第10期。